Economic Snapshot: A tale of two halves- June 2018

To use a well-worn sporting analogy, the 2017/18 financial year was a feature of two halves.

The Summary

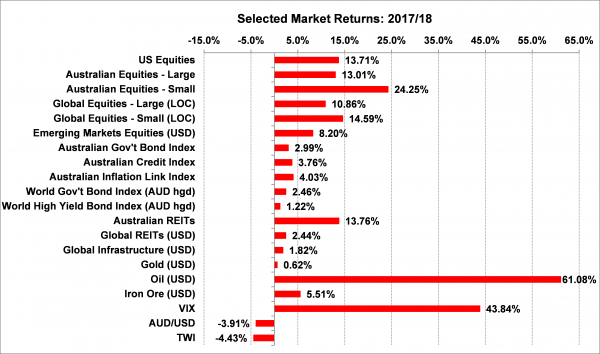

The first half: 2017 saw a general swing among global investors towards risk assets [equities] as the world economy enjoyed accelerating growth, low inflation and low interest rates – often referred to the “Goldilocks scenario”. In the US, the popularity of technology stocks and the Administration’s tax cuts pushed US equity markets up to new highs, with buoyant flow-on effects to other markets around the world. Bitcoin became the new speculative flavour of the day, while real estate markets around the world continued to post solid gains. In Australia the peak of the property market started to become apparent.

The second half: Inevitably, the Goldilocks scenario could not be sustained and started to unwind in early 2018. While growth in the US was supported by the tax cuts, the rest of the world began to slow. At the same time, there were signs of inflation beginning to rise in the US, leading to tighter monetary policy relative to the rest of the world. That pushed up the US$ and created funding pressures all over the world, from emerging market nations through to our Australian banks. The mood of global investors started to swing from risk-on to risk-off. Applying the brakes brought volatility as we gave back some returns from the beginning of the period.

Geopolitics remained turbulent throughout 2017/18. Notable events included fears of “trade wars” between the US and other countries, especially China, the US reimposing sanctions on Iran and the US and North Korea pressuring each other to the negotiating table. In Europe, Catalan secessionists, Spanish and Italian elections and Brexit all provided moments of concern but ultimately failed to have much of a lasting impact on markets.

Figure 1: 2017/18 was a tale of two halves - Good in 2017 followed by a small retreat in 2018

Source: Thomson Reuters, Bloomberg 1 July 2018

Looking to the new financial year, it is hard to see a return to Goldilocks and risk-on any time soon. The Federal Reserve seems set on its course of continuing to lift interest rates as inflation rises, even if the economy slows. Other countries, including Australia, are unlikely to start lifting interest rates until 2019, which means the US dollar is likely to rise further and put more pressure on already vulnerable equity and bond markets. As investors swing away from risk assets, it naturally gets more difficult to generate big portfolio returns and consequently great care and capital protection becomes even more important than usual. This is typically why Economists and Fund Managers forward predict volatility in market returns. Inevitably diversification is pre-eminent during these times.

2017/18 In Review - The Whole Story

The first half of the financial year was very positive for global investor sentiment around the world. Economic growth was picking up, unemployment was falling and there were few signs of inflation rising, although higher oil prices were starting to push up headline inflation. Central banks generally maintained their accommodative monetary policy, while the US Federal Reserve lifted cash rates and was then joined by other central banks in taking steps towards withdrawing excess liquidity that had been put into the global system in recent years.

Not surprisingly, financial markets saw this as a good environment for risk assets. By the end of 2017 there was talk of synchronised global growth and analysts were looking forward to another strong year in 2018. This environment, of firm growth, low inflation and low interest rates is known as the “Goldilocks scenario” and is reflected in a strong swing to risk assets. In this environment, it was not surprising that equity markets rallied strongly through the second half of 2017, credit spreads narrowed further, and commodity prices rose.

Around the World

The price of oil rose an astonishing 30% in the first half of the financial year as OPEC reached a new agreement to reduce global supply to push up prices. For avid watchers of oil, it has retreated more than 15% within the last month. The prices of iron ore and coal also did well as fiscal stimulus in China continued to stoke demand for high-quality resources exported by countries like Australia. Not surprisingly, Australian resource stocks performed very well through this period.

In the US, the popularity of the tech stocks also helped propel the market to new highs. The broader US market also got a significant boost from the Trump Administration’s tax cuts introduced late in 2017, which lifted the corporate earnings reported in the first quarter of 2018. However, analysts recognised that the tax cuts were largely one-off influences and concluded that the latest earnings figures were likely to be as good as it gets in the current cycle. Having rallied on news of the tax cuts in late 2017, the equity market did little in response to the announcement of the actual earnings reports themselves.

One of the more spectacular symptoms of the global risk-on mood was Bitcoin and the world of “crypto-currencies”. Long the domain of niche enthusiasts, Bitcoin suddenly burst into global prominence driven by spectacular price gains, feverishly reported by commentators around the world. The fact these assets are poorly understood and cannot be properly valued did not dampen investor enthusiasm for buying them. In a few weeks over November/ December 2017, Bitcoin rose 230% in price to US$19,343. By June 30th, 2018 it had fallen 67% to US$6,387. Given that experience, descriptions of cryptocurrencies as fads and social movements rather than reliable investments seem appropriate.

In Australia

Here in Australia, property investment is one of our most popular risk-on activities, but the tide began to turn in the second half of 2017. The middle of the year represented the peak of growth in the national house price index with the rate of growth of prices slowing steadily since then. By the end of financial year house prices were starting to fall in several centres across the country. This reflected increased pressure from APRA on the banks to moderate their lending, while the Hayne Royal Commission and a general tightening in global financial conditions only added to this pressure.

The US Federal Reserve steadily lifted its cash rate through 2017 while also gradually removing the excess liquidity pumped into the system in the wake of the GFC. Other central banks were also taking steps towards reducing their countries’ excess liquidity. This led to a tightening of financial conditions around the world, including higher short-term interest rates. Borrowers from Australian banks to emerging market nations saw their funding costs increase. For the latter, this has become a significant problem.

Emerging Markets

Since the GFC, many countries and corporations have taken advantage of low US interest rates and a relatively low US dollar to make substantial borrowings in US dollars. Emerging market countries were prominent in this activity: since 2008, more than 75% of this new debt has been taken on by these countries.

The risk-on environment of strong global growth and rising commodity prices is especially beneficial for these nations. However, they traditionally struggle when US interest rates and the US dollar go up, because this increases the cost of servicing their foreign debt and at the same time commodity prices usually decline. This problem grew dramatically as the first half of 2018 unfolded with the currencies of many emerging market nations falling sharply. Some countries, notably Argentina, Turkey and Mexico, lifted interest rates to defend their currencies. However, their equity markets fell sharply in response. At the same time, concerns about a trade war between the US and China helped undermine the Chinese equity market which had been performing very well. The whole emerging market bloc of assets started to fall and sharply under-performed their developed market counterparts.

More Change in Investor Sentiment

A couple of other factors contributed to the change in global investor sentiment between the second half of 2017 and the first half of 2018. The first came in February 2018 when some stronger than expected US wages numbers triggered fears of higher inflation and interest rates in that country. Having seen some stellar performance in January 2018 – in US$ terms, the emerging market equity index was up 8% in that month alone – February then saw equity markets fall sharply and volatility spike up around the world.

The second important factor was a sign of slower global growth around the world. Although growth in the US had held up quite well in the first half of 2018 in the wake of the Administration’s tax cuts, growth had been slowing elsewhere, notably in Europe and Japan and to a lesser extent in China.

Here in Australia, business conditions have held up well this year and the unemployment rate has declined further. However, wage growth and inflation remain subdued, while household confidence has been less robust than business confidence. Analysts are still concerned about risks to the growth outlook here in Australia over the rest of the year.

Synchronised global growth disappeared almost as soon as it appeared in the headlines. Suddenly one of the key planks of the Goldilocks scenario was called into doubt, while at the same time the Federal Reserve outlined plans to keep lifting the US cash rate despite seemingly low inflation.

Financial markets then started to fret about the key US ten-year bond yield rising through 3% to levels which would undermine the still stretched valuations of equity markets.

These differences between the US and the rest of the world are important because they are driving the US to tighten monetary policy ahead of the rest of the world. Higher US interest rates relative to other countries leads to the higher US dollar and pressures on emerging markets outlined above.

Here in Australia, the local cash rate has fallen below the US cash rate for the first time in many years and the $A/US$ exchange rate has been falling in response. This is likely to continue.

Looking ahead – crystal ball gazing

After nearly 10 years of continued, if occasionally interrupted growth, most fund managers and economists envisage the more difficult conditions seen in the recent quarter to continue into next year.

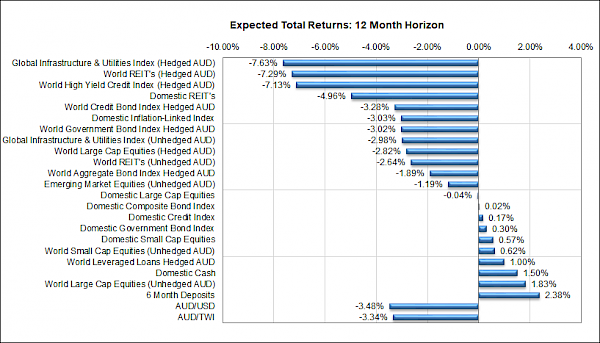

For instance, Figure 2 below, provides a potential outlook of asset classes courtesy of Quilla Consulting, one of the consultants to the FMD Investment Committee (IC).

These suggest a relatively unattractive set of expected returns across all major asset classes next year, but when reviewing these, we all need to remember that economic forecasts and actual market returns can diverge significantly in the short and long term.

Good portfolio management requires a clear focus on preserving capital, while still trying to generate returns. Diversification is better than concentrated portfolios in this environment because the level of risk in “getting it right” multiplies.

As such the FMD IC has begun to position portfolios a little more defensively, in anticipation of a more difficult year ahead, but is not making wholesale changes.

Figure 2: Forecast returns over 2018/19 (base case scenario)

Source: Quilla Consulting

Looking ahead…

Some risk factors to be watched carefully in the coming year might include:

-

A faster downturn in the global economy and markets than expected – this could provide an opportunity to begin moving back into risk assets (equities, credit);

-

A full-blown crisis in emerging markets which spreads to the rest of the world – again this could provide an opportunity, as excess valuations are washed out of the markets;

-

A financial system crisis in China centred around bad debts would slow that economy more than expected and upset world markets;

-

The housing slowdown in Australia turning into a more serious deflationary shock to the economy – this would hurt equities as well as property and push the A$ down even more; defensive positions in equities and short A$ would benefit from this;

-

OPEC pushing the price of oil back towards US$100/bl – this would add to inflationary pressures and damage global growth;

Geopolitical risks which may cause bouts of volatility in markets include:

-

Failure of the North Korean deal is always on the cards;

-

Further tension between China and the US, focussing on trade but also including security issues;

-

Conflict in the Middle East, not only in Syria and Palestine, but also the risk of escalation in the proxy war between Iran and Saudi Arabia currently underway in Yemen;

-

Brexit could well lead to more turbulence in UK politics with another General Election.

In conclusion…

As we head into the 2018/19 financial year, it appears that the economic and geopolitical outlook will remain challenging.

Snapshot expects investors should be prepared for uncertain markets in the coming year and that despite having experienced a number of years of positive returns, returns may slow.

However, if we should move into a less positive environment, investing for the long term is still all about asset allocation and being diversified across asset classes, with timed movement into and out of certain classes on a ‘gradual’ basis.

This is a proven approach in uncertain market conditions and the approach that the FMD IC has consistently applied over the last 18 years.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Paragem Pty Ltd [AFSL 297276] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Paragem or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.