Economic Snapshot: Markets more buoyant

Summary

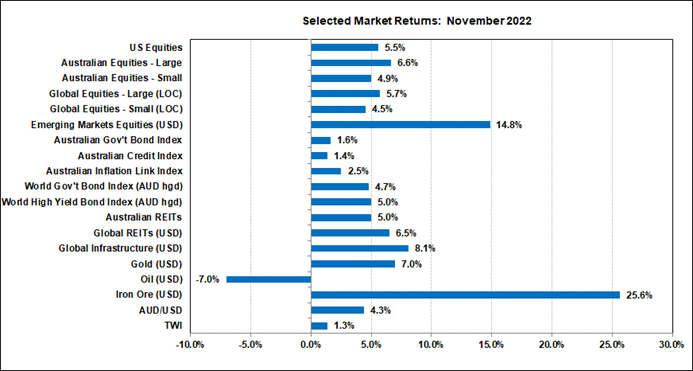

Markets were in a more buoyant mood in November, hoping the worst of the interest rate hikes may be over after some better inflation data and more cautious comments from key central banks.

At the start of the month, the RBA started moderating its rate hikes with a 0.25% increase in November after a string of 0.5% increases in previous months.

Markets revised down their expected path for interest rates into 2023, causing bond yields and the US$ to fall. Emerging market equities benefited handsomely from this with a 14.8% rally, while other equity markets rallied by smaller but still respectable amounts.

The A$/US$ rallied 4.3% as the US$ weakened. Commodity prices were mixed, with gold, coal and iron ore rallying while oil fell amid concerns about weaker global demand. Bitcoin fell 17% in November as the impact of the collapse of FTX flowed through the crypto sector.

Chart 1: Markets rallied on hopes of interest rate relief from central banks

Source: Thomson Reuters, Bloomberg, 1 December 2022

Global Financial Markets

Markets were in a more buoyant mood in November, hoping the worst of the interest rate hikes may be over after some better inflation data and more cautious comments from key central banks.

Data released through the month showed better than expected inflation results in a number of countries, including Australia, the US and Europe. In the US, both producer and consumer price inflation fell in year-on-year terms in October at both the headline and underlying levels.

In addition, core CPI inflation rose by only 0.28% in October, about half the pace seen in September.

Australia

Here in Australia, the ABS published its CPI Indicator for October, which showed headline inflation in the year to October was 6.9%, compared with 7.3% in the year to September.

The corresponding figures for core inflation were 5.3% and 5.4%. These figures were better than markets had expected, but we must remember this indicator is only a partial reading that covers about 60% of the full quarterly Consumer Price Index. What the remaining 40% will contribute is not yet known.

Europe & New Zealand

Latest figures for inflation in Europe also came in below expectations, leading to hopes the ECB could moderate the pace of its forthcoming rate hikes. New Zealand was an exception to the pattern of better news.

The RBNZ said inflation was proving harder to contain than expected and that a recession is coming in mid-2023. The RBNZ increased the cash rate by a record 0.75 percentage points to 4.25 per cent, the highest since 2008.

Interest Rates

As usual, there were statements from a number of central bank officials through the month. Some of these were hawkish, emphasising the need to do what it takes to curb inflation, but others adopted a more moderate tone by focussing on scope to slow the pace of rate hikes to assess the impact on economies of the tightening so far.

This, in conjunction with the inflation data, was what the markets wanted to hear, leading investors to scale back their expectations for the future path of interest rates.

Compared with a month ago, the US cash futures market is now expecting the Fed funds rate to reach 4.75% by mid-2023 (previously 5%) and to be around 3.25% by end-2024 (previously 4%).

In Australia, the market now expects the cash rate to peak around 3.75% by November 2023, compared with nearly 4% a month ago, and to fall to around 3.5% by mid-2023 (previously 4%).

The RBA had already started moderating its rate hikes with a 0.25% increase in November and October after a 0.5% increase the previous months. The US Federal Reserve however, imposed another 0.75% hike. Markets expect a 0.5% hike in December.

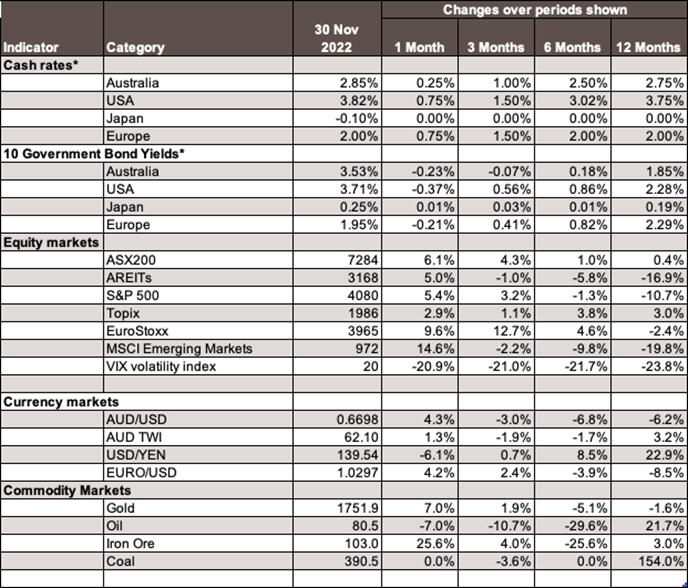

These revised interest rate expectations flowed through to other asset classes. Bond yields fell sharply. The US 10-year government bond yield fell 0.37% to 3.71%. The equivalent Australian yield fell 0.23% to 3.53%. Other bond markets also rallied, with the exception of Japan where there was little change in yields.

The US$ also reacted to November’s developments by falling against other currencies around the world. The US$ TWI (trade-weighted index) fell 3.3% and the A$/US$ rallied 4.3% to US$0.67.

The combination of lower US bond yields and a lower US$ is good news for emerging market (EM) equities. This sector has underperformed significantly in 2022 as rates have gone up, but in November the EM index rallied just under 15% in US$ terms. Other equity markets, including in Australia, also rallied but by more modest amounts between 4%-7%.

Commodities

The price of gold, which is sensitive to the direction of US bond yields, also rallied back through a key technical level to close the month at US$1752 / oz. The prices of iron ore and coal also rose, helped by news of support for the economy from the authorities in China.

The price of oil fell 7% as the market worried about the impact of slower global growth on the demand for oil. Bitcoin fell 17% in November as the impact of the collapse of FTX flowed through the crypto sector.

Although inflation is now passing its peak as expected, it is important markets do not get ahead of themselves regarding inflation and interest rates. A reduction in the pace of rate hikes does not mean there are no more hikes come – the central banks have made it clear we will see more rate hikes. Nor does it mean that rate cuts are necessarily any closer.

Although year-on-year inflation can fall quite quickly due to statistical base effects, it is likely to take some time for inflation to fall back into the official target ranges. The longer that process takes, the longer interest rates will need to remain higher.

Unemployment rates

Furthermore, there are other inflationary pressures of concern to the central banks.

Labour markets are still very tight. For example, in the US although the unemployment rate edged up slightly in October to 3.7%, the economy still added 261,000 new jobs and the excess demand for labour remains high.

Wages growth is showing some signs of peaking, but also remains elevated. In Australia, the unemployment rate fell further in October to a new multi-decade low of 3.39%.

The tightness of the labour market since last year has flowed through to wages growth. The wage price index rose 3.1% over the year to the September quarter, compared with 2.6% over the year to the June quarter.

Inflation Expectations

Inflation expectations are another key factor for central banks. As long as these expectations remain well-behaved the central banks will have less incentive to tighten policy aggressively.

Australian household expectations of inflation were fairly steady at a bit under 3% in October,

Finally, we should remember that the full impact of the interest rate hikes seen so far has yet to be felt on economies. Although equity markets have priced in some degree of profit weakness, it is an open question whether they have priced in enough.

Chart 2: Major Market Indicators – November 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.