Electric vehicles: How the numbers stack up

As electric vehicles (EVs) become cheaper and more popular, many of our clients areasking if buying an electric car stacks up financially. Of course, the answer depends on your personal circumstances, but here are some key things to consider.

More expensive to buy, cheaper to own

Drive magazine’s 2023 Ownership Cost Survey found that electric cars aren’t the cheapest to buy, but they are cheaper to own.

An electric vehicle recharged exclusively on solar power will save between $820 and $2570 in fuelling costs per year. Electric vehicles are also cheaper to service by an average of $465 over the first three years, but they are more expensive to comprehensively insure by an average of $661.

The Drive survey found the cheapest EV to run is the Hyundai Kona, with a monthly bill of $260 compared with the most expensive petrol car, the Nissan Patrol, coming in at $976 per month. In total, 18 of the Top 25 best value cars in the survey are either pure electricvehicles or petrol-electric hybrids.

The price of electric cars should keep falling

The Federal Government’s New Vehicle Efficiency standard comes into effect in January 2025, benefiting EV giants like Tesla, BYD and Polestar. The big profits they are set to make from selling fuel emission credits to petrol-vehicle manufacturers, should see the purchase price of electric cars continue to fall.

Combined with lower running costs, this will make EV’s a more cost-effective option in the future. Options are also increasing and prices are lowering as battery technology improves. We’re so close to price parity, both Deloitte and Bloomberg are pinning 2024 as the year we’ll see EV showroom prices match petrol car prices.

Government incentives tip the scale for novated leases

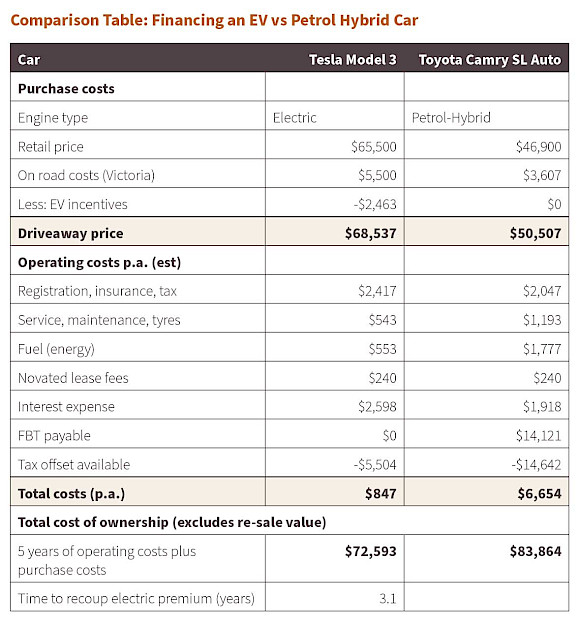

Novated leases (where a car is purchased in a three-way agreement between an employer, an employee, and a financing company) have become less financially beneficial in recent years. This is largely because the Fringe Benefit Tax (FBT) applicable often wipes out the income tax benefits of using pre-tax dollars when salary sacrificing car repayments.

The Federal Government’s recent decision to exempt EVs from FBT, up to the luxury car tax (higher threshold for EVs), makes novated leases on electric cars much more financially attractive, particularly for those on higher incomes.

Based on costs of ownership, the purchase price outlook and legislated incentives, electric vehicle ownership does look increasingly appealing, particularly for those who are drawn to more sustainable cars and with good access to charging ports.

If you or someone you know is considering purchasing an electric vehicle, talk to your FMD adviser to see how the numbers stack up in your circumstances.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.