Superannuation changes with effect from 1 July 2017

New superannuation laws came into effect from 1 July 2017

With every change in super laws, it's important to review your super plans to ensure you are in compliance with new limits and regulations, and it's important to do so as soon as possilbe as you may need to make decisions about assets or plans as the new laws take effect. Book a financial health check before to find out how your super is tracking and how the new laws may have impacted you.

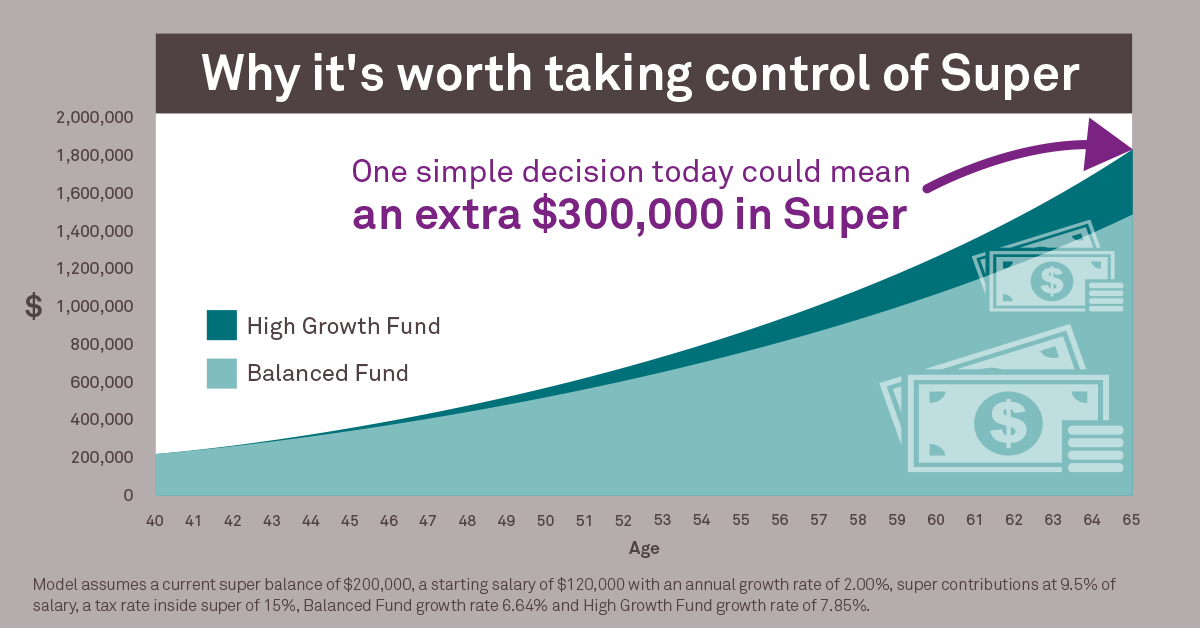

(And for those who think they don't need to worry about super yet, scroll down to see an example of why the investment fund you chose in your 40's could mean an additional $300,000 in super for your future!)

Changes that came into effect on 1 July 2017 include:

- The introduction of a $1.6 million cap on the amount of capital that can be transferred to, or retained in the tax-free earnings retirement phase of superannuation.

- Removing tax exempt earnings for Transition to Retirement income streams.

- Reducing the annual concessional (before tax) contributions limit to $25,000 for everyone.

- Allowing a deduction for personal contributions without testing the proportion of employment income received (the “10% test”).

- Reducing the non-concessional (after-tax) contributions limit from $180,000 p.a. to $100,000 p.a. for those with super balances under $1.6m. If using the bring-forward rule the limit reduces from $540,000 to $300,000 over a 3 year period.

- Reducing the threshold at which high-income earners pay an additional 15% tax (Division 293 tax) on their concessional contributions to superannuation from $300,000 to $250,000.

- Introducing the Low Income Superannuation Tax Offset (LISTO) to refund tax paid on concessional contributions for those with taxable income less than $37,000.

- Extending the spouse contribution tax offset; and

- Abolishing the anti-detriment payment.

FMD still strongly believes superannuation offers many benefits for building wealth but the July 2017 legislation made it more important than ever to have a proactive investment strategy within super to get ahead and enjoy the future you’re working towards.

The right strategy is different for everyone, but consider these numbers below. They show the impact of moving from a balance to high-growth strategy, certainly something worth seeking advice about if you’re still in your 40’s and want to build wealth faster.

Take the next step toward maximising your super

[1] (Personal contributions in the September quarter 2016 were $3,701 billion down from $5,201 billion the same quarter a year earlier – AFSA stats)

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.