Economic Snapshot: Markets react to US rate rises

The rally enjoyed by financial markets in July came to an abrupt halt in August. The key driver of this change in sentiment was the outlook for US interest rates.

Markets had been expecting the US Federal Reserve would lift interest rates into early 2023 and then unwind some of that as the year progressed in response to a slowing economy. However, these hopes were dashed when FOMC Chair Powell’s speech at the Jackson Hole Symposium in late August made it clear the Fed intends to hold the line on higher rates for longer. In particular, the Fed said it will not revert to the unsuccessful stop-go monetary policy of the 1970’s and 1980’s.

Higher real yields in August pulled equity P/E (price/ earnings) ratios down and pushed the US$ up again. Commodity prices fell, in response to higher real yields and to concerns about weaker global growth. In this environment the A$/US$ fell around 1.5% to US$0.69.

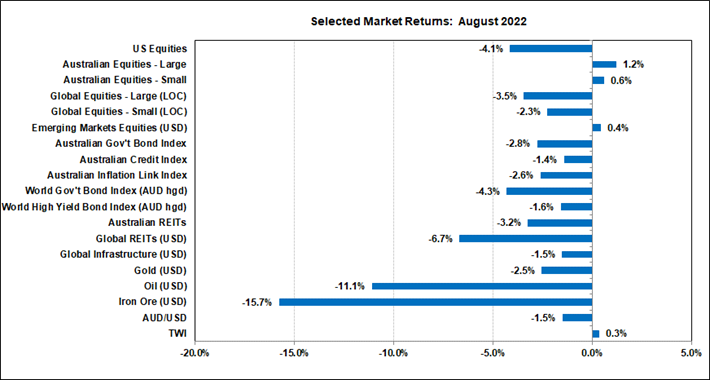

Chart 1: Disappointment about US interest rates undermined markets in August.

Global Financial Markets

The rally enjoyed by financial markets in July came to an abrupt halt in August. Most equity markets posted losses, but the Australian market managed modest gains for the month. Bond markets, both here and overseas, had another bad month.

Interest Rates and Inflation

The key driver of this change in sentiment was the outlook for US interest rates. Markets had been expecting the US Federal Reserve would lift interest rates into early 2023 and then unwind some of that as the year progressed in response to the economy slowing down. This has become known as the “Powell pivot”, named after Federal Open Market Committee (FOMC) Chair Jay Powell.

Equity markets had viewed the implied profile of the US cash rate as relatively benign and managed to rally in the first half of the month, but bond markets were less comfortable. After rallying in July, bond markets focussed on the annual central bankers’ symposium at Jackson Hole in Wyoming held towards the end of August. Markets knew Chair Powell would make a statement about US interest rates and started to push bond yields up ahead of the event. By the middle of August equity markets decided to follow the bond markets and the equity rally seen in the first half of the month started to unwind.

At the symposium, Chair Powell delivered a more hawkish speech than expected. His key message was that the Federal Reserve would continue to lift interest rates as aggressively as needed to bring inflation down, even at the rising risks of a recession. Powell, along with other Federal Reserve Governors, made it clear they would not make the mistake of the stop-go monetary policy seen in the 1970’s and 1980’s, which failed to curb inflation at that time. The Fed now intends to raise rates and hold them there until they can be confident inflation is heading sustainably back to their 2% target.

The cash futures markets raised cash rate expectations and bond yields rose further in response. The market still expects some reduction of the US cash rate starting in the second half of 2023, but the overall profile of the cash rate is higher than it was at the end of July. Equity markets did not like these developments and quickly sold off, wiping out the gains seen earlier in the month.

US inflation protected bond yields (TIPS) rose sharply, from around 0% at the start of the month to around 0.8% by the end of August. These yields are heavily correlated with a variety of other key assets, including equity market P/E ratios – hence the drop in equities noted above. However, the TIPS yields are also closely linked to the US$, which rose nearly 4% against the Yen and 2% against the Euro. The A$ was caught up in this US$ strength and fell 1.5% in August to finish below US$ 0.70 again. The Reserve Bank’s decision to lift the cash rate by 0.5% to 1.85% provided a temporary boost to the A$, but this was overwhelmed by subsequent developments from the US.

The price of gold is also sensitive to the TIPS yields but fell only slightly given how big was the move in the yields. In other commodity news, the price of oil fell sharply on concerns about weaker demand as the global economy slows down, and the price of iron ore dropped nearly 16% amid further signs the Chinese economy is struggling.

Key Economic Indicators

Looking at the economic data released during August, we can see why central banks are still focussed on the need to hold a firm line on interest rates. Although there are signs inflation may be peaking in the US it is too soon to be sure, let alone confident of a rapid decline from here. In other countries, including Australia, the UK and Europe, inflation has not yet peaked.

In the US, indicators of manufacturing and service sector activity maintained a similar pace to the previous month, but the labour market showed continuing strength. Employment rose 528,000 in July and the unemployment rate edged down slightly to 3.5%. This is not an environment in which the Fed will be able to achieve its inflation objectives. The unemployment rate will have to rise sooner or later as the lagged impact of slower growth feeds through the economy.

Similarly, here in Australia the unemployment rate is still very low at 3.4%, even though employment fell in July. The June quarter Wage Price Index came in softer than expected, but still posted 2.6% growth over the 12 months to the quarter. The low unemployment rate should help deliver stronger wages growth in the September quarter. Indicators from private sector surveys confirmed inflation has not yet peaked. Notwithstanding reports of risks to the housing market, the Reserve Bank is expected to raise the cash rate to around 3.25% by the middle of next year.

Geo-political activity

China was in the headlines again with concerns about new outbreaks of Covid and further disruptions to economic growth. In response, policy makers have announced more measures to support the economy. Nancy Pelosi’s visit to Taiwan in early August provoked a flurry of protests from Beijing as well as provocative incursions of missiles into both Taiwan and Japanese waters. Although this issue faded relatively quickly as August progressed, actions like this add to the markets’ overall nervousness at the moment.

Source: Thomson Reuters, Bloomberg 1 September 2022

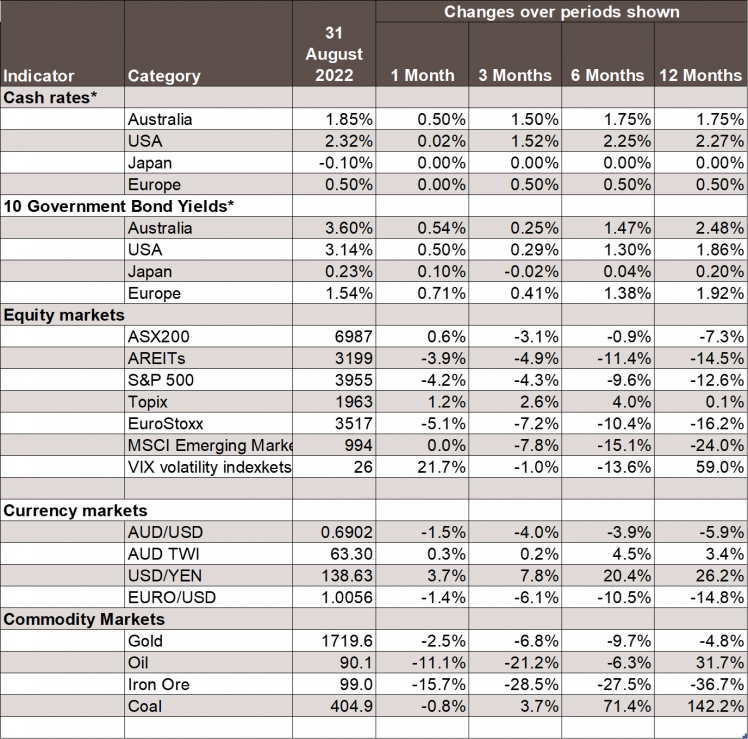

Chart 3: Major Market Indicators – August 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.