Economic Snapshot: Global markets rally - November 2020

Summary

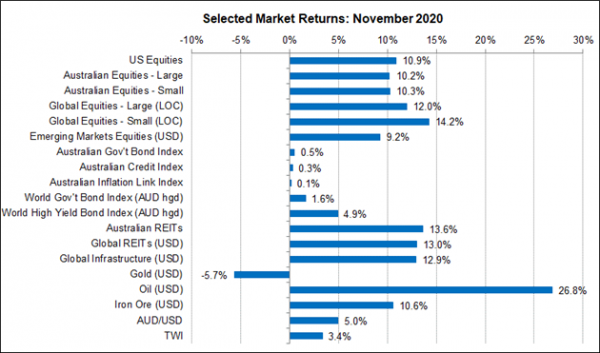

November was a massive month for global financial markets. Two of the biggest uncertainties facing the markets were resolved in ways which led global investors to become much more bullish about the outlook as we move out of 2020 and into 2021.

First, the US election is now out of the way and Joe Biden has beaten Donald Trump for the White House. The markets no longer need to fear a contested election.

Second, the news of successful vaccines for Covid-19 marked a sea-change in investor sentiment, even though big waves of the virus are rolling through Europe and the US. These factors, plus the prospect of further policy support, triggered a big risk-on move in financial markets.

Equity markets had one of their biggest months on record and there was a major rotation to value/small cap stocks away from growth/large cap stocks. REITs, infrastructure and bank stocks also did well and beat the broader market indices. The common features of these outperforming sectors/countries is that they all have a greater exposure to cyclical upswings and they have been cheaper than the rest of the markets.

The A$/US$ rose with the iron ore price, as well as general US$ softness. The price of gold fell nearly 6% in November as investors perceived less need for it as a safe haven asset after the news about the vaccines. Gold was already looking expensive compared to underlying fundamentals, especially bond yields, and was poised for a correction.

Chart 1: November was a huge month for risk assets.

Source: Thomson Reuters, Bloomberg 1 December 2020

Global Markets

November was a massive month for global financial markets. Two of the biggest uncertainties facing the markets were resolved in ways which led global investors to become much more bullish about the outlook as we move out of 2020 and into 2021.

US Election Results

First, the US election is now out of the way and Joe Biden has beaten Donald Trump for the White House.

The markets’ big fear was that there would be a contested result leading to weeks of uncertainty. As it turned, out Biden won enough Electoral College votes to make victory look comfortable even though there were some delays in getting the final figures sorted out.

Nor did Trump’s refusal to concede and threats of lawsuits derail the markets’ optimism about Biden becoming President. The markets also liked the prospect of the Democrats not getting a clean sweep of the White House and Congress.

The Democrats did not do as well in the House of Representatives as they had expected, retaining a reduced majority. The Senate race is still undecided with run-off elections in Georgia on 5 January and the results possibly not known until mid-January.

At this stage it is generally expected that the Republicans will win those elections and retain a slender majority in the Senate. That would serve as a check on the more aggressive spending and reform plans proposed by the Democrats.

COVID -19: Second Waves & Vaccines

Second, the news of successful vaccines for Covid-19 marked a sea-change in investor sentiment.

The fact that there are multiple vaccines with different characteristics, including with regard to storage and transportation, means the risk of vaccine failure is greatly reduced. This is a simple question of risk diversification which investors understand all too well.

News of the vaccines was most timely as Covid waves roll through the US and Europe. These waves are much worse than anything previously seen in these countries.

For example, in the US new cases per week rose to around 1.2 million by late November. Restrictions imposed by the authorities in Europe have seen case numbers start to decline, although still at very high levels. The US has been much slower to impose restrictions, resulting in higher infection rates.

Global investors know this will adversely impact economic activity in these countries. There are already signs of this in some of the economic indicators, particularly relating to employment and service sector activity.

However, the markets have taken all this in their stride because they are focusing on the vaccines and a new fiscal package in the US despite delays caused by the election.

Support from Central Banks

Markets also have faith in central bank’s lending a hand. For example, the Reserve Bank of Australia cut the cash rate from 0.25% to 0.10% and announced a new program for buying longer dated government bonds. The RBA made it clear the bond-buying program is explicitly aimed at trying to keep the A$/US$ rate down.

In Europe, the ECB has flagged more stimulus measures in December. As long as the news on vaccines and policy stimulus outweigh that on the virus itself then markets should retain a reasonably positive outlook.

Markets Rally

This was certainly the case in November, as investors revised up their views on global growth and adopted a strong risk-on mood.

In this climate, equity markets rallied very hard to post some of their best ever monthly returns. The US equity market posted new highs, including the Dow Jones Index briefly surpassing 30,000 for the first time ever. Within and across equity markets, there was a pronounced swing to “value” stocks and away from “growth” stocks.

Investors have been waiting for the opportunity to make this rotation and the vaccine news provided the trigger. November also saw small cap stocks outperform large cap stocks and Europe and Japan outperform the US. REITs and infrastructure stocks also did well and beat the broader market indices.

The common feature of these outperforming sectors/ countries is that they all have a greater exposure to cyclical upswings in the economy and have also been cheaper than the markets that had been performing stronger.

Australian bank stocks are a good example. Having languished for several months the banks index rose around 18% in November.

Commodities and Currencies

Other key features of the global risk-on trade were increases in the A$/US$, the prices of oil and iron ore, as well as higher bond yields. Commodity prices like oil and iron ore do well when global growth improves.

In the case of oil, hopes of a resumption of airline travel helped deliver a 27% price rise in the month. Iron ore did well on some positive growth figures from China. The price of iron ore is especially important for the A$ so it is not surprising our currency rose 5% in November.

However, the A$ was also helped by general softness of the US$ which is regarded as a risk-off currency. That is, the US$ tends to do better when global growth is slowing because it is seen as a safe haven asset.

The higher A$ poses a problem for the Reserve Bank which wants to see the currency weaker rather than stronger to help Australian exports remain competitive. However, there will be little the RBA can do if the US$ is about to have a period of sustained weakness.

Reports of further actions by China against Australian exports had no impact on the A$. The price of gold fell nearly 6% in November as investors perceived less need for it as a safe haven asset after the news about the vaccines. Gold was already looking expensive compared to underlying fundamentals, especially bond yields, and was poised for a correction.

Conclusion

The word “unprecedented” was used extensively in describing 2020 but, while we can’t expect the future to be without challenges, as we approach the end of the year, we can start to see a turnaround in the international situation to a more settled 2021.

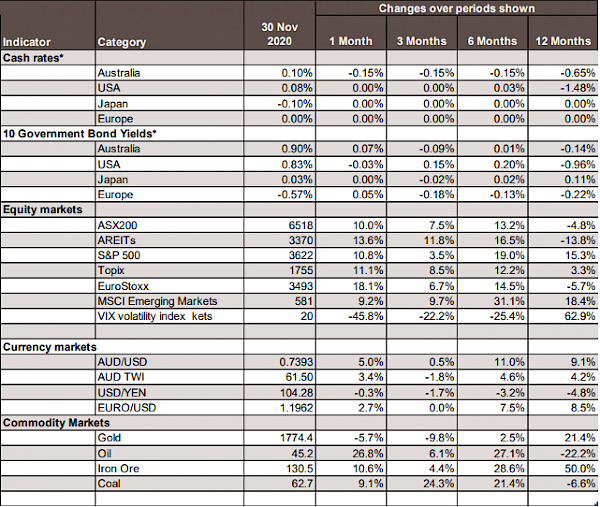

Chart 2: Major Market Indicators – November 2020

*For cash rates and bonds, the changes are % differences; for the rest of the table % changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.