Economic Snapshot: Positive momentum on markets

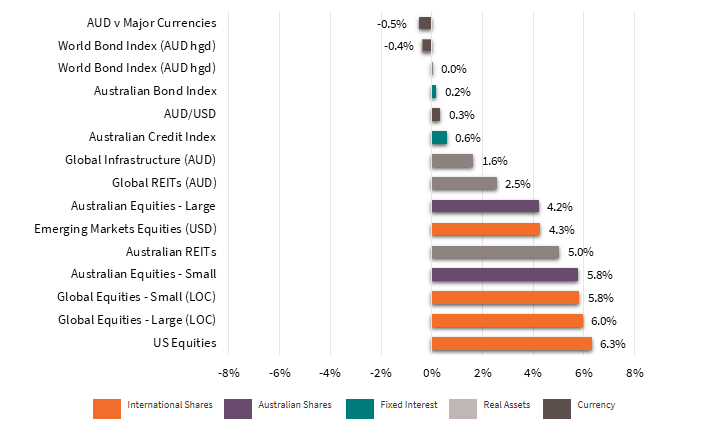

May marked a turning point for both domestic and global markets, with improving sentiment and positive momentum across key asset classes.

In Australia, the economic backdrop brightened as the Reserve Bank cut the cash rate by 25 basis points to 3.85%, the second cut for 2025. The decision reflected a more favourable inflation outlook, even as global uncertainties remained in focus.

Equity markets rebounded strongly, reversing April’s losses. Global shares rose 5.3% in Australian dollar terms, supported by easing tariff concerns and resilient corporate earnings. The local market followed suit, gaining 4.2% for the month and edging closer to its all-time high. Mid-Cap companies led the local rally, with strong gains in IT, communications, and real estate sectors. The major banks also saw renewed strength.

Bond markets were more subdued, reflecting a shift in expectations around US monetary policy. Investors scaled back their forecasts for interest rate cuts from the Federal Reserve. Yields on US 10-year bonds rose early during the month before easing slightly by month-end. Australian bonds posted a modest return of 0.2% in May, bringing the 12-month return to a solid 6.8%.

Altogether, May delivered a welcome boost in investor confidence, supported by constructive economic signals and more accommodative policy settings. While markets often move in response to headlines and short-term data, it’s important to remain focused on long-term investment goals. This month’s gains are a reminder of how quickly conditions can shift, and why staying invested through periods of uncertainty is often the most effective strategy.

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 135, May 2025

Global Developed Equities

Global share markets bounced back in May, recovering losses from April as concerns about US-China trade tension eased. A reduction in average US tariff rate, from nearly 30% down to around 12%, helped lift investor sentiment. However, uncertainty remains after a US Supreme Court decision questioned the legal basis for recent tariff hikes, highlighting the unpredictable nature of trade policy going forward.

Encouraging economic data and stronger-than-expected corporate earnings, particularly from the US, also helped shift expectations away from recession fears toward a more positive "soft landing" scenario. The so-called "Magnificent 7" technology giants led the way, with earnings growth of 27.7% for the quarter, well ahead of the broader market’s 9.4% growth.

Inflation trends were also favourable. Both US and European rates moved closer to central bank targets, easing pressure on policymakers. Even so, long-term government bond yields rose during the month, especially in the US and Japan, reflecting concerns about government debt levels and future borrowing costs. This may eventually weigh on equity market valuations if it continues.

Despite those headwinds, equity markets delivered strong returns overall. The MSCI World ex-Australia rose 6% in USD terms, with IT and communication sectors leading the gains. Growth-oriented stocks outperformed Value and Quality styles buoyed by optimism around earnings and innovation.

For long-term investors, this reinforces a few key themes; global equities remain supported by earnings strength and a stable inflation backdrop, but markets can shift quickly in response to policy news. Staying diversified and focused on fundamentals, rather than headlines, is as important as ever.

Australian Equities

The Australian share market rose 4.2% in May, closely tracking global markets and bringing the ASX index within 2% of its all-time-high. After a sluggish start to the year, Australian equities are now broadly in line with global peers, though still trailing European markets.

The Reserve Bank of Australia cut interest rates for the second time this cycle, lowering the cash rate to 3.85%. The decision was supported by a further improvement in inflation data, with underlying inflation falling back within the RBA’s 2–3% target range for the first time since 2021. With both inflation and unemployment now near their desired levels, markets are expecting further rate cuts, potentially taking the cash rate to 3% by early 2026.

The improving economic outlook has contributed to a modest upgrade in company earnings forecasts, with analysts now expecting nearly 6% growth over the next year. However, share valuations remain elevated, the local market is trading at around 19 times expected earnings, meaning future gains are likely to depend on whether companies can meet or exceed earnings expectations.

Performance in May was led by mid-cap stocks, with standout gains in the technology sector, which surged nearly 20%. Strong returns were also seen in communications, real estate, and the major banks. Over the past 12 months, the financial sector has led the market, gaining almost 25%. In contrast, materials and healthcare stocks have underperformed, recording declines over the same period.

For investors, this reinforces the importance of staying diversified across sectors and remaining mindful of valuation risks. While the economic outlook has improved, Australia’s market remains heavily concentrated (financials and materials businesses), so it’s important not to rely on a single sector or group of stocks to carry future performance. Staying disciplined and diversified helps manage this risk over the long term.

Emerging Markets

Emerging market equities rose 4.3% in May, extending their year-to-date gains to 8.7%, outpacing developed markets. Easing trade tensions between the US and China helped boost investor sentiment, especially in Taiwan and South Korea. These markets jumped 12.5% and 7.8% respectively, supported by strong global demand for technology and artificial-intelligence-related sectors.

Elsewhere, results were more mixed. China and India underperformed during the month. In China, concerns about the strength of the economic recovery weighed on markets, while in India, high share prices led to some investor caution. Brazil was flat following another interest rate hike, while Mexico stood out with a strong currency and surprise rate cut that supported local equities.

A weaker US dollar has also played a role in lifting emerging markets, as it tends to attract more capital flows into these regions. If global growth remains steady, this supportive trend could continue.

For investors, emerging markets offer growth potential but often come with more short-term volatility. Maintaining exposure as part of a diversified portfolio can help capture long-term opportunities while managing the ups and downs across individual countries.

Property and Infrastructure

Australian listed property (AREITs) rose another 5% in May, extending their strong run from April. Since February, sector leaders like Charter Hall have gained more than 20%, while Vicinity, Scentre Group, and Mirvac have all delivered double-digit gains. Even Goodman Group, which had previously weighed on the sector, rebounded sharply during the month. Globally, REITs also performed well, rising 2.5% in May.

Global infrastructure delivered another month of steady gains, rising 1.6% and bringing the year-to-date return to 6%. This is a strong result, particularly considering the backdrop of rising long-term bond yields. In fact, infrastructure has outperformed hedged global equities so far this year, highlighting its appeal as a relatively defensive asset class.

For investors, property and infrastructure have returned to their roots as fundamentally driven sectors. In recent months, they’ve benefited from a focus on reliable income, inflation-linked cash flows, and earnings stability—factors that are increasingly valued in a higher-rate, more volatile environment.

These attributes – yield resilience, inflation protection, and stable demand – make property and infrastructure valuable diversifiers within a long-term portfolio, especially during periods of economic uncertainty.

Fixed Interest – Global

US recession fears eased in May, with steady economic data and softer inflation helping calm markets. The labour market added 177,000 jobs, unemployment held at 4.2%, and headline CPI fell to 2.3%, the lowest since early 2021. A more conciliatory US stance on China trade also improved sentiment.

The Federal Reserve held rates steady, citing tariff-related uncertainty. Markets now expect fewer than four rate cuts over the next year, down from five earlier in 2024.

Despite lower inflation, bond yields rose as investors focused on the US fiscal outlook. The 10-year yield touched 4.6% before easing to 4.4%, and the 30-year reached 5%, a level not seen since 2007, amid concerns over debt and policy credibility. Japanese bond yields also climbed above 3% on inflation and weak auction demand.

In the UK, the Bank of England cut rates to 4.25% as growth softened but maintained a cautious tone. Meanwhile, narrowing credit spreads signalled improving sentiment and reduced concern about near-term recession risk.

For long-term investors, global fixed interest continues to provide valuable income and portfolio stability, particularly during periods of economic uncertainty and shifting market expectations.

Fixed Interest – Australia

In May, the Reserve Bank of Australia cut the cash rate by 25 basis points to 3.85%, marking the first time rates have fallen below 4% in two years. The decision came despite a slight uptick in inflation, with headline CPI rising to 2.4% and underlying inflation at 2.8%, both still within the RBA’s 2–3% target range.

Australia’s labour market remains resilient. In April, 89,000 new jobs were added, and wages rose 0.9% for the March quarter, bringing annual wage growth to 3.4%. Much of this growth was led by sectors such as healthcare and education. Unemployment remains low, indicating a moderately tight labour market and steady pressure on wages.

Business conditions are still subdued, but forward orders suggest a mild recovery may be ahead. Consumer confidence, while still below average, has improved compared to a year ago.

Compared to the US, inflation in Australia appears more contained. If China continues redirecting its exports away from the US, it could help ease imported price pressures further. This may give the RBA additional room to reduce interest rates later in the year—markets are currently pricing in up to three more rate cuts over the next 12 months.

Australian bond markets were steady in May. The Bloomberg Composite Index rose 0.2% for the month and has returned 6.8% over the past year—highlighting the consistent role fixed interest continues to play in diversified portfolios, particularly in delivering income and managing risk during uncertain times.

Commodities and Currencies

Improved sentiment in May saw gold ease to US$3,289 an ounce after hitting a record high in April, though it remains up over 25% for the year, driven by US policy uncertainty and a softer US dollar.

Oil prices held steady, with Brent crude ending the month at US$63.90 a barrel, but are still down 14.6% year-to-date amid demand concerns and rising OPEC supply. Iron ore stayed below US$100 a tonne on weak Chinese demand, while copper prices rose, supported by strong global demand and supply constraints tied to the energy transition and infrastructure development.

In currency markets, the US dollar regained some ground as trade tensions eased but remains pressured by fiscal and policy concerns. The euro has appreciated strongly this year, while the yen and pound were relatively stable in May. The Australian dollar rose 0.5% to close at 64.3 US cents, supported by relative valuation strength.

While not a direct portfolio focus, these shifts influence the operating environment for companies, particularly in sectors like energy, materials, and exporters, affecting input costs, margins, and earnings outlooks.

Key takeaways for investors

- Global equities rebounded, led by strong earnings and easing trade tensions. US markets were lifted by resilient economic data and standout performance from the "Magnificent 7" tech stocks. Growth sectors outpaced Value and Quality.

- Australian shares gained 4.2%, bringing the ASX close to record highs. A second RBA rate cut, combined with inflation returning to target and a stable labour market, supported market strength. However, Australia’s equity market remains concentrated, with a few large companies influencing broader performance.

- Emerging markets outperformed developed markets year-to-date, supported by strong tech demand and a weaker US dollar. Taiwan and South Korea led gains, while China and India lagged due to valuation concerns and economic softness.

- Property and infrastructure remained solid contributors, with AREITs extending their recovery and global infrastructure continuing to deliver consistent, inflation-linked returns. Investor focus has returned to fundamentals such as income, pricing power, and stable earnings.

- Fixed income markets were mixed. Recession fears eased, but bond yields rose in the US and Japan amid fiscal concerns. The Fed held rates steady, while Australian bonds remained stable, backed by low inflation and expectations for further RBA cuts.

- Commodities delivered varied results. Gold pulled back from record highs but remains one of the year’s top-performing assets. Oil held steady but is still down year-to-date, while copper gained on strong demand tied to electrification and infrastructure investment.

- Currency markets stabilised, with the US dollar firming modestly despite longer-term fiscal pressures. The Australian dollar rose slightly, supported by improved sentiment and its relative valuation.

Bottom Line for Investors

Markets are showing renewed resilience as inflation eases, earnings improve, and central banks adopt a more patient stance. While policy and fiscal uncertainty – particularly in the US – remains a risk, current conditions broadly support equities, property, and infrastructure. Cautious optimism is appropriate, with an emphasis on long-term discipline, diversification, and fundamental portfolio positioning.

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.