Economic Snapshot: Markets steady as inflation persists

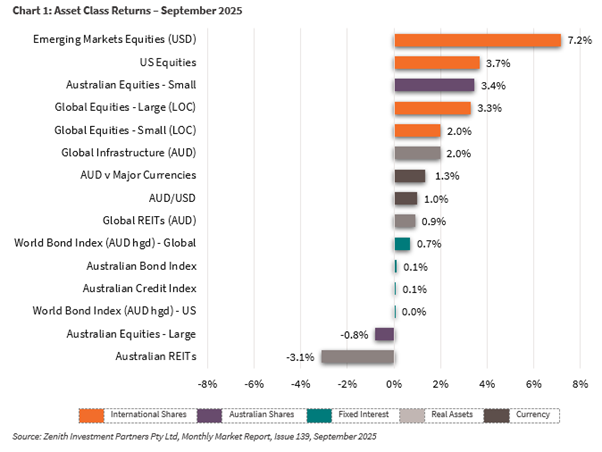

Financial markets were influenced by shifting expectations around inflation and interest rates in September.

The Reserve Bank of Australia kept the cash rate steady at 3.6%, noting that inflation may stay higher than expected in the September quarter.

While investors still anticipate rate cuts, these are now expected to occur later than previously forecast. Global equities continued their strong run, with the MSCI World ex-Australia Index up 6.1% for the quarter and nearly 10% year to date.

However, Australian shares lagged, falling 0.8% for the month as investors adjusted to the prospect of higher than desirable inflation. Bond markets reflected similar uncertainty—US yields fluctuated between 4% and 4.15%, while Australian 10-year yields rose to 4.42% before easing slightly to 4.3% by month end.

Overall, markets remain buoyed by resilient global growth but cautious about the pace of inflation moderation and the timing of future rate cuts.

Global Developed Equities

Global share markets performed strongly in September, with the MSCI World ex-Australia Index up 6.1% for the quarter and 9.7% year to date.

US markets led the gains, rising 3.7% in September and 8.1% for the quarter.

Several factors supported the rally: solid corporate earnings (profits expected to grow 13% over the next year), optimism around artificial intelligence and technology, and the US Federal Reserve’s decision to cut interest rates by 0.25%. This rate cut—along with signals of further easing ahead—helped boost investor confidence despite growing signs of slower economic activity, weaker job growth, and softer consumer sentiment.

While some economic indicators have started to cool, markets appear focused on the potential for easier monetary policy and resilient corporate profitability to keep equity returns on track into year end.

Australian Equities

The Australian market lagged global peers, falling 0.8% in September, though it remains up 11.5% year to date.

Investors reassessed interest rate expectations after inflation proved stickier than expected, tempering recent gains. Mid- and small-cap stocks were standouts, outperforming larger companies as confidence improved in the domestic outlook.

Sector performance was mixed - Materials and Utilities led the gains, supported by rising commodity prices, while Health Care, Consumer Staples, and Financials underperformed.

Gold, copper, and iron ore prices all moved higher amid global supply concerns and optimism about a recovery in China.

The Reserve Bank of Australia kept rates steady at 3.6%, acknowledging that inflation may stay higher for longer. Markets still expect rate cuts eventually, but probably later than first thought.

Emerging Markets

Emerging markets outperformed developed economies in September, with the MSCI EM Index up 5.8% in AUD terms and 16.5% year to date.

South Korea and Mexico were standout performers, helped by strong technology exports and capital inflows after the US Federal Reserve rate cut. The global AI boom continues to benefit chipmakers, particularly in Asia.

India underperformed due to weaker earnings and high valuations, while China’s markets rose modestly amid signs of stabilisation and easing concerns about tariffs. However, persistent deflation pressures and weak corporate profits continue to weigh on China’s long-term outlook.

Property and Infrastructure

Australian listed property (AREITs) declined 3.1% in September after interest rate expectations shifted higher, though the sector remains up nearly 19% for 2025.

Goodman Group continues to dominate the index, accounting for about 40% of its weight.

Global listed property (GREITs) rose slightly, while infrastructure assets underperformed broader equity markets, returning less than 1% for the month. Despite this, both sectors remain supported by moderate inflation and stable yields.

Fixed Interest – Global

Bond markets were mixed. US yields initially fell after weak employment data but ended the month higher at 4.15% as inflation stayed sticky and GDP growth was revised up to 3.8%. Inflation remains above the Federal Reserve’s target, with core inflation at 3.1%.

The Fed’s decision to cut rates by 0.25% marked its first easing since 2024, shifting focus from fighting inflation to supporting the labour market. However, policymakers cautioned that inflation risks remain, and markets now expect a slower pace of cuts into 2026.

In Europe, unemployment is near record lows at 6.2%, while inflation is close to the European Central Bank’s 2% target, allowing it to hold rates steady.

The UK, however, continues to battle high inflation and weak growth, with long-term gilt yields around 5.5%, near multi-decade highs. Credit markets stayed firm, reflecting low concern about recession risk.

Fixed Interest – Australia

Australian bond yields fluctuated through September, finishing slightly higher at 4.3% after the RBA left rates unchanged at 3.6%. The central bank signalled that inflation might stay above expectations for longer, even as job growth softened.

Household spending and government investment continue to support growth, though risks from tariffs and global tensions remain. The unemployment rate held steady at 4.2%, suggesting a still-tight labour market despite slower hiring.

The Bloomberg Composite Bond Index rose 0.1% for the month and 4.4% year to date.

Commodities and Currencies

Commodity markets were mixed. Oil prices fell 4.1% to around USD62 a barrel as OPEC and other producers lifted supply. Gold surged nearly 17% in the quarter to a record USD3,859 per ounce, boosted by investor demand for safe-haven assets amid uncertainty about the US government shutdown and a weaker US dollar.

The US dollar fell slightly during the quarter, while the Australian dollar gained 1.1%, supported by stronger domestic inflation data and expectations that the RBA’s rate-cutting cycle will be gradual.

Key Takeaways for Investors

- Global markets remain resilient, supported by easing policy and strong corporate earnings.

- Australia continues to grow, though inflation and interest rate expectations are restraining local equities.

- Emerging markets are benefiting from technology demand and a softer US dollar.

- Property and infrastructure returns have moderated but remain stable in a supportive yield environment.

- Bonds face mixed forces—slowing growth and sticky inflation—making diversification important.

- Gold continues to perform strongly as investors seek safety.

Bottom Line for Investors

Markets are balancing optimism about easier policy with caution over slowing growth and persistent inflation.

Looking for Personal Financial Advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.