Term deposits putting retirement income at risk

Global interest rates have been trending down for years. In the wake of the global Coronavirus pandemic central banks are expected to continue to keep rates near record lows to help struggling economies recover.

The potential impacts on investors depends significantly on their approach to earning retirement income.

FMD, like most diversified institutional investors, have been responding with active portfolio repositioning to protect our clients’ capital and maintain returns. We’ve talked a lot about how the FMD Investment Committee has approached this with our AMS Funds and portfolios over the last 12 months.

In essence, we were actively positioning into more conservative assets in 2019 as the market ran hot and were cautiously greedy from April 2020 when value returned. As a result, our client wealth was well-protected despite the extreme volatility of 2020. Yet for retirees relying predominantly on term deposits to generate income, it’s a challenging set of circumstances to navigate.

Term deposits no longer deliver

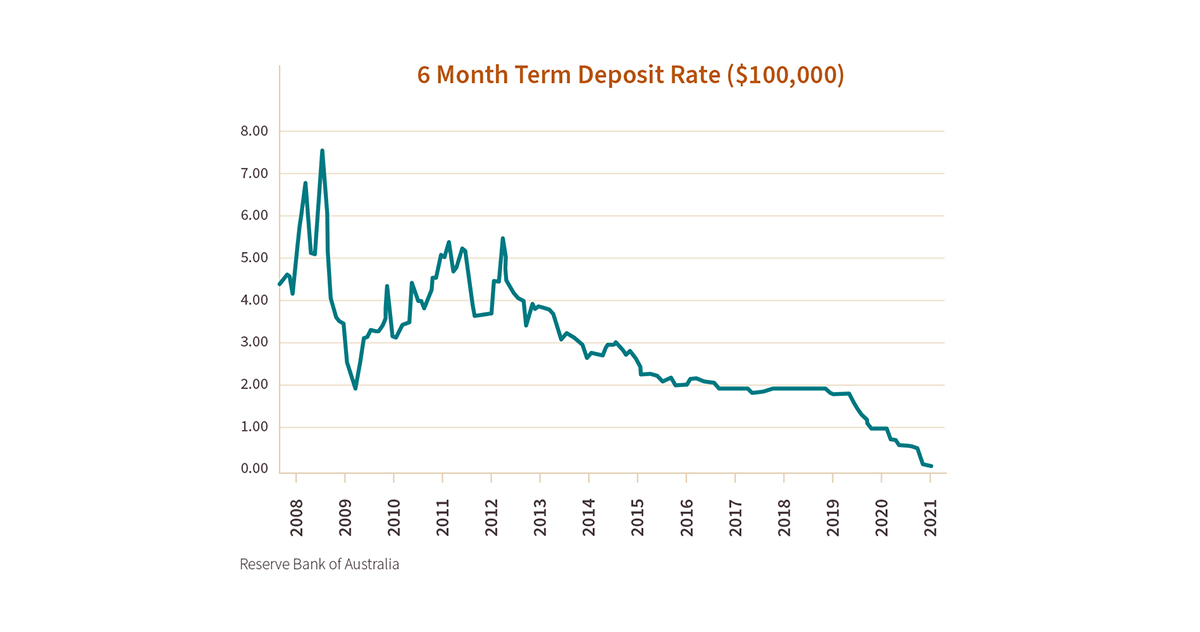

Historically, many self-funded retirees have relied on term deposits to generate a retirement income. If we ignore inflation for a moment, this approach may have made sense when 1-year term deposits paid around 4% interest, as they did for much of this century, and capital preservation is assured since the government guarantee was introduced during the GFC (up to $250,000). But as the chart below shows, since the middle of the last decade it has become harder and harder to generate adequate income from term deposits. When rates dropped to 3% in 2014/15 retirees solely reliant on this strategy took a 25% income hit.

Perhaps manageable at the time, but with the ultralow interest rates of 2021, retirees dependent on term deposit income have had their income decimated. These investors often stuck to term deposits as they were concerned about the volatility of the share market. But the lack of income is now forcing many to consider alternate strategies or investments to generate income. Unfortunately, this hunt for better returns and mistrust of the share market creates the perfect environment for the rise of risky investment funds that promise returns, often too good to be true, that pose risks for unsuspecting and less savvy investors.

Understand the risk of switching

Take for instance those high-interest mortgage funds you may have seen being promoted. With a term deposit you put $100,000 in and you get $100,000 at the end. Mortgage funds are often promoted as “capital stable” appearing to offer a similar investment. The reality can be completely different. It really pays to know what you are investing in, and without good advice it can be hard to know what sits behind these investment offerings.

The higher the interest rate, the more risk you are taking

In reality, mortgage funds mostly lend money to property developers. These borrowers, like all borrowers, will first aim to source funding from a big-4 bank where they get the lowest rates, but if they can’t borrow enough, they will look to mortgage funds that charge higher rates. The higher the borrower’s risk, the more the developer has to pay for finance.

Capital really can be lost

If one development in a mortgage trust falls over, there’s a good chance the fund will receive little or none of the loan back, so you may not get 100% of your investment back, and there is no government guarantee with these investment funds.

Liquidity can be restricted

The ability to withdraw funds is at the discretion of the manager. If times are tough and a lot of investors seek to withdraw funds at the same time, liquidity may become tight and you may not be able to get your money out when you want to. Unlike an equity fund that can sell a portion of their holding on the share market to fund redemptions, a mortgage fund needs to wait for a development to be finished before they get their loan capital back. We just need to look back to the GFC, where even high-quality mortgage funds like that offered by Perpetual, had to cease redemptions for several years to protect capital.

Asymmetric risk

As noted above it is possible to get less than 100% of your capital returned from a mortgage fund. But unlike an equity fund, where if one stock falls another might go up, allowing you to recoup losses over time, mortgage funds can never return more that 100%. This asymmetric (downside only) risk is why the best mortgage funds spread their loans widely to limit the impact of any one investment. Often the funds promoting the high rates are smaller in size and simply can’t diversify enough. So, if a self-funded retiree moves 100% of their retirement funds from term deposits to one mortgage fund,they have dialled up the “risk factor” and may not even know it.

Rise in scams

Even more concerning than these higher risk funds advertising aggressively to attract frustrated investors, we’re also seeing the rise of outright scams. In late January, the Australian Securities

and Investment Commission (ASIC) warned of a rise in imposter “bond” investment offers touting high yields which are simply

a scam. With global interest rates so low, high yield offers will continue to attract investors unaware of the risks.

What can you do if a friend or family member needs more income in retirement?

While mortgage funds can play a role in generating income, due to the limited diversification of most mortgage funds FMD typically looks for income elsewhere. As such, the answer lies in one of FMD’s core investment mantras – diversification. So while the move from term deposits to a conservative diversified portfolio does introduce some market volatility, it’s actually a lot less risky than any single mortgage fund.

A fund like FMD’s AMS Moderately Conservative Fund has significant diversification to protect from the risks identified above. This skilful blending of the 16 -20 expert fund managers and thousands of underlying positions has returned over 3% income as well as a similar level of capital growth, with an annual total return of 5.5% since inception.

It’s a timely reminder of the value of having a strong relationship with an experienced and qualified adviser, backed by a robust investment capability with appropriate oversight.Good advice from someone you trust can be all that stands between a sound and achievable financial strategy and falling down the rabbit hole in search of impossible returns, eroding wealth and possibly setting your financial plan back decades. You only get one chance to earn your wealth, it is far too valuable to risk it in these headline-attractive offers.

If you have any questions about your investment portfolio, please contact your FMD adviser.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.