Economic Snapshot: Slowing global recovery - September 2020

Summary

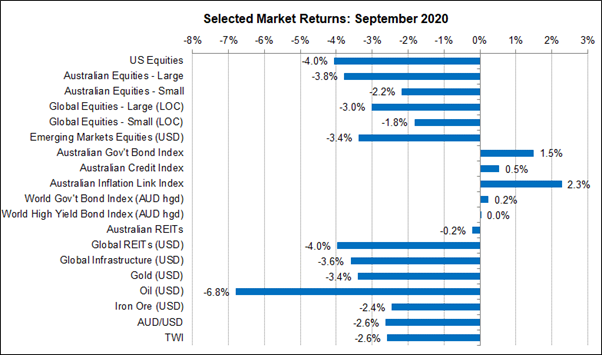

September saw a break in the rally in global equity markets. Several factors contributed to this, including signs that the global recovery, while proceeding, is nevertheless slowing down. Growing concerns about prospects for fiscal stimulus in the US added to the volatility, as did reports that Japanese firm Softbank had purchased billions of dollars of equity options, driving tech stocks up on speculative positions.

Markets are increasingly worried about the US political scene with the election only a month away, the first debate between Trump and Biden degenerating into a farce, and the sudden vacancy on the Supreme Court all adding to uncertainty.

The RBA flagged the possibility of the cash rate being cut from 0.25% to 0.10% and further quantitative easing. Soon afterwards the Government announced the relaxation of lending rules to make it easier for consumers and businesses to obtain credit. The news of a possible rate cut, along with a softer iron ore price, helped push the A$/US$ down. Gold and oil also fell in September.

Bond markets were the best performing asset class in the month.

Chart 1: September was a risk-off month over concerns about the US economy and election

Source: Thomson Reuters, Bloomberg 1 October 2020

Ongoing impact of COVID-19

Australia made good progress through September in reducing the spread of Covid-19. The number of new infections per week is now as low as it was in late June.

However, the story is very different in many other countries.

In the US, infections fell early in the month but then started rising again back to where they were at the end of August. The US still has plenty work to do to get the level of infections down to more manageable levels before the onset of the Northern winter.

In Western Europe, the second wave has been widespread with a number of countries reporting much higher rates of infection than in the first wave. This includes Spain, France, the Netherlands, Belgium and the UK. Italy, Germany and Sweden are exceptions.

Russia and Eastern Europe are also seeing significant second waves.

Market recovery

Against this backdrop, there were signs that the global recovery, while proceeding, is nevertheless slowing down. Here in Australia, the National Accounts data showed real GDP fell 7% in the second quarter as the Covid-19 recession hit. Although this was not as bad as economists had expected, leading them to revise up their growth forecasts for this year, they also lowered their forecasts for next year.

Deloitte estimated that Covid-19 may cut $200 billion in economic growth over the next two years. Although latest figures show some improvement in business confidence, both business conditions and employment intentions worsened.

A slower outlook for growth focussed the markets’ attention on potential further stimulus measures from the authorities. Given how far interest rate have been cut around the world, the emphasis is now on fiscal policy to provide more support.

Federal Budget 2020-21

Prior to its release on October 6, the Australian Government flagged that the Federal Budget would include more spending as well as tax relief. RBA Deputy Governor, Guy Debelle, raised the possibility of the cash rate being cut from 0.25% to 0.10% and increased purchases of bonds.

Soon afterwards the Government announced an easing of lending rules to make it easier for consumers and businesses to obtain credit. The local equity market rose on these reports, while the A$/US$ fell. A weaker iron ore price also contributed to the softer A$/US$ which fell 2.6% in the month.

United States

In the US, the news on the policy front was not what the markets were hoping for. The statement from the Federal Reserve after the Federal Open Market Committee (FOMC) meeting said nothing new about interest rates, while Washington was just a source of worry for the markets.

The forthcoming election has been getting in the way of Congress and the White House agreeing a new fiscal support package. This was compounded by the sudden vacancy on the Supreme Court bench that President Trump filled with his nominee, Amy Coney Barrett. Markets were worried that this would delay the stimulus package until after the election. Although commentators are now speculating if this appointment will create further tension in the aftermath of the election.

The fractious state of US politics is also proving a concern for markets the closer we get to Election Day on 3 November. The unedifying debate between Trump and Biden towards the end of September added to these concerns, especially the idea that Trump may re-fuse to concede the election if he loses. That would be a very bad result for equity markets.

At this stage Biden still commands a lead over Trump in the polls, but anything is possible yet. The news that Trump contracted COVID added to the uncertainty for markets.

Equity markets

Given how stretched equity market valuations were already looking, it was not surprising that September saw some retracement. For example, the NASDAQ, which reached a new high on 2 September, fell 12% before recovering some ground towards the end of the month. Reports that Japanese firm Softbank had purchased billions of dollars of equity options, driving up the price of tech stocks, caused the market to re-assess the underpinning of the rally. Large speculative options positions are not generally regarded as strong foundations for a rally that take markets to record highs.

Another factor sparking the retracement in tech stocks was Tesla’s failure to be included in the S&P500 index which caused the stock to drop sharply. Also, concerns that developing a vaccine may take longer than previously expected did not help equity markets.

Commodities

Oil fell heavily in September as the market downgraded expectations for the demand for oil in the face of slower global growth. Gold also had a softer month, falling 3.4%. Some of this reflected the fact that gold had simply run too far ahead of key underlying indicators, notably the US Treasury inflation-protected securities (TIPS) yield, and that the US$ recovered some ground as equities declined. As gold fell some key technical levels were breached, which triggered further selling.

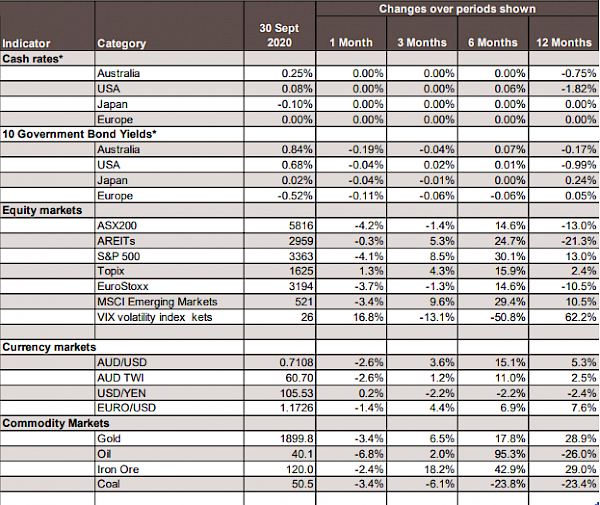

Chart 2: Major Market Indicators - September 2020

*For cash rates and bonds, the changes are % differences; for the rest of the table % changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.