Economic Snapshot: Goodbye, 2020. Here's to recovery - December 2020

Summary

2020 began off the back of a big global equity rally, with a few geo-political concerns, but no inkling of the havoc that COVID-19 was about to wreak on the world.

As the March quarter unfolded with lockdowns following the virus from one country to another, risk assets such as equities and the Australian dollar fell sharply as expectations of recession spiked.

At the same time, a shortage of US dollar liquidity pushed financial markets close to freezing up. Central banks and governments stepped in with massive liquidity and spending packages while interest rates were cut to historic lows.

Equity markets then began a rally that ran through to the end of the year, taking the US market to new highs. Technology stocks performed very strongly as economic activity switched from physical to virtual operations.

Bricks and mortar companies hit by social distancing underperformed. These developments were part of a bigger picture of underperformance of value stocks compared with growth stocks.

As the year progressed, the economic recovery proved faster than expected, but by the end of the year much remained to be done in returning unemployment to pre-COVID levels. Central banks vowed to keep interest rates at current levels for years if necessary.

Progress with vaccines pushed equity markets higher again towards the end of the year and also triggered some rotation from growth stocks back into value stocks. The A$/US$ pushed towards US$0.77 on the back of a strong iron ore price and expectations of US dollar weakness.

Looking into 2021, barring COVID derailing things again and any major geopolitical shocks such as a China/ Taiwan dispute, equity markets should able to post reasonable gains in 2021. However, a higher Australian dollar will make hedged equities more attractive than unhedged equities. The rotation into value stocks has scope to continue. A further sustained rally in gold depends on US inflation expectations rising further.

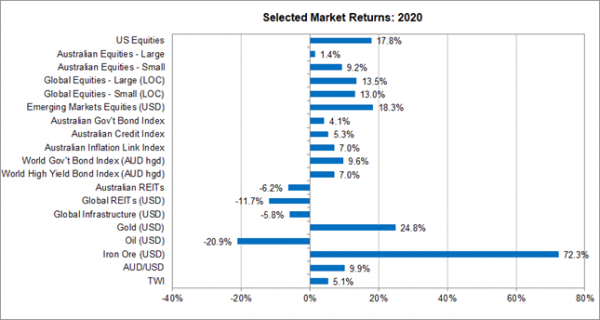

Chart 1: Performance of key financial markets in 2020.

Source: Thomson Reuters, Bloomberg 1 January 2021

Global Markets

By the end of 2019 equity markets had staged a huge rally to new record highs and investors were becoming more confident of stronger growth in 2020.

However, the New Year started on a more troubling note with renewed hostilities between the US and Iran, the Democrat-controlled House of Representatives voting to impeach President Trump, and terrible bushfires here in Australia.

January also saw the first signs of the event that would go on to define 2020 – the emergence of COVID-19 in China.

Impact of COVID-19

Within weeks COVID infections were spreading around the world and by March lockdowns were being imposed in many countries.

One of the most important aspects of COVID at this point was surprise and uncertainty. The last global pandemic had been 100 years earlier, there was little information about the origin and nature of COVID, and the general view about a vaccine was that while efforts would be made to find one, there had never been a successful COVID vaccine.

Market response to COVID-19

Financial markets took these developments very seriously and immediately started to price in a major slowdown in economic activity caused by the lockdowns.

Talk of global recession replaced the confident mood of the start of the year. Volatility exploded across markets with the prices of risk assets such as equities, oil and the Australian dollar falling very sharply.

By the end of March, equity markets were 20% - 30% below where they started the year. The US dollar rocketed up on demand for “safe-haven” US cash and the Australian dollar rate fell to US$0.557 on 19 March after starting the year at US$0.70. At one point in late April, the price of oil actually fell to negative US$37 per barrel as supply far outstripped demand.

These developments reflected more than just a sudden and dramatic downward revision to global growth expectations. They were also a sign of imminent market failure, reviving memories of how global financial markets froze up in the wake of the Lehman Brothers collapse in late 2008.

Policy makers were faced with two problems: keeping financial markets working and providing support for economies to offset the hit to the private sector caused by the mandated lockdowns.

Policy response

Central banks responded by cutting cash rates to historic lows and injecting massive amounts of liquidity into the global financial system.

The US Federal Reserve cut the cash rate to 0.05% and dramatically expanded its Quantitative Easing (QE) program to support low interest rates.

The Reserve Bank of Australia cut the cash rate to 0.25%, although by the end of the year this had been reduced further, to 0.10% and the RBA had started a QE program like other central banks.

At the same time, governments around the world announced massive increases in fiscal spending primarily aimed at supporting household incomes through job preservation/wage subsidy schemes. The combined degree of stimulus between both fiscal and monetary policies far exceeded what was done in the GFC.

Market reaction

Financial markets reacted swiftly and started to discount the surging virus cases, higher unemployment and weaker growth in favour of a better 2021, led by the stimulus programs.

As the year went on, increasing confidence about a vaccine also supported this more optimistic view. Equity markets rose sharply, as did the price of oil, and the Australian currency moved back towards US$0.70.

The price of gold enjoyed a sustained rally, taking it to new highs of over US$2,000. The rise in the gold price was partly due to safe-haven demand on the surging COVID cases in the US and partly on fears of inflation caused by the massive expansion of the money supply provided by the central banks.

The big rally in equities masked some interesting developments between sectors within equity markets as investors assessed the relative prospects of stocks impacted by COVID. For example, online retail companies did better than shopping centres. Selected pharmaceutical stocks also did well on expectations about vaccines.

Banks struggled in the low interest rate environment and business lockdowns, amid concerns about the level of bad debts. At the same time, low interest rates and bond yields helped growth stocks, including tech-companies, relative to the more cyclical value stocks.

Added to this, the rise of online stock trading platforms brought a new wave of retail investors to global equity markets. These investors proved more interested in momentum and speculation than in traditional valuation metrics.

Bond Market

While all this was happening in equity markets, bond yields remained very low as central bank QE operations aimed to suppress any upward drift in bond yields.

One result of this was that as US inflation expectations rose, bond market traders were less able to price those expectations into nominal yields and so resorted to pushing the yields on inflation protected bonds (TIPS) down. (Recall that nominal yields minus inflation protected yields equals inflation expectations predicted by bond investors).

As markets revised up their inflation expectations towards 2%, so the yield on TIPS fell to -1%. The TIPS yield is a key driver of the price of gold, which rose as the TIPS yield fell.

Commodity Prices and Australian Dollar

An important development on the commodity front was the sharp rise in the price of iron ore, especially towards the end of the year, as China’s economy recovered, helping drive the Australian dollar up towards US$0.77.

The Reserve Bank expressed concerns about the dollar rising too far, potentially hurting exports and growth. This was a key reason the RBA introduced its QE program late in the year.

For 2020 overall, as Chart 1 shows, by the end of the year equity markets were higher than a year earlier, though the Australian markets lagged the rest of the world. Property (REITs) and infrastructure indices underperformed, while bond markets posted some good positive returns.

Geopolitical events

As if 2020 was not already dramatic enough, there were also important developments on the geopolitical front.

The tensions between the US and Iran at the start of the year evaporated quickly as COVID expanded.

Tensions between China and the rest of the world increased. China’s treatment of Hong Kong, its behaviour in the South China Sea and renewed rhetoric about reclaiming Taiwan, have all been sources of concern about China’s attitude and intentions.

Their verbal attacks on Australia and attempts to punish us economically have also not gone unnoticed on the broader global stage. However, our currency and equity markets have yet to reflect any significant concerns about this pressure from China.

In the US, after a somewhat inept primary season, the Democrats finally settled on Joe Biden as their Presidential candidate. As COVID rolled through the US and Donald Trump’s performance became increasingly bizarre, so the tide of electoral sentiment started shifting to the Democrats.

But the Democrats did not do as well as expected, losing seats in the House of Representatives and initially not securing a clear majority in the Senate, although the successes in the Georgia run-off elections ultimately yielded a 50-50 split in the Senate, giving the tie-breaking vote to Vice President-elect Kamala Harris.

In the UK, Boris Johnson squeaked a Brexit deal through at the last moment. Implementing the deal will of course take time and have major implications. Not surprisingly, the Scottish Nationals have started talking about independence again.

Looking ahead – issues for 2021

So, where does all this leave us at the end of 2020 and what does it mean for 2021?

COVID-19

The current virus situation varies greatly between countries. Some, including Australia and New Zealand, have infections well under control. Others, notably the US, never had it under control, while others, including throughout Europe and the UK, have lost control of it.

Progress in developing multiple vaccines has been extraordinary and the race is on to distribute and employ them as quickly as possible. Although markets have largely chosen to ignore the virus in recent months, it is likely that at times it will cause bouts of volatility.

Similarly, if the vaccine rollout does not go as smoothly as markets hope, then that too would upset markets.

Global Economic Outlook

Economies are recovering, but still have a way to go. In particular, it will take time to see inflation and unemployment back to where the central banks want them.

There are some signs of over-confidence in markets and households about these variables. The data suggest that by the end 2021, inflation will still be lower, and unemployment higher, than the central banks want.

This means that we can take literally the central bank statements about no interest rate rises for the coming year. With interest rates at rock bottom levels, bond and credit markets are likely to deliver only modest positive returns.

Equity markets should be the best performing asset class in 2021, although not as spectacularly as 2020’s swift turnaround from the early lows. Continued economic recovery should underpin profit growth, while central bank liquidity and interest rate settings will help keep share market price/earnings (P/E) ratios elevated.

Within equity markets, the rotation from growth to value stocks has scope to continue. Underperforming sectors like REITs and infrastructure can also outperform, as long as the virus does not disrupt the gradual normalisation of economic activity.

The Australian dollar is likely to rise further to around US$0.80, meaning hedged international equity exposures will do better than unhedged exposures. If the US$ depreciates as much as the markets expect, then the Australian dollar could go higher than this and emerging market equities could outperform.

If we are right about inflation not being as big a threat in the coming year as the markets currently think, then the price of gold may have little upside from here.

Key Risks for 2021

Key risks to the outlook, apart from COVID derailing things again, include the Democrats taking control of the Senate and enacting a much more aggressive program of reform and fiscal expansion.

China deciding to try its luck with taking over Taiwan would be a major shock to global financial markets.

If we are wrong about inflation and it does go up more than expected, then rising interest rate expectations could hurt equity markets. However, gold could rally in this scenario too.

It seems another interesting year is ahead of us for investment markets.

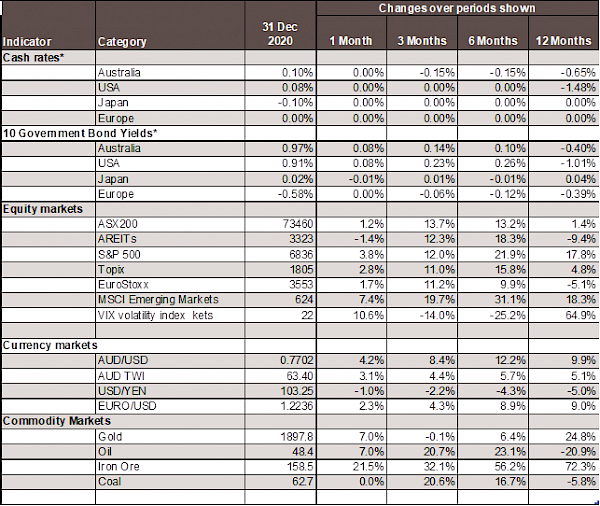

Chart 2: Major Market Indicators – December 2020

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.