Self-Managed Super without going it alone

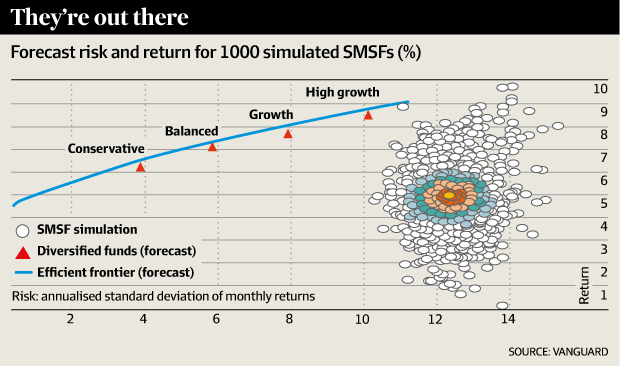

More research is coming to light that raises serious questions about the long-term investment performance of self-managed super funds (SMSFs). Recent analysis reported in the Australian Financial Review last week (http://www.afr.com/personal-finance/superannuation-and-smsfs/equities-bias-puts-smsfs-on-the-edge) shows many SMSFs are carrying too much risk and yielding too little in investment returns. As our advisers see on a regular basis, the problem is often due to poorly weighted or poorly diversified investment strategies.

Image published in the Australian Financial Review, August 31st, 2015

Image published in the Australian Financial Review, August 31st, 2015

It’s an unfortunate reality that the very things investors find so appealing about having an SMSF – control over their investments and the flexibility to concentrate on investment strategies where they’ve had previous experience or success, such as property or direct shares – are actually serving to destabilise their investments through a lack of diversification, in turn putting their retirement savings and future lifestyle at risk. We are working with an increasing number of business owners and professionals to help them manage risk and diversify their investments held in superannuation, including self-managed super funds.

Yet, while some 13,000 tax agents and accountants (according to the ATO) are looking after the administration and tax implications of SMSFs, too few trustees seek professional advice when it comes to their investment strategy. As the typical age of SMSF members continues to fall with nearly 42% now under the age of 45, there is an even greater need for expert advice. Many younger members will be at the peak of their professional and family responsibilities and simply won’t have the time or expertise to closely manage and adapt the investment strategy within their SMSF.

Seeking advice from qualified advisers offers best of both worlds. Our clients have control and autonomy, with the support of a proven investment committee behind them. They can still call the shots without going it alone. Give me a call if it’s time to review the performance of your SMSF.

Find out why we’re different or book a FREE Financial Health Check today.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.