Young professionals feeling the squeeze

As households absorb the impact of 12 consecutive interest rate rises and a slowing economy, it’s increasingly clear the pain is not being felt evenly.

According to Commonwealth Bank (CBA) CEO, Matt Comyn, Australians aged between 30 and 34 are facing the greatest strain and households are expected to feel more pressure over the next 6 months.

[1]Appearing before a parliamentary committee last week, the bank chief noted that despite mortgage holders bearing the brunt of monetary policy, the CBA’s data shows renters were actually under more pressure than those with mortgages, with rents continuing to rise as landlords pass on the 4% rise in interest rates.

The growing challenge for investors aged 25-35

It’s a conundrum that FMD advisers and our clients are well aware of as we witness a significant shift in generational wealth accumulation, along with concerns that the next generation could be the first since Federation to be worse off than their parents.

This cohort faces the perfect financial security storm. A lack of asset ownership, stagnant wages over the previous decade, increased HECS debts and rising living costs including rent, energy, food and fuel prices.

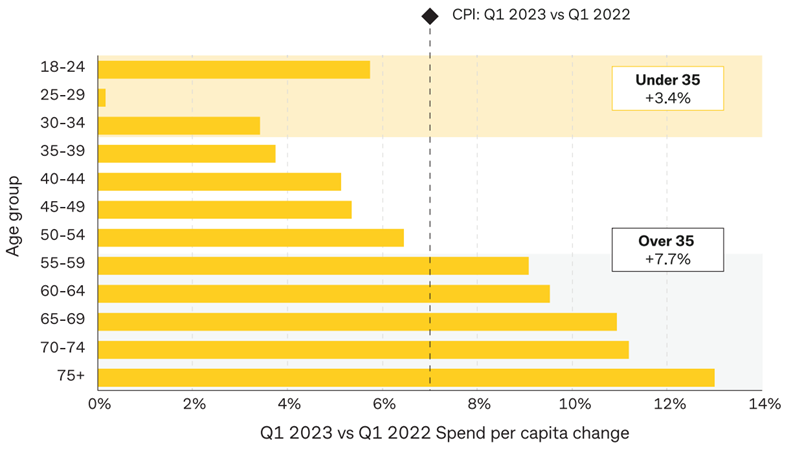

This makes it increasingly difficult to get ahead, even for those on a good professional salary. The below chart shows this age group is cutting back on discretionary spending most.

While it’s true that younger cohorts have always had to tighten their belts in economic downturns (as those who remember the 17% interest rates of the 1980’s can attest to) the difference is most families were previously building wealth in their homes, even while battling through challenging years.

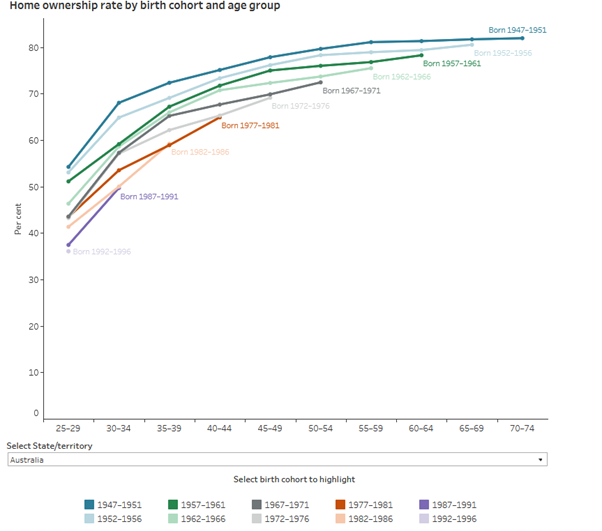

Recent Census data (see chart below) shows that the [2]home ownership rate of 30-34 year olds today is just 50% compared with 64% in 1971, with more than 30% now renting. Among 25-29 year olds, just 36% are home owners, compared with 50% in 1971.

So rather than turning around after a tough economic decade and finding they have an asset behind them, today’s young professionals may well find their wealth building journey is yet to start.

Enter the bank of Mum and Dad

With older cohorts holding greater property and wealth, much has been made of the growing need for the “Bank of Mum and Dad."

Whether financial support comes in the form of kids staying in the family home longer to save a deposit, or parents or grandparents lending younger family members money towards their first home, the dilemma is real.

Today’s combined economic forces mean it will take longer for this generation to achieve financial independence and freedom.

It’s now clear people will need to invest from a younger aged to benefit from the power of compounding before they can accumulate enough to get into the property market.

Many millennials already intend to rent long-term and build wealth via other investments.

The rise of investment alternatives

The rise of online investing, particularly via Exchange Traded Funds (ETF’s) has exploded in Australia in the last five years to meet this changing trend and the needs of young investors.

Many supplemented uncertain wages during the pandemic, pouring millions of dollars into micro investing platforms such as Raiz, Sharesies and eToro which offer investments from as little as $5, as well as bank affiliated online investment platforms like CommSec, IG Markets and NABtrade.

While those investors may love analysing performance charts, picking shares and managing trades, others don’t have the confidence or the time this approach demands.

In fact, the latest [3]ASX Investor Study 2003 shows 33% of 18-35 year-olds are not confident they can make the best decisions and that is the reason why that haven’t started investing.

A further 30% said they didn’t know where to find the right information or what investments to get started with.

Access to managed portfolios via Rev Invest

That’s where investing in Exchange Traded Funds (ETFs) in managed portfolios via a trusted, proven investment team, becomes a great option.

FMD recently launched Rev Invest, to take the guess work out of investing for busy young professionals, by offering access to a range of online investment portfolios, backed by the FMD Investment Committee.

There is a portfolio for a range of different investor types. From lower risk cash-plus focused portfolios to portfolios seeking to balance risk and return attributes, to higher risk portfolios focussed on generating capital growth over time.

You can even open an account for your children or grandchildren, knowing they’ll get ahead faster with transparent online investing, backed by the FMD team.

Visit revinvest.com.au where you can learn more, set up an account in minutes and start giving the gift of a sound investment today.

One thing is certain, if the next generation isn’t entering the property market, it’s critical that they invest in sound alternatives to build long-term wealth and ensure they don’t become a generation that falls behind.

[1] https://www.aihw.gov.au/reports/australias-welfare/home-ownership-and-housing-tenure

[2] https://www.abc.net.au/news/2023-07-13/renters-under-more-pressure-than-mortgaged-households-cba/102597314

[3] https://www.asx.com.au/investors/investment-tools-and-resources/australian-investor-study

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.