Economic Snapshot: Positive outlook for growth

Summary

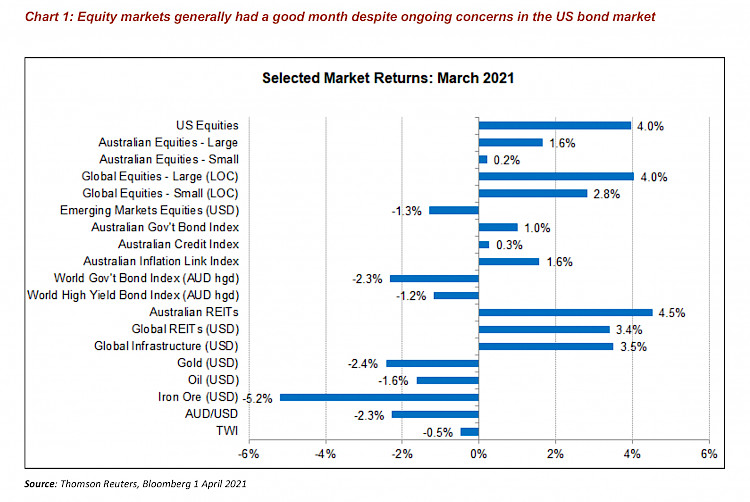

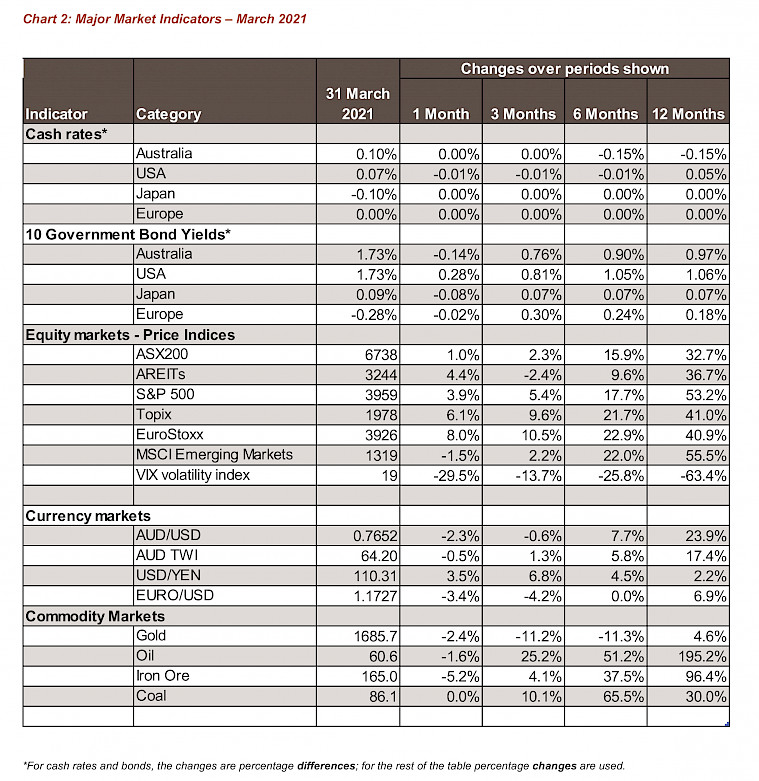

March saw further good news about the pace of global economic recovery, with the OECD revising up its forecasts for global growth, and strong employment and growth figures reported in both Australia and the US. Financial markets receieved the better growth news with mixed outcomes. Their concern is that the US economy will start to overheat sooner than expected, leading to higher inflation and tighter monetary policy.

The US bond market was the focus of these concerns, with yields rising through the month and impacting a range of other markets. Gold and emerging market equities both fell because of the higher bond yields and the associated stronger US dollar. In the US equity market, the S&P500 index posted a 4% gain despite a fall in the Price/Earnings ratio. The message from this is that equity investors were encouraged by the prospect of better profit growth from the strengthening economy. REITs and infrastucture equities also had a good month despite concerns about higher bond yields.

The A$/US$ eased from around US$0.783 at the end of February to around US$0.765 at the end of March as the US dollar strengthened against other currencies and the iron ore price declined.

Global Economic Recovery

March saw further good news about the pace of global economic recovery, but globally investors were unsure whether this would mean good news for profits or bad news for inflation. Volatility in equity markets reflected the balance of these forces in investors’ minds from one day to another.

Among the good economic news, the OECD revised its forecasts for global growth this year from 4.2% to 5.6% and from 3.7% to 4.0% for 2022. The OECD cited the rollout of COVID vaccines and the big fiscal stimulus in the US as key factors behind the improved outlook. The OECD also revised up its forecasts for Australia, with GDP growth in 2021 now expected to be 4.5% (previously 3.2%) and 3.1% in 2022.

Australia

Local economic news included the Australia Bureau of Statistics reporting that GDP grew 3.1% in the fourth quarter of 2020, which was more than expected. By the end of 2020 GDP was only 1.1% below its level a year earlier. The figures showed strong consumer spending in areas linked to the reopening of the economy (eg. recreation, hospitality and spending on vehicles) as well as a sharp drop in household savings.

The NAB Business Survey showed both business confidence and conditions rising to their highest levels in a number of years. Surveys also showed improvements in consumer confidence. Employment in February rose by just under 89,000 and the unemployment rate fell from 6.3% to 5.8%. These figures were better than the market expected.

United States

In the US, the labour market figures were better than expected. Employment rose 916,000 in March and the unemployment rate fell to 6%. Indicators of manufacturing activity rose strongly, with the national, forward-looking Institute of Supply Managers (ISM) manufacturing PMI (Purchasing Managers’ Index) at its highest level since 1983. The ISM’s service sector index also posted solid gains in March.

China

Meanwhile in China, there were more signs of economic activity slowing as authorities seek to moderate the expansion of finance in the system. Nevetherless, China is still expected to achieve a robust rate of growth this year.

Response from Financial Markets

Financial markets received the better news on global growth with mixed feelings. This applied especially in the US, where Congress passed the US$1.9 trillion stimulus package and talk has begun on another massive package to address infrastructure needs and other matters. The markets worry that the economy will start to overheat sooner than expected, leading to higher inflation and tighter monetary policy.

US Bond Market

The US bond market was the focus of these concerns. The yield on 10 year US government bonds rose from 1.45% at the end of February to 1.75% at the end of March (leading to paper losses for investors, as bond yields and price move in opposite directions). The yield on Treasury Inflation Protected Securities (TIPS) bonds rose from -1.04% to -0.68% over the same period. The difference between the yields on these two types of bonds reflects the market’s expectations of inflation. These expectations were around 2.15% at the start of March and 2.4% by the end of the month. The markets are concerned central banks are being too blasé about inflation risks and the need to keep interest rates down. However, both the Reserve Bank and the US Federal Reserve reiterated that they do not see inflation as a problem for some time and will be maintaining current interest rate settings for another 2-3 years.

Equity and other markets

The higher US bond yields impacted a range of other markets. For example, the price of gold fell as the TIPS yields rose. Gold is very sensitive to the direction of TIPS yields. Emerging market equities fell because much of these nations’ external debts are denominated in US dollars. As US yields and the US dollar rise, both of which happened in March, EM equities tend to underperform.

In the US equity market, the NASDAQ had a volatile month and finished March not much higher than February’s close. The NASDAQ index is populated by stocks that do less well when inflation expectations and bond yields rise. In contast, the broader S&P500 index posted a 4% gain in March. Importantly, this was achieved despite a fall in the Price/ Earnings ratio. The message from this is that equity investors were encouraged by the prospect of better profit growth from the strengthening economy.

REITs and infrastucture equities also had a good month despite concerns about higher bond yields. Prospects for reopening economies as vaccines are rolled out, and the impact of President Biden’s infrastructure program helped these sectors.

The A$/US$ eased from around US$0.783 at the end of February to around US$0.765 at the end of March. This reflected the decline in the iron ore price, as well as some strength in the US dollar while US bond yields rose more than those in other countries.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.