Economic Snapshot: Markets deliver strong gains

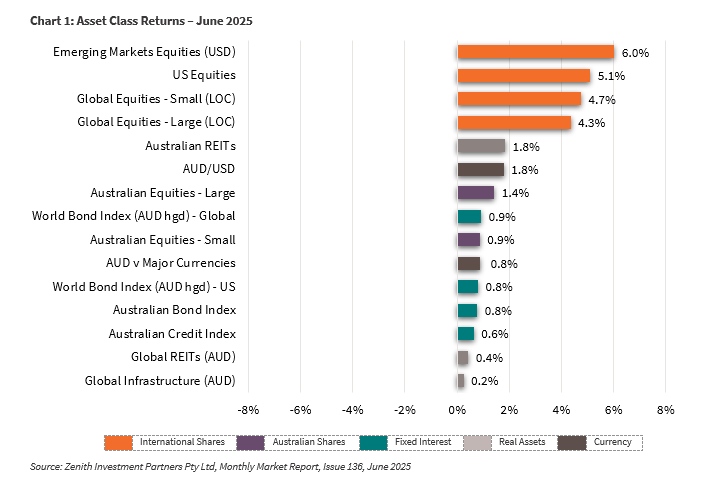

Markets delivered strong gains in June, capping off an impressive quarter for both global and Australian equities. Global shares rose 2.45% for the month and 5.9% over the quarter, despite ongoing geopolitical tensions, concerns over US debt levels, and renewed tariff fears.

The Australian market performed even better, climbing 1.4% in June and 9.5% for the quarter, supported by positive global sentiment and a more favourable domestic economic outlook.

Inflation continues to ease locally, with the RBA’s preferred measure — the trimmed mean — falling to 2.4%, below the mid-point of the target range. This has strengthened expectations that interest rates will be cut further, with markets now pricing in a cash rate below 3% by early 2026 (down from 3.85%).

In bond markets, yields were volatile, particularly in the US. The US 10-year yield dipped to 4% during the tariff announcements before rising to 4.5% on fiscal concerns, finishing the quarter at 4.25%. Australian 10-year yields were more stable, ending June at 4.2%, as political and monetary policy settings remained relatively steady.

Overall, falling inflation and resilient markets have helped boost investor confidence heading into the second half of the year.

Global Developed Equities

Global equity markets rallied strongly in June, despite a backdrop of geopolitical tension, US fiscal concerns, and trade uncertainty. The MSCI World ex-Australia Index rose 4.3% in June and 11.5% over the quarter. The S&P 500 hit a record high, led by mega-cap and AI-related stocks, while emerging markets also posted solid gains.

Mid-month conflict between Israel and Iran briefly shook markets and lifted oil prices, but fears eased after a US-led strike and a ceasefire.

In the US, the proposed “One Big Beautiful Bill Act” – a mix of extended tax cuts and spending reductions – passed both houses of Congress in early July. While expected to fuel economic growth, the package may add over $3 trillion to US debt, raising concerns in bond markets.

Trade tensions persist, with uncertainty over whether tariff pauses will hold beyond July. Limited progress with China and Vietnam means risks remain.

Despite these headwinds, markets appear optimistic: fiscal stimulus is seen as growth-supportive, inflation risks from tariffs seem contained, and a more dovish US Federal Reserve stance is expected. Growth stocks led the way, particularly in tech and communications, while quality and defensive sectors lagged.

Australian Equities

Australian shares posted strong gains in June, with the ASX200 up 1.4% for the month and 9.5% for the quarter—outperforming global markets on an unhedged basis. This strength was supported by buoyant global markets and improving local economic conditions.

While March quarter GDP growth came in at a modest 0.2%, the broader picture is more encouraging. The labour market remains healthy, wages are rising in real terms, and inflation continues to ease.

The RBA’s preferred core inflation measure fell to 2.4%, just below the mid-point of its 2–3% target range. As a result, markets are increasingly confident the RBA will cut rates, potentially pushing the cash rate below 3% by early 2026. This should help support household spending and the housing market, particularly as population growth slows.

Corporate earnings expectations remain subdued overall, with banks facing weak growth. However, bank stocks have surged—up 16.1% for the quarter—led by CBA, which jumped 22.4%. This rally has been linked to increased offshore investor interest and super fund benchmarking activity. Valuations are now elevated. Elsewhere, energy and diversified financials performed well, while more defensive sectors like consumer staples lagged.

Emerging Markets

Emerging markets delivered strong returns in June, rising 6% for the month and 12% for the quarter in USD terms. The rally was supported by a weaker US dollar, improving global growth prospects, and expectations of lower interest rates. South Korea led the gains, soaring 32.7% on the back of a pro-market election outcome and booming semiconductor stocks.

Taiwan also performed well, up 26.1%, while Brazil and Mexico posted solid gains. China lagged with just a 2% rise, though signs of economic stabilisation are emerging—retail sales and industrial production are improving, even as property and deflation pressures persist.

Many investors had feared emerging markets would suffer from trade tensions and slowing growth. Instead, falling rates, easing tariff rhetoric, and currency support have helped ease recession concerns and boosted investor confidence.

Fixed Interest – Global

Bond markets were volatile in the June quarter, with US 10-year yields dipping to 4% on tariff concerns before rising to 4.5% amid fears over US debt levels and foreign selling. They settled at 4.25% by quarter’s end, while two-year yields fell below 4%.

US economic data painted a mixed picture. Job growth remains steady but slower, with May payrolls rising by 139,000. Inflation, however, is easing—core CPI rose just 0.1% in May, bringing the annual rate to 2.8%. Sticky core inflation has slowed to an annualised 2.6% over the past three months.

The Fed held rates steady at its June meeting, maintaining its focus on inflation. However, signs of a split emerged, with some Fed members signalling possible rate cuts as soon as July. Markets now expect four to five cuts over the next year, up from three to four a month earlier. Speculation around Fed independence has grown as Jerome Powell’s term ends in 2026.

In Europe, the European Central Bank cut rates by 25 basis points, while the Bank of England held steady but hinted at future cuts. High-yield credit spreads narrowed, reflecting fading recession fears and growing investor confidence in the global outlook.

Fixed Interest – Australia

Australian 10-year bond yields were relatively stable in the June quarter, ending at 4.2% after ranging between 4.09% and 4.5%. A stable policy environment and a predictable election outcome helped dampen volatility.

Markets expect the RBA to begin cutting rates from August, with the cash rate potentially falling to 2.95% by early 2026. This reflects confidence that inflation and unemployment will return to target levels.

Inflation is easing faster than expected—the headline CPI fell to 2.1% in May, while the RBA’s preferred core measure dropped to 2.4%, below the midpoint of its target range.

While GDP growth was weak at just 0.2% in the March quarter and household spending remains soft, the broader outlook is improving. Real wages are rising, job creation remains solid, and mortgage rates are falling.

The Bloomberg Composite Bond Index rose 0.75% in June, bringing quarterly and annual returns to 2.6% and 6.8%, respectively.

Commodities and Currencies

Commodity markets were volatile in June, especially oil. After trending lower for nearly two years, oil prices spiked toward US$80 a barrel following conflict between Israel and Iran. Fears of supply disruption through the Strait of Hormuz briefly raised concerns of prices hitting US$100, but a ceasefire helped ease tensions by month-end.

Gold struggled to gain further despite the geopolitical risk, though it rose 5.7% for the quarter and 42% over the year. Copper continued its upward trend, supported by strong demand linked to the global energy transition. Iron ore, however, fell to US$94.5 a tonne, down 11.3% over 12 months due to weak Chinese demand.

In currency markets, the US dollar weakened on concerns over debt levels, trade policy, and political interference with the Fed. The euro, Swiss franc, and yen all gained sharply. The Australian dollar also edged higher, ending June at 65.8 US cents, supported by global shifts away from US assets.

Key takeaways for investors

- Global and Australian equities performed well, with the MSCI World ex-Australia up 11.5% and the S&P 500 hitting record highs, led by tech and AI stocks. The ASX200 rose 9.5%, boosted by easing inflation, steady jobs, and expected rate cuts.

- Emerging markets surged 12% (USD), driven by South Korea and Taiwan’s tech strength and political shifts. China’s growth shows signs of stabilizing despite property sector challenges.

- US bond yields fluctuated amid fiscal concerns and tariff risks, while Australian yields stayed steadier. Markets now price in multiple rate cuts in both countries due to easing inflation and slowing growth.

- Core inflation eased in key regions, with Australia’s rate at 2.4%, below target. The US also saw soft inflation, increasing market confidence in rate cuts starting as early as July (US) and August (Australia).

- Growth stocks, especially tech and communications, led gains. AREITs rebounded, banks rallied despite muted earnings, while defensive sectors lagged.

- Oil remained volatile but stable post-ceasefire. Gold and copper rose; iron ore fell on weak Chinese demand. The USD weakened in 2025, while the AUD strengthened to 65.8 cents, benefiting from relative value and asset shifts.

Bottom Line for Investors

Despite geopolitical tensions and fiscal uncertainty, markets have remained resilient, delivering strong returns. Falling inflation and likely interest rate cuts support equities and bonds. Australia’s steady economy, easing inflation, and better consumer sentiment add to this positive outlook. Growth sectors like technology, infrastructure, and clean energy are gaining, while property and financials attract renewed interest.

Staying invested and diversified is key, as markets focus on improving monetary conditions and long-term trends. With rate cuts expected and inflation easing, the second half of the year offers opportunities - although caution is needed around high valuations and ongoing global risks. Overall, the outlook is cautiously optimistic.

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.