Maintaining the right level of insurance

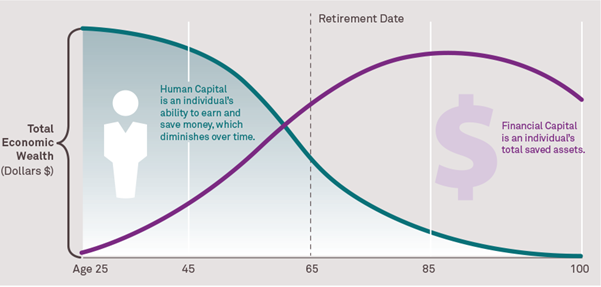

When you’re in the peak earning years in your career, your income is one of the most important assets you have, enabling you to fund investment of longer term growth assets and maintain your desired lifestyle.

Protecting your income and wealth

Having the right level of insurance to protect your income if illness or injury strikes is an important part of building and protecting wealth to achieve your overall financial goals.

That’s why it’s a key aspect of any sound financial planning process and one of our six pillars of advice.

This chart shows the importance of protecting income – which declines over time, to successfully covert it to long-term wealth to fund retirement.

Insurance premiums on the rise

Every day we see more stories in the news about the soaring cost of insurance premiums from home and car insurance through to personal insurances like life, trauma, TPD and income protection.

Inflation is playing a role in rising premiums along with the huge loses insurers have had to absorb in a string of natural disasters, from bushfires to floods, in recent years.

When significant inflationary rises in premiums combine with personal insurance policies on stepped premiums, that go up each year with age, the increased cost of premiums can come as a shock to clients.

I’ve had a lot of conversations with clients who are understandably concerned by premium renewal prices.

Yet, when inflation is impacting the economy, it is even more important to have the right insurances in place.

If illness or injury does strike, cost of living pressures mean more cash flow will be needed to maintain mortgage repayments, energy costs and school fees, as well as maintaining holidays and the overall quality of life for you and your family.

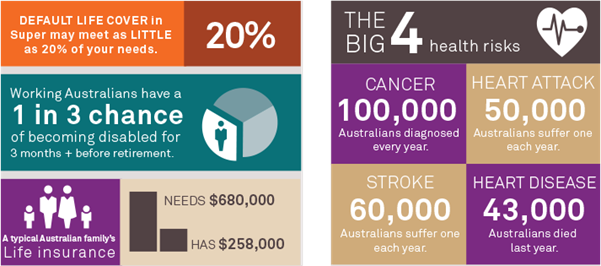

We all like to think these things won’t happen to us, but the figures paint a different picture. The big four health risks impact a large number of Australians every year and we routinely see what a huge relief the right insurance can be.

When the value of insurance hits home

I recently worked with a client who received a cancer diagnosis right before Christmas and a planned overseas trip. The client was a business owner and father who earned a high income when he was able to work, but suddenly it wasn’t clear when he would be able to work again.

The trauma insurance and income protection payments he received meant he could focus on his treatment, build a buffer on his mortgage, pay bills and maintain quality of life for his family.

Thankfully, he is now fully recovered, but he realised first hand how much the insurance payouts reduced stress and enabled him to put his health first.

Wealth protection for every client

This is the outcome we want for all our clients in the event of a serious illness, so if you’re concerned about the cost of your insurance renewal, talk to your adviser.

They will discuss with you whether your insurances are at the right level to meet your needs, suggest adjustments to make your premiums more affordable and recommend the best way to fund them to ensure you can protect your health, wealth and happiness when difficult times strike.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.