Economic Snapshot: Covid-19 and consumer confidence - August 2020

Summary

August saw restrictions maintained in a number of countries to contain COVID-19 second waves. Progress was made in Australia and the US in getting infections down, but the US still has a long way to go before they really get the virus under control.

Europe is in the grip of a significant second wave. The most affected countries include Spain and France, both of which now have infection rates exceeding those in their first waves.

Not surprisingly, the COVID-19 resurgence has had a dampening impact on confidence and spending. Consumer confidence in Australia had slipped in July and in August slipped further as the second wave took off in Victoria. However, by the end of August sentiment had returned to levels seen in late June.

The Reserve Bank revised down its expectations for growth next year. In the US, the improvement in unemployment slowed in August and measures of GDP growth showed the recovery stalling at levels below what markets had been expecting for the third quarter.

The US Federal Reserve announced a new approach to setting interest rates which will see them aim for much lower unemployment rates as long as inflation does not rise too far above their 2% target. This means they will be slower to lift interest rates than they have been in the past. Markets liked this news and pushed the US$ down, helping drive the A$/US$ up to US$0.735. The price of gold slipped back as COVID-19 cases in the US declined.

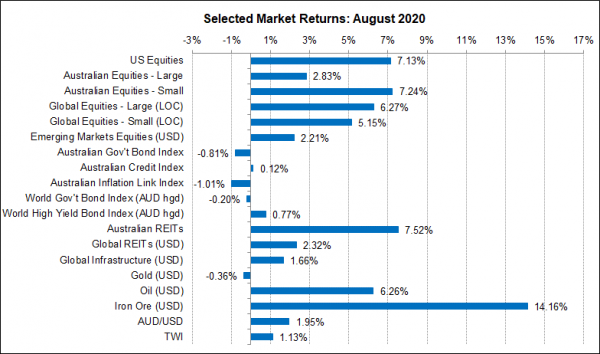

Chart 1: Equities rallied further in August and higher iron ore prices pushed A$ up

Source: Thomson Reuters, Bloomberg 1 September 2020

Ongoing impact of COVID-19

Renewed lockdowns in a number of countries saw progress in managing second waves of infections. Here in Australia, the number of new cases per week fell from 3,000 at the end of July to 860 at the end of August. In the US, the figures were just under 300,000 at the end of August compared with 461,000 at the end of July.

Although the US is making good progress on containing the virus, we need to remember that they only ever reduced infections to around 150,000 a week after their first wave. Infections are still running at twice that level now, so there is still a long way to go yet in getting it properly under control.

China and Japan have also turned around the recent surge in infections, but Europe is in the grip of a significant second wave. The most affected countries include Spain and France, both of which now have infection rates exceeding those in their first waves. Italy, Germany and the UK are seeing much more modest increases.

Consumer Confidence

Not surprisingly, the COVID-19 resurgence has had a dampening impact on confidence and spending. Consumer confidence in Australia had slipped in July and in August slipped further as the second wave took off in Victoria. However, by the end of August sentiment had returned to levels seen in late June.

The Reserve Bank revised down its expectations for growth next year. In the US, the improvement in unemployment slowed in August and measures of GDP growth showed the recovery stalling at levels below what markets had been expecting for the third quarter.

US Interest Rates

One of the most important developments in August was a long-awaited speech by Jerome Powell, the Chairman of the US Federal Reserve. Powell announced the results of the Fed’s review of how it sets interest rates. This was prompted by the Fed’s failure to meet its 2% inflation target for a number of years, as well as the fact that when the unemployment rate fell to 60-year lows in 2019, inflation did not pick up as expected. Importantly, the Fed has become more concerned about the social aspects of unemployment, especially how it impacts more vulnerable sections of society.

The essence of the changes Powell announced were that the Fed is prepared to see the unemployment rate fall a long way and allow inflation to rise above 2% in the process without increasing rates. That is, they will be slower to raise interest rates than they have been in the past.

Markets reacted to this by thinking the Fed has gone soft on inflation and that it will soon be going up in the US. This seems wrong on both counts. In the short run, the Fed’s news will not make any difference to inflation. And if the experience of the post-GFC years is any guide, it may not make much difference for quite some time because it will take years to absorb the spare capacity in the economy from COVID-19 related impacts. And if inflation were to rise too quickly the Fed would not hesitate to act.

Markets also liked the news because interest rates will stay lower for longer, but it is hard to see how anyone could have realistically been expecting a rate hike from the Fed anytime in the next couple of years anyway.

Exchange Rates

Nevertheless, the news helped push the US$ down further. This, plus another solid rise in the iron ore price, helped drive the A$/US$ up from US$0.721 at the end of July to US$0.735 at the end of August.

Gold had a softer month though. Having topped the US$2,000/oz mark, gold could not hold the gains and slipped back to around US$1,968/oz by the end of August. One factor contributing to this was the decline in COVID-19 infections in the US. There has been a clear link between gold and COVID-19 in the US. Higher rates of infection seem to drive higher demand for gold as a safe-haven asset.

Equity Markets

The US equity market powered on in August, led once more by tech stocks. Our market had a more subdued month, although AREIT’s outperformed to make up some of the ground lost to the rest of the market in recent months.

US Election

As the US election gets closer, campaigning is stepping up. The Democrats held a virtual party convention this year, while Trump chose to put in a live appearance in the White House grounds. Commentators have suggested that Biden’s performance was flat and dull compared to Trump’s more showman-like effort and that he shrewdly put his finger on Democrat weak points.

Overall, the message was not to write Trump off just yet.

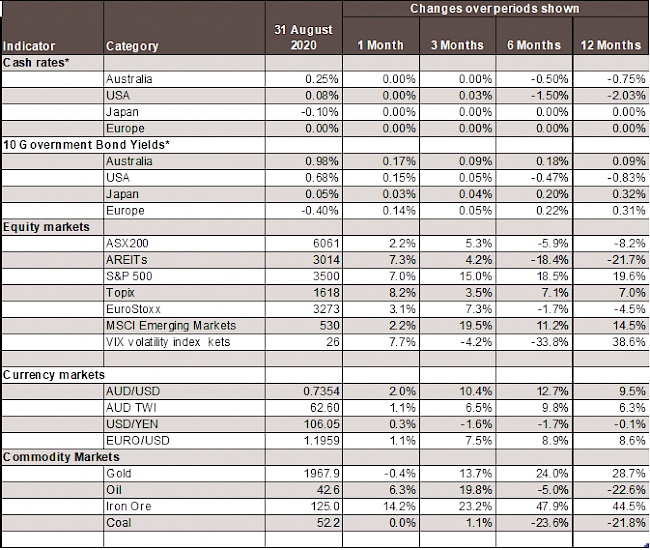

Chart 2: Major Market Indicators - August 2020

*For cash rates and bonds, the changes are % differences; for the rest of the table % changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.