Economic Snapshot: Global equities bounce back

The Reserve Bank of Australia (RBA) increased the cash rate to 4.35% in response to a resilient job market and domestic demand, with inflation moderating slower than anticipated.

October's Consumer Price Index (CPI) indicated a decrease in inflation from 5.6% to 4.9%. Global equities rose by 9.4% in November, the largest monthly gain since the 2020 COVID recovery, driven by signs of economic moderation in the US and disinflation in developed markets.

Australian stocks, up 5% in November, showed a 4.8% year-to-date increase, led by the tech sector. In the month, Real Estate Investment Trusts (REITs) surged 11%, and pharmaceuticals and biotech rose 13.7%, while banks advanced 6.1%. However, energy, utilities, and food and beverages declined.

Global bond yields rose in October due to a resilient economy, with Australian yields affected by expectations of another RBA tightening in November. Both global and Australian bond yields dropped in the month due to ongoing disinflation trends and more dovish comments from Federal Reserve officials, prompting a reassessment of the 2024 outlook for Fed funds cash rate.

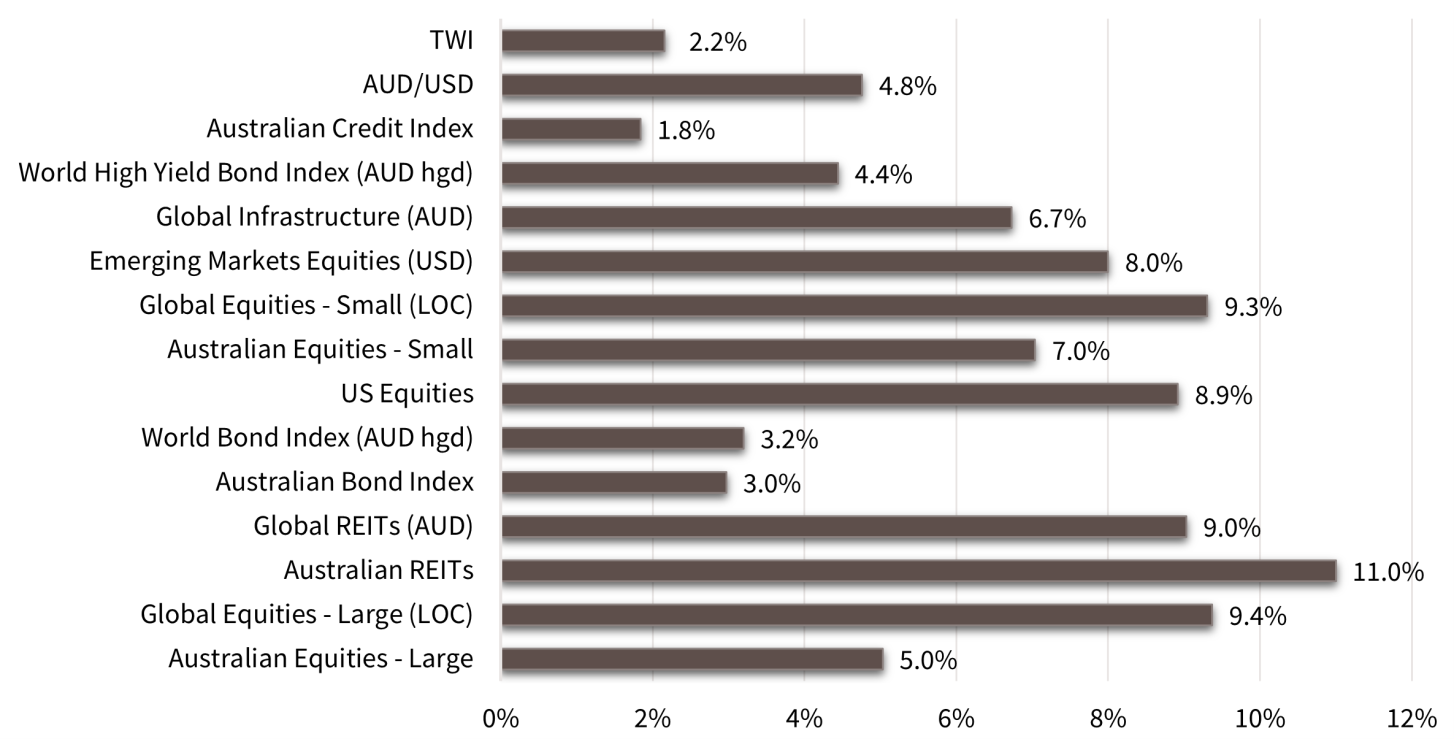

Asset Class Returns - November 2023

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 117, November 2023

Global Developed Equities

In November, global markets were positive due to signs of economic moderation and disinflation. Signs that central banks were reaching the peak of tightening cycles supported both equities and fixed income markets. Bond yield declines boosted global equities by 9.4%, marking the largest monthly increase since the 2020 COVID-related recovery. The global MSCI World ex-Australia index is up 18.3% for the year in USD terms.

Despite the Israel-Hamas conflict, a temporary ceasefire eased pressure on oil prices, contributing to the disinflationary narrative. Larger-than-expected drops in inflation in Europe and the US, coupled with dovish language from Fed officials, led to expectations of 3-4 rate cuts in 2024. US company earnings growth for the last quarter of 2023 is 2.7%, down from 4.9% in Q3, with weaker performance in energy, materials, and healthcare.

Inflation news was positive, with US inflation at 3.2% and European CPI at 2.4%. Fed Governor Waller's comments on policy flexibility pushed bond yields lower and equities higher. The US economy expanded by 5.2% in Q3, and positive growth was observed in Europe, particularly Germany, Spain, and Italy.

Investment markets for November were led by Europe (ex-UK) rising 10.8%, followed by the US (9.4%) and Japan (8.6%). Construction materials, IT, REITs, banks, and consumer discretionary were top-performing sectors. Growth outperformed Value, returning 31.2% YTD, while Value saw a modest 5.8% increase.

Australian Equities

In Australia, the equity market gained 5% this month, bringing the year-to-date increase to 4.8%. Like global trends, lower bond yields and increased price-to-earnings ratios were observed. However, Australia's earnings outlook is modest, with consensus earnings per share (EPS) growth for the next 12 months of around 1% (historically it’s usually higher than 5% per annum).

The RBA raised the cash rate to 4.35%, citing ongoing strength in the labour market and domestic demand. Despite a slower-than-expected decline in underlying inflation, the RBA highlighted a shift among businesses towards passing cost increases to consumers. October's CPI data showed a decrease in inflation to 4.9% from 5.6%.

Data-wise, the NAB monthly business survey indicated a decline in business conditions to their lowest since early 2022, with decreased forward orders. September quarter GDP was below expectations at 0.2% (2.1% for the year), driven by stagnant consumer spending.

The equity market rebound was led by the tech sector, with REITs and pharma/biotech performing well. Banks saw a solid 6.1% advance, while energy, utilities, and food/beverages were down. Year-to-date, (excluding technology), the insurance sector has been the best performer with a 19.5% increase followed by retailers at 17.2%

Emerging Markets

In November, emerging markets rose by 8% in US dollars or 3.1% in Australian dollars. However, their year-to-date performance of 5.7% lags global developed equities by about 12%.

The emerging market rally occurred despite subdued Chinese equities, which only rose by 2.5% in the month and are down 9% for the year. In contrast, Korea and Taiwan surged by 16.2% and 13.2% in November, with year-to-date gains of 15.5% and 23.6%, respectively. Brazil and Mexico were other notable performers, up 14.2% and 15.5%.

While emerging markets remain relatively inexpensive compared to developed markets, they have needed a catalyst for outperformance. The recent shift in the Federal Reserve's language is likely that driving factor.

Property & Infrastructure

Real Estate Investment Trusts (REITs) and infrastructure have been hit hard by the surge in bond yields in 2023. However, a large bond rally in November helped propel the sectors higher with AREITs up 11% and GREITs (global real estate) up 9%.

The sector is still dealing with questions over underlying property valuations, although much appears to be factored into listed markets. For the year-to-date, AREITs are up 5.5 per cent.

The FTSE Global Infrastructure index was 6.7 per cent higher during the month, cutting this year's loss to 3.9 per cent.

Fixed Interest – Global

In November, US bond yields rallied significantly, ending the month at 4.37% for the 10-year yield and 4.73% for the 2-year yield. This shift was influenced by ongoing disinflation trends and more dovish comments from various Federal Reserve officials, leading to a reassessment of the outlook for Fed funds (cash) rate in 2024. The market began factoring in up to four rate cuts in 2024.

Positive inflation news, particularly in the US, where CPI readings for October were cooler than expected, contributed to the bond market's encouragement. Headline and core inflation dropped to 3.2% and 4.0%, respectively, due to declines in energy, gasoline prices, and lower travel and hotel costs. This raised hopes of reaching 2% inflation before the end of 2024, eliminating expectations of further Fed rate hikes.

In Europe and the UK, inflation also showed positive trends, allowing central banks to consider not just the end of tightening cycles but also the possibility of rate cuts with Fed officials suggesting the US central bank has the ability to manage inflation without significantly raising unemployment.

High-yield spreads narrowed, reflecting confidence in a soft landing, while investment-grade spreads also contracted. The Barclays Credit index returned 4.4% for the month.

Fixed Interest – Australia

Australian bond yields surged to 4.95% in October, up from 4.5%, outpacing global counterparts. US 2-year yields held at 5.06%, while Australian 2-year yields rose to 4.46%, anticipating further RBA tightening. September CPI exceeded expectations, with core inflation at 5.4%, challenging the RBA's 3.9% forecast by end-2023.

In early November, the RBA raised the cash rate to 4.35%, the first increase in four months, acknowledging persistent inflation. Australia's unemployment rate dipped to 3.6%, but the underemployment rate rose to 6.4%, signalling potential labour market softening. The NAB business conditions index (a sign of current corporate health) remains above average.

In November, Australian bond yields decreased from 4.95% to 4.42%, in line with global trends, despite the Reserve Bank of Australia (RBA) raising rates to 4.35% on Melbourne Cup Day. The RBA acknowledged economic resilience but noted a slower-than-expected decline in inflation.

Positive data in October showed a drop to 4.9% from 5.6%. The Bloomberg Composite Bond index gained 3% in November, totalling a 2.3% year-to-date increase. The inflation-linked bond index increased by 2.5%, up 4.4% for the year.

However, economic indicators revealed challenges: the NAB business survey showed declining business conditions, September GDP data was lower than expected, and consumer spending stagnated. Despite tight labour markets, with a 3.7% unemployment rate, concerns persist.

The RBA's rate hike aimed to address persistent inflation. Markets anticipate Australian cash rates aligning with US Fed funds in early 2025, supporting the AUD in the past month.

Commodities

Commodity prices dipped in November. Brent crude oil fell over 5% to $82.85 per barrel due to increased US supply and OPEC+ members not meeting production quotas amid ongoing Middle East conflicts.

Gold prices rose 1.9% to $2035 per ounce, driven by a drop in US Fed funds expectations, declining real yields, and a weaker US dollar. Iron ore prices increased to $132 per tonne, boosted by positive Chinese growth data and stimulus plans.

Currencies

The Australian Dollar (AUD) rebounded from around 62 cents to over 66 cents, influenced by the Melbourne Cup Day tightening, higher-than-expected inflation data, and changes in Fed funds expectations.

The Euro rose 3% to 1.09, the Pound increased by 3.9% to 1.262, and the Yen closed just above 148 against the US Dollar.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.