Economic Snapshot: Markets React to Russian Invasion of Ukraine

Financial markets have been unsettled by the Russian invasion of Ukraine. Higher prices for energy and other commodity exports of those countries have added to pre-existing concerns about how central banks will manage the current inflationary surge.

There are also some concerns about whether the stringent sanctions imposed on the Russian economy and financial system may have repercussions on counterpart countries elsewhere.

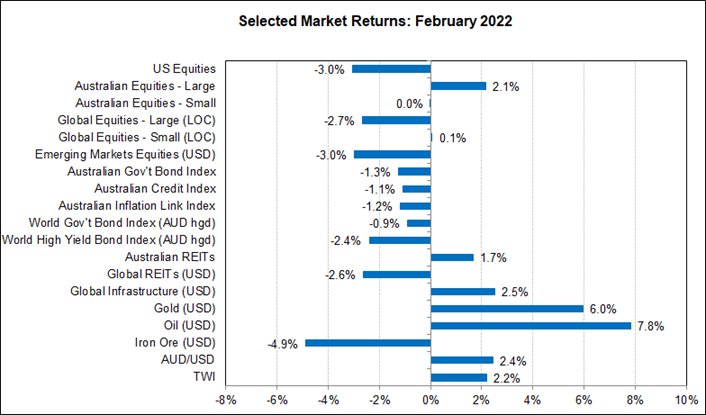

In this environment many equity markets fell in February, with the worst being a 30% drop in the Russian equity market. However, the Australian equity market was seen as a beneficiary of the higher commodity prices and rose 2.1%. For the same reason, the A$/US$ rose 2.4% in February.

The price of gold rose 6%, which is to be expected given the geo-political events in Europe.

Chart 1: The Russian invasion of Ukraine caused volatility in financial markets in February.

Source: Thomson Reuters, Bloomberg 1 Febraury 2022

Global Financial Markets

Russia’s invasion of Ukraine has increased uncertainty and volatility in global financial markets. Although markets had been watching the situation closely, the actual event was still a shock.

Apart from the terrible tragedy for the people of Ukraine, markets are worried about the implications for further geo-political unrest, as well as the impact on the broader global economy.

Geo-Political implications

On the geo-political side, a key question is whether success in Ukraine would embolden Mr Putin to make moves against neighbouring NATO countries. In that event, the risk of full-scale military conflict between NATO and Russia escalates dramatically.

This is one reason the West has moved so aggressively on sanctions against Russia, in addition to the provision of materiel to Ukraine. The aim is to make invading Ukraine so costly to Russia that they do not try the same elsewhere.

Impact of Sanctions

The sanctions, including expulsion from the SWIFT banking system and restrictions on dealing with Russian commercial banks, are very serious. However, the most serious is the sanctioning of the Bank of Russia, which is the central bank, and freezing the country’s foreign exchange reserves. Other countries to have their central banks sanctioned like this include Syria, Iran, Afghanistan and Venezuela.

Under these sanctions, the Bank of Russia can no longer access Russia’s foreign exchange reserves to help fund the invasion or support the rouble in the global currency markets. When a country can no longer defend its currency in the face of severe global risk-aversion to that currency, the inevitable result is depreciation. The rouble fell 28% against the US dollar in February.

Currency depreciation of that magnitude has serious ramifications for the Russian economy. Imported inflation will spike sharply and flow into generalised inflation. The Bank of Russia lifted the cash rate from 9.5% to 20% to try to support the rouble, a move which will further hurt the Russian economy.

The equity market fell 30% in February and Russian bonds have been downgraded to low-level junk status. Investors around the world are jettisoning investments in Russian assets, which have effectively become un-investable. In a matter of days, Russia has become a pariah in the global financial markets.

Global Economic Implications

What impact will all this have on the global economy? At the simplest level, the Ukraine and Russian economies are very small by global standards. According to IMF figures for 2021, Russia’s GDP is about 7% the size of that in the US, and Ukraine is about 1% the size of the US.

However, what matters is what these countries produce, rather than just the size of their economies. Russia is a significant exporter of oil and gas, while Ukraine exports iron, steel, mining and agricultural products. The invasion will disrupt the supply of these goods, and their prices in world markets have risen in response. For example, the price of oil rose nearly 8% in February to US$96/bl.

Inflation

Markets are concerned that these higher commodity prices will further fuel inflation around the world and lead to more aggressive interest rate increases, especially in the US. Comments from one of the Federal Reserve Presidents that a 0.5% interest rate increase in March may be needed, added to these concerns.

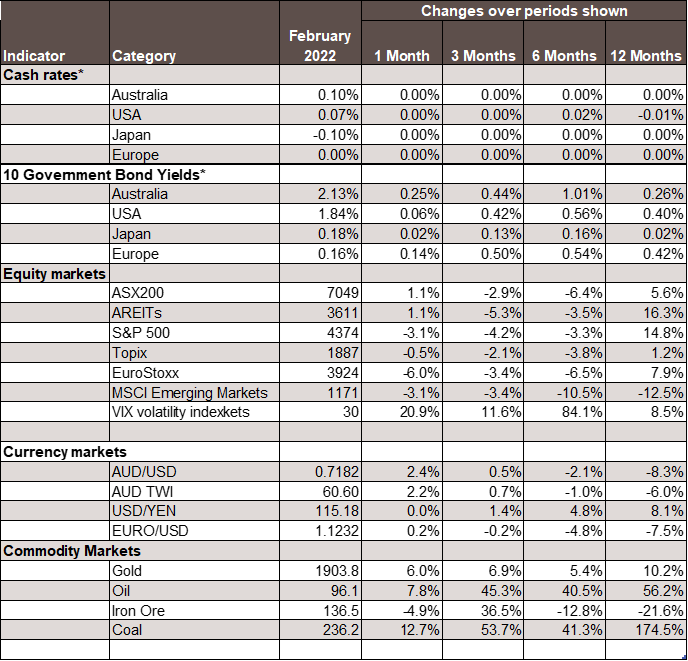

At the start of February, the market was pricing two rate hikes in the US by June and three by September. By the end of the month, an additional rate hike had been added to each of those expectations.

At the same time, US inflation figures remained elevated. Producer prices rose 9.7% in the year to January, while consumer prices rose 7.5% over the same period. Growth in the US economy remains robust with activity indicators for both manufacturing and services well into expansion territory.

An extra 467,000 jobs were added in January and unemployment remained steady at 4%.

Markets are wondering if the Fed will have to cool the economy more than previously expected to manage the inflation risks. The US bond market has lifted its expectation for inflation over the next five years to 3.1%.

Bond and Equity markets

In light of all this, 10-year bond yields in the US rose only slightly, but two-year yields rose just over 40 basis points. This meant the 10-year/2-year yield curve flattened quite a bit to close the month at just 0.25%. This is consistent with the bond market thinking the economy will slow as a result of the Fed’s interest rate increases.

The US equity market started to worry about the impact of this on earnings growth, combined with general risk aversion from a conflict that could escalate. Mr Putin’s comments about nuclear weapons did not help.

The S&P500 fell 3% in February, and the NASDAQ by 3.4%. Other global equity markets also fell, especially in Europe given the proximity to Ukraine and the dependence on oil and gas imported from Russia. The Euro Stoxx index fell 6% in February.

Australia

In contrast to this, the Australian equity market performed well, with the ASX200 rising 2.1% in the month. This was because Australia is also an exporter of the commodities sold by Russia and Ukraine, so those sectors of our economy should benefit from the higher global commodity prices. For much the same reason the A$/US$ was able to rally nearly 2.5% in February.

In other domestic news, the wage price index data for the December quarter turned out to be softer than expected, with growth of only 2.3% over the year. This reinforced the Reserve Bank’s moderate approach to lifting interest rates.

The price of gold rose 6% in February, which is to be expected given the geo-political events in Europe.

Chart 3: Major Market Indicators – February 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.