Understanding aged care costs

When the time comes for a loved one to move into aged care, there are lots of complex and emotional decisions to be made, not least of which is how to fund aged care costs.

The best way to pay for aged care depends on your family’s unique circumstances.

It’s important to seek personal financial advice because getting funding arrangements wrong can be costly and erode family wealth that could, instead, be passed to the next generation.

You can book a meeting with one of our expert aged care advisers here if you need personal financial advice.

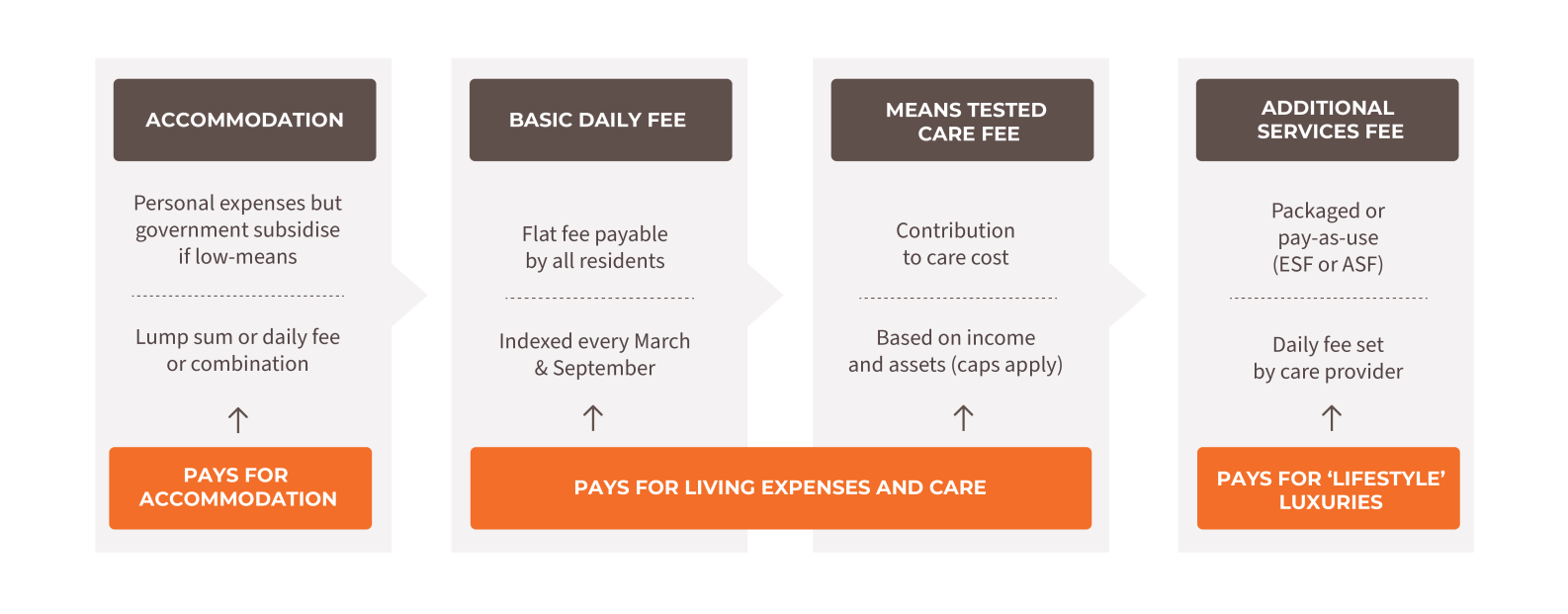

This article explains the different types of aged care costs in Australia, what they cover and what you can expect to pay. The diagram below is a summary of all the costs at a glance.

Accommodation Costs

The cost of a room in an aged care facility can be paid in a number of ways.

A full lump sum known as a Refundable Accommodation Deposit (RAD)

The resident pays a sum of money to the aged care facility which equates to the advertised cost of the room e.g.$600,000. This can be thought of like “purchasing” a house. It is a one-off payment which is returned when the resident leaves the facility.

A regular payment known as a Daily Accommodation Payment (DAP)

The resident pays the advertised cost of the room multiplied by an interest rate* which is determined by the Government e.g. $600,000 X 8.38% pa = $50,280 per year. This can be thought of like “renting” a house. Regular payments are made but not returned when the resident leaves the facility.

A combination of the RAD and DAP

The resident pays a lump sum towards the RAD and then pays interest on the unpaid portion of the RAD e.g. $300,000 lump sum RAD plus $300,0000 x 8.38% pa = $25,140 per year.

Ongoing Care Costs

In addition to accommodation costs, there are also ongoing care costs.

Basic Daily Care Fee

As the name indicates, the Basic Daily Care Fee covers fundamental costs for services required by all residents such as food, electricity, laundry, etc. This equates to 85% of the basic rate of the Age Pension which is currently $63.57 per day (as at October 2024).

Means Tested Care Fee

The Means Tested Care Fee is a contribution toward the cost of nursing care at the aged care facility. The amount the resident pays is based on their income and assets and is calculated by Centrelink/Services Australia. It is subject to both an annual cap and a lifetime cap. The current maximum rate is $416.05 per day.

Additional Service Fee

The Additional Service Fee pays for extra services such as choice of meal, a glass of beer or wine with meals, or subscriptions for newspapers, streaming services, etc. This fee is not charged by every aged care facility and may vary by provider. Often it is negotiable by the resident.

Own Living Expenses

A resident may have items they choose to pay for once they move into aged care. This may include private health insurance and clothing, as well as spending money for the café or outings. Living expenses are based on each resident’s personal preferences and financial means.

*MPIR = Maximum Permissible Interest Rate = 8.38% pa as at October 2024.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.