Economic Snapshot: Tarrifs rocked markets

April delivered a sharp reminder that headlines can drive short-term volatility even when the broader economic story is more stable. Markets were rocked by a surge in trade-related uncertainty, as the US Administration’s threats of sweeping new tariffs and retaliatory measures led to fears of a global slowdown. The resulting volatility wasn't just confined to equities; concerns spilled over into bond markets, with yields whipsawing as investors questioned the durability of economic growth and began pricing in a more fragile global outlook.

Indeed, it was this deterioration in sentiment, most visible in fixed income markets, that ultimately prompted the US Administration to announce a 90-day pause on further tariff measures on April 9. By then, growth expectations had become notably more uncertain, with investors increasingly wary of the risk of stagflation – a challenging environment where economic growth slows while inflation remains high, making it harder for central banks to respond effectively.

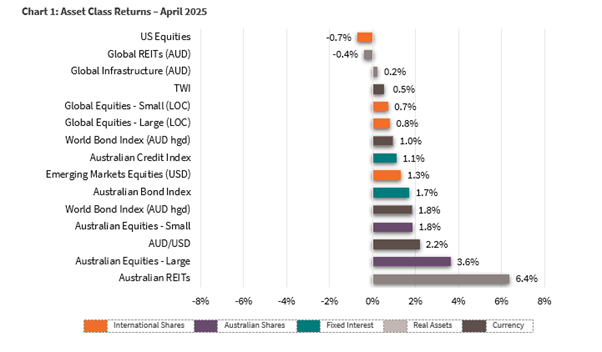

Yet, for those not following markets daily, the month-end results might seem deceptively calm! Despite the mid-month drawdowns and wild swings, equity markets largely recovered.

Australia’s equity market delivered a particularly strong result, while global equities, though down in AUD terms, showed resilience. It was a month that tested investor resolve but ultimately reinforced the importance of looking through short-term volatility to the bigger picture.

Periods like this also underscore a core investing principle: reacting to headlines in real-time can often lead to poor decision-making. It's essential to take the time to properly assess what a policy change or market shock really means—rather than jumping to conclusions before the full implications are understood. In volatile conditions, patience, perspective, and disciplined investing behaviour remain key.

Turning to economic fundamentals, Australia’s inflation outlook showed encouraging signs during the month. Core CPI for the March quarter eased to 2.9%, back within the RBA’s target range for the first time since late-2021. While new US tariffs may place upward pressure on inflation domestically, China’s efforts to redirect exports away from the US could help contain pricing pressures elsewhere.

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 134, April 2025

Global Developed Equities

April was marked by considerable volatility across global share markets, largely triggered by aggressive US trade policy announcements. Early in the month, the US government proposed sweeping new tariffs—including a headline-grabbing 145% tariff on certain Chinese imports—stoking fears of higher inflation and a potential recession. These announcements rattled investors, prompting a sharp sell-off in equities and bonds, and even pushing the S&P 500 briefly into bear market territory (a fall of 20% or more from recent highs).

Bond markets also came under pressure, particularly as highly leveraged trades were unwound amid rising yields and tighter liquidity. However, markets stabilised mid-month after the US softened its stance, pausing some of the proposed tariffs and exempting key products like smartphones. By late April, signs of a potential de-escalation in trade tensions with China helped restore some investor confidence

.Despite the shaky backdrop, developed market equities managed to post modest gains by month-end. The MSCI World ex-Australia Index rose 0.9%, although it remains down 4.4% over the past three months. European markets outperformed, with Germany and Spain delivering strong results, while US equities continued to lag. Interestingly, although sentiment surveys suggest a recessionary outlook, underlying data such as job growth and consumer spending remains solid—raising hopes of a possible soft landing.

From a sector perspective, defensive areas like consumer staples and banks held up relatively well, while energy stocks underperformed as oil prices fell on concerns about softer demand and rising supply.

Australian Equities

Australian shares rebounded sharply in April, with the ASX 200 rising 3.6% for the month, outpacing most global markets. After falling more than 15% from February highs, the local market clawed back around 11% from its early April lows in a broad-based recovery led by banks, telcos, property trusts, and consumer-related sectors.

Several factors supported this turnaround. Globally, the easing of US tariff threats improved overall market sentiment. Locally, Australia’s limited direct exposure to US trade measures offered some insulation from global risks. On the economic front, softer-than-expected inflation and resilient employment data lifted expectations that the Reserve Bank may consider a rate cut in May, further supporting equity valuations.

There was also evidence of increased foreign investor interest, with capital rotating out of the US and into Australian equities – particularly the major banks. This contributed to a strong rally in the financial sector, although valuations are now looking stretched in some areas.

Inflation data showed a meaningful improvement, with core CPI falling back into the RBA’s 2–3% target range for the first time since 2021. Meanwhile, tentative signs of improvement in business confidence and house prices added to the more constructive tone. Political uncertainty surrounding the federal election – scheduled for early May – was a background consideration during the month.

Since then, the decisive result removed a layer of uncertainty and is likely to support market confidence going forward, as investors focus on economic fundamentals and earnings.

Emerging Markets

Emerging markets delivered a positive return in April, with the MSCI Emerging Markets Index rising 1.3% in USD terms, outperforming developed market peers. However, performance varied significantly across regions as shifting trade headlines and local factors influenced sentiment.

China, which had previously led emerging market gains, fell 4.3% during the month. Uncertainty around new US tariffs weighed heavily on Chinese equities, despite the release of better-than-expected GDP figures showing 5.4% growth in the first quarter. In contrast, several Latin American and Asian markets performed strongly. Mexico surged 13%, while Brazil gained 5.1%, and India and South Korea also delivered solid returns.

Supportive conditions included a weaker US dollar and signs that the US might ease its aggressive trade stance, both of which tend to favour capital flows into emerging economies.

Looking ahead, emerging markets remain sensitive to developments in global trade policy and the broader economic cycle. While further tariffs on Chinese exports are expected to slow growth, there’s potential for additional domestic stimulus measures in China to help offset some of the impact and stabilise regional markets.

Property and Infrastructure

After a soft start to the year, Australian listed property trusts (AREITs) staged a strong recovery in April, rising over 6% for the month. Market sentiment improved as views on property valuations stabilised and falling bond yields helped support income-generating assets. Key names such as Goodman Group rebounded, while retail-focused trusts like Scentre and Vicinity also attracted renewed interest, likely reflecting a more optimistic outlook for discretionary spending and foot traffic.

Global listed property lagged in comparison, with global REITs dipping slightly, down 0.4% for the month. Diverging regional growth expectations and currency moves likely contributed to the disparity.

Meanwhile, global infrastructure continued its steady performance, delivering a modest gain in April and bringing its three-month return to 3.6%. Over the past year, infrastructure has stood out as a consistent performer, returning nearly 15% and offering defensive appeal in a volatile market environment.

Looking ahead, valuation support, interest rate expectations, and the inflation outlook will remain key drivers of returns across both property and infrastructure assets.

Fixed Interest – Global

Global bond markets experienced significant volatility in April as investors reacted to escalating trade tensions and concerns about their broader economic impact. In the US, yields initially fell sharply on fears that the severity of new tariffs could tip the economy toward recession. The US 10-year Treasury yield briefly dropped toward 4%, highlighting the traditional role of government bonds as a defensive asset during periods of stress.

However, extreme volatility soon set in. Forced selling by leveraged investors and growing concerns about market liquidity pushed the 10-year yield back up to 4.5% by mid-month.

This spike unsettled markets further, with fears that China might retaliate by selling US Treasuries, adding pressure to US fiscal credibility. Investor anxiety was also fuelled by President Trump’s public criticism of Federal Reserve Chair Jerome Powell, raising questions about central bank independence.

By the end of the month, tensions around tariffs began to ease, and softer economic data led markets to anticipate multiple rate cuts from the Federal Reserve later in the year. This shift in expectations drove the 2-year Treasury yield down to 3.6%.

Outside the US, yields in Germany and Japan also declined, supported by lower inflation readings and cautious signals from their central banks. Despite the market turbulence, the Barclays Global Aggregate Index rose 1% in April, reflecting a rally in high-quality sovereign bonds.

In contrast, riskier parts of the bond market struggled. High-yield bonds posted a 1% loss for the month as investors demanded higher compensation for credit risk, with spreads widening in response to growing recession concerns.

Fixed Interest – Australia

Australian bond markets remained relatively stable in April, outperforming their more volatile global counterparts. Yields on 10-year government bonds eased from 4.42% to 4.17%, supported by a stronger-than-expected inflation result and growing expectations of interest rate cuts by the Reserve Bank.

Core inflation for the March quarter came in at 2.9%, bringing it back within the RBA’s 2–3% target range for the first time since 2021. This renewed confidence in the inflation outlook led markets to price in multiple RBA rate cuts, potentially starting as early as May. Current market expectations suggest the cash rate could fall to around 2.9% over the next year, which would bring it below estimates of the “neutral” rate (the level considered neither stimulative nor restrictive to the economy).

While US tariffs may contribute to higher local inflation over time, some of that pressure could be offset by China redirecting exports away from the US, which may help contain global pricing.

Domestically, business conditions remain soft, but forward-looking indicators such as new orders have shown signs of improvement. Consumer confidence has held up relatively well, and housing prices have continued to trend higher over the past three months, adding to a cautiously optimistic tone.

Australian bonds delivered a solid return of 1.7% in April and have gained 7.1% over the past 12 months, highlighting their role as a stabilising force in diversified portfolios

Commodities and Currencies

Commodity and currency markets in April reflected growing investor uncertainty around US trade policy and shifting global economic dynamics. Safe-haven demand drove gold sharply higher, with prices rising 5.3% to reach US$3,500 an ounce, bringing its 12-month gain to nearly 42% as investors looked for protection against market volatility and inflation risk.

Oil prices moved in the opposite direction. Brent crude fell more than 15% to US$63.82 per barrel, driven by concerns over softer global demand and OPEC’s announcement to increase production by 400,000 barrels per day starting in June. Iron ore prices also dipped 3% to just below US$100 a tonne, while copper – often seen as a bellwether for global economic growth – fell almost 5%, reflecting weaker growth expectations.

In currency markets, investors began shifting away from the US dollar in response to protectionist policy moves and softening economic sentiment. The euro gained 4.7% against the US dollar to reach 1.13, buoyed by a more growth-oriented fiscal outlook across Europe. Traditional safe-haven currencies such as the Japanese yen and Swiss franc also strengthened.

Closer to home, the Australian dollar rose 2.5% in April to 64 US cents. This reflected improved sentiment toward commodity-linked currencies and a broader rotation away from the US dollar. Despite the rally, the AUD remains undervalued based on purchasing power measures, suggesting it may have room to appreciate further if global capital flows continue to shift.

Overall, markets appear to be repositioning in response to changing global trade flows, inflation expectations, and diverging economic policies across major economies. These shifts continue to have important implications for commodity prices, currency values, and broader asset allocation decisions.

Key takeaways for investors

- Australian equities rebounded strongly in April, supported by easing trade tensions, encouraging inflation data, and growing expectations of Reserve Bank rate cuts.

- Emerging markets posted solid gains, despite US tariff headwinds, with leadership rotating from China to markets like Mexico, Brazil, and India.

- Australian listed property (AREITs) bounced back sharply, while global infrastructure continued to deliver consistent long-term returns.

- Bond markets remained volatile, particularly in the US, amid trade-related uncertainty, policy shifts, and recession fears. In contrast, Australian bonds were steadier, with yields falling as rate cut expectations firmed.

- Gold surged to record highs, reflecting increased demand for safe-haven assets during periods of geopolitical and market stress.

- Oil prices fell sharply due to weaker demand outlooks and OPEC’s decision to increase supply, while other industrial commodities like iron ore and copper also softened.

- Currency markets reflected a shift away from the US dollar, with investors favouring the euro, yen, and Swiss franc. The Australian dollar gained modestly, buoyed by relative undervaluation and changing global capital flows.

- Investor sentiment remains cautious. Markets are likely to stay sensitive to geopolitical developments, incoming economic data, and evolving central bank policy signals.

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.