Are you ready for Centrelink Pension changes, 1st January, 2017?

From 1 January 2017, if you receive an Age Pension and are asset tested, your pension may change.

What will change from 1 January 2017?

- The value of assets you can own before your entitlement is affected will increase to:

- $250,000 for a single homeowner

- $375,000 for a homeowner couple

- $450,000 for a single non-homeowner

- $575,000 for a non-homeowner couple

- Changes to the asset test calculation also include a steeper reduction in your Age Pension entitlements, increasing to $3.00 from $1.50 for every $1,000 over the amounts above. This essentially means that many will see a reduction in their Age Pension, with some losing their fortnightly entitlement completely.

How will it impact those currently receiving the Age Pension?

How will it impact those currently receiving the Age Pension?

How the changes will affect you depends on your personal circumstances, but broadly speaking:

- Those currently receiving the full Age Pension will retain the full Age Pension.

- Those who are currently close to receiving the full Age Pension (and are assets tested) may get an increase in their Age Pension entitlement.

- Some people who currently receive the part Age Pension may have their pension reduced or may lose it completely. For example, a couple who own their own home and have assessable assets of $900,000 will lose the Age Pension based on the new cut-off of $816,000.

Note: The Government will ensure people who lose the Age Pension receive a Commonwealth Seniors Health Card (CSHC) and low income Health Care Card without having to meet the normal tests. (Refer to the comparison table overleaf).

To find out if you are impacted, visit our Centrelink Assets Test Calculator at fmd.com.au/CAT

How can you prepare for the changes?

If your Age Pension entitlement is going to be materially reduced from 1 January 2017, we encourage you to consider how you will replace this lost income (e.g. by increasing your account-based pension payments) or whether reducing your ongoing living expenses is possible.

In addition, you may hear of various approaches to help reduce your level of assessable assets, including gifting, funeral bonds and home improvements. Prior to implementing any of these approaches, we encourage you to contact your FMD Adviser to discuss whether they are suitable for your personal situation.

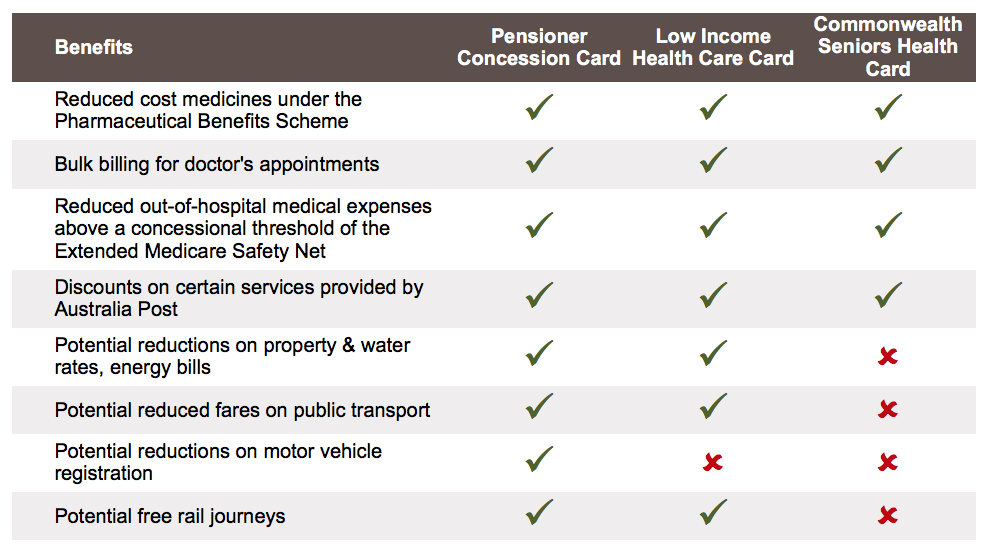

Comparison Table: Pensioner Concession Card vs Commonwealth Seniors Health Card vs Low Income Health Care Card

Current recipients of the Age Pension who lose their entitlement as a result of the changes will receive a Commonwealth Seniors Health Card (CSHC) and Low Income Health Care Card (LIHCC) without having to meet the normal tests. The following table compares the benefits of the Pensioner Concession Card, that those on the Age Pension are entitled to, with the CSHC and LIHCC:

If you have questions about how the Centrelink Age Pension changes could impact you or need advice on how to maximise your income in retirement, take the first step. Complete our quick and easy online financial health check or book a free 1 hour consultation with a qualified adviser.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.