Economic Snapshot: Markets maintain support

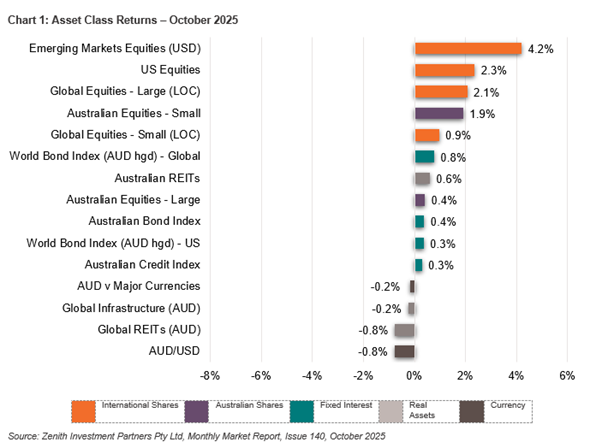

Global markets continued their strong momentum in October, supported by solid corporate earnings, easing inflation pressures and central banks beginning to lower interest rates.

The US and Japan led gains, while Europe was more subdued. Australia once again lagged global peers as stubborn inflation and weaker earnings weighed on performance, though mid- and small-cap stocks continued to show resilience. Emerging markets were standouts, with South Korea and Taiwan surging on the back of strong semiconductor demand and improving global trade conditions.

Bond markets were mixed, responding to shifting expectations around the pace of future rate cuts as policymakers balanced slowing labour markets with still-elevated inflation. Commodity prices remained broadly firm, with copper and gold continuing their strong run, while oil eased on rising supply. The Australian dollar weakened against a stronger US dollar.

Overall, markets were generally supportive, though inflation trends and policy uncertainty continue to shape the outlook.

Global Developed Equities

Global share markets extended their strong run in October, rising another 2.1% and bringing year-to-date gains close to 20%. Japan led performance with a 3.4% rise in USD terms, boosted by the election of Sanae Takaichi, whose pro-stimulus stance pushed the yen lower and supported equity markets.

The US also delivered solid returns, with the market up 2.4% as major technology and AI-related companies continued to perform strongly. A robust US earnings season helped sentiment, with Q3 earnings growth surprising on the upside—led by technology and financials. Well-known names including Amazon, Microsoft, Intel, JP Morgan and Morgan Stanley all reported stronger-than-expected results.

Rate cuts from the US Federal Reserve, falling bond yields and a temporary trade truce between the US and China further lifted market confidence. The agreement eased tariff risks and stabilised access to rare earth minerals—a key input for AI technology. Markets also took comfort from softer US inflation data, despite limited visibility caused by the ongoing US government shutdown.

The US Federal Reserve has been trying to slowly reduce the amount of money in the financial system – a process called quantitative tightening. It’s basically the opposite of stimulus. Instead of adding money into the economy by buying bonds, the Fed lets some of those bonds mature and roll off its balance sheet. This can make borrowing a little more expensive and financial conditions a bit tighter.

In October, the Fed paused this process because there were some short-term funding pressures in the system. That pause, combined with comments from Fed Chair Jerome Powell that a December rate cut wasn’t guaranteed, caused a brief wobble in markets.

Even so, global share markets still ended the month strongly, supported by solid economic growth and healthy company earnings.

Australian Equities

The Australian share market again lagged global peers, rising just 0.4% in October. Persistent inflation and shifting expectations around interest rate cuts continue to weigh on local sentiment. Inflation for the September quarter came in stronger than expected, pushing out the likely timing of any further RBA easing.

Weak earnings growth has also been a drag, with consensus expectations sitting at around 5% following two years of declines. The healthcare sector was a key detractor, largely due to another sharp fall in CSL as investors reacted negatively to downgraded profit guidance and restructuring outcomes.

Resources performed better, supported by rising commodities—gold, copper and other metals strengthened, lifting the materials sector by over 4%. Smaller resource companies, in particular, have benefited from the surge in gold prices this year.

Market leadership has continued to broaden, with mid- and small-caps outperforming larger companies—often a sign that markets are looking ahead to future growth and a lower interest-rate environment. However, the RBA’s challenge remains significant. A still-tight labour market, sluggish productivity and higher unit labour costs are keeping services inflation elevated.

These factors also point to a lower sustainable growth ceiling for Australia, making it harder to reduce inflation without slowing activity further.

Emerging Markets

Emerging markets (EM) outperformed developed economies in October, helped by exceptionally strong gains in South Korea and Taiwan. Korea rose nearly 23% for the month and over 90% for the year, driven by powerful AI-related demand for semiconductors and supportive domestic reforms. Taiwan also posted strong returns, gaining nearly 10% in October.

The MSCI Emerging Markets Index rose 5.5% in AUD terms for the month and 25.7% year to date. EM Asia rose despite a decline in the MSCI China Index; however, Chinese equities remain well up for the year overall. Latin American markets were quieter in October but continue to post very strong year-to-date results.

Several tailwinds continue to support EM performance: the global AI boom, higher commodity prices, improving growth conditions and capital inflows encouraged by US rate cuts. A weaker US dollar earlier in the year also helped EM currencies and financial conditions.

Property and Infrastructure

Despite falling cash rates and easing bond yields, property and infrastructure assets underperformed broader equity markets in October as investor attention remained concentrated on growth-oriented sectors such as technology. Australian REITs recovered modestly, rising 0.6% after a weak September, but remain softer than global equity indices overall. Global REITs fell slightly, down 0.8%, though they remain positive for the year.

Global infrastructure also dipped marginally, declining 0.2% for the month. While the sector benefited from sticky inflation and signs that real yields may be peaking, it continues to lag the broader market—which has been buoyed by strong AI-linked capital expenditure and improving corporate earnings.

Overall, REITs and infrastructure remain supported by a more favourable interest-rate backdrop, but investor preference for higher-growth sectors has held back relative performance.

Fixed Interest – Global

Global bond markets were influenced by shifting expectations of how quickly central banks will cut rates. US bond yields drifted below 4% early in October on hopes of further Federal Reserve easing and softer-than-expected inflation. The Fed delivered a widely anticipated rate cut to 3.75–4% later in the month, but Chair Powell emphasised that another cut in December was “not a foregone conclusion,” prompting yields to rise back above 4%.

Powell highlighted the difficulties posed by the US government shutdown, noting that limited data visibility was like “driving in the fog.” He also addressed tensions within the Fed, with some policymakers concerned about labour-market risks, while others worry that stronger-than-expected growth—estimated at over 3.5% for Q3—may keep inflation elevated.

Inflation data was encouraging in October. In the US, core prices rose just 0.2% for the month, bringing annual core inflation down to 3%. In Europe, inflation is now sitting close to the European Central Bank’s 2% target, giving it room to keep interest rates on hold.

In the UK, government bonds (gilts) performed well because both inflation and economic growth softened. This allowed the Bank of England to sound more dovish - meaning it was more relaxed about inflation and less likely to raise interest rates.

Credit spreads widened slightly late in the month but remain tight overall, signalling continued investor confidence and limited concern about recession.ixed Interest – Australia

Australian bond yields fluctuated through September, finishing slightly higher at 4.3% after the RBA left rates unchanged at 3.6%. The central bank signalled that inflation might stay above expectations for longer, even as job growth softened.

Household spending and government investment continue to support growth, though risks from tariffs and global tensions remain. The unemployment rate held steady at 4.2%, suggesting a still-tight labour market despite slower hiring. The Bloomberg Composite Bond Index rose 0.1% for the month and 4.4% year to date.

Fixed Interest – Australia

Australian 10-year bond yields moved within a relatively narrow range in October, drifting as low as 4.1% before finishing the month at 4.31%. The main event was the release of September quarter inflation, which came in much stronger than expected. Headline inflation rose to 3.2%, while core inflation climbed to 3%, well above the RBA’s preferred trajectory.

The higher-than-expected figures have pushed out expectations of any further RBA rate cuts, with markets now placing less than full probability on even one additional 25-basis-point cut. Unemployment unexpectedly rose to 4.5%, but Governor Michele Bullock reiterated that the RBA’s priority remains returning inflation to target.

The RBA acknowledged uncertainty around how restrictive policy settings truly are, particularly given high unit labour costs, solid wage growth and weak productivity. Overall, bond returns were modest, with the Bloomberg Composite Index up 0.4% for the month and 4.75% year to date.

Commodities and Currencies

Commodity markets saw broad strength in October, though recent high-flying precious metals experienced some late-month profit-taking. Gold finished October at USD 4,002 per ounce—up 3.7% for the month but down from a mid-month peak—yet remains up an impressive 52% this year. Copper rose sharply, gaining almost 10% amid strong demand from the energy-transition sector and ongoing supply constraints. Iron ore also edged higher.

Oil prices fell 3% to around USD 65 per barrel, with increased supply from OPEC+ and non-OPEC producers weighing on prices.

In currency markets, the US dollar strengthened following reduced geopolitical tensions and a more cautious tone from the Fed. The yen weakened further after the election of Japan’s new prime minister, while the Australian dollar slipped 1.1% to around USD 0.654, held back by mixed signals—higher local inflation on one hand and a stronger USD on the other.

Key Takeaways for Investors

- Global markets continued to rally, supported by strong earnings, easing policy and robust growth.

- Australia again underperformed, held back by sticky inflation and weak earnings in key sectors.

- Emerging markets - especially Korea and Taiwan - were standout performers thanks to AI and semiconductor demand.

- Property and infrastructure lagged as investors favoured growth sectors.

- Bond markets remain sensitive to inflation data and shifting central-bank expectations.

- Commodities stayed strong, particularly copper and gold, while oil prices softened.

- The Australian dollar weakened despite higher inflation, reflecting a stronger USD backdrop.

Bottom Line for Investors

Markets remain supported by solid global growth and improving corporate earnings, but persistent inflation -particularly in Australia - continues to delay expectations for further rate cuts.

Looking for Personal Financial Advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.