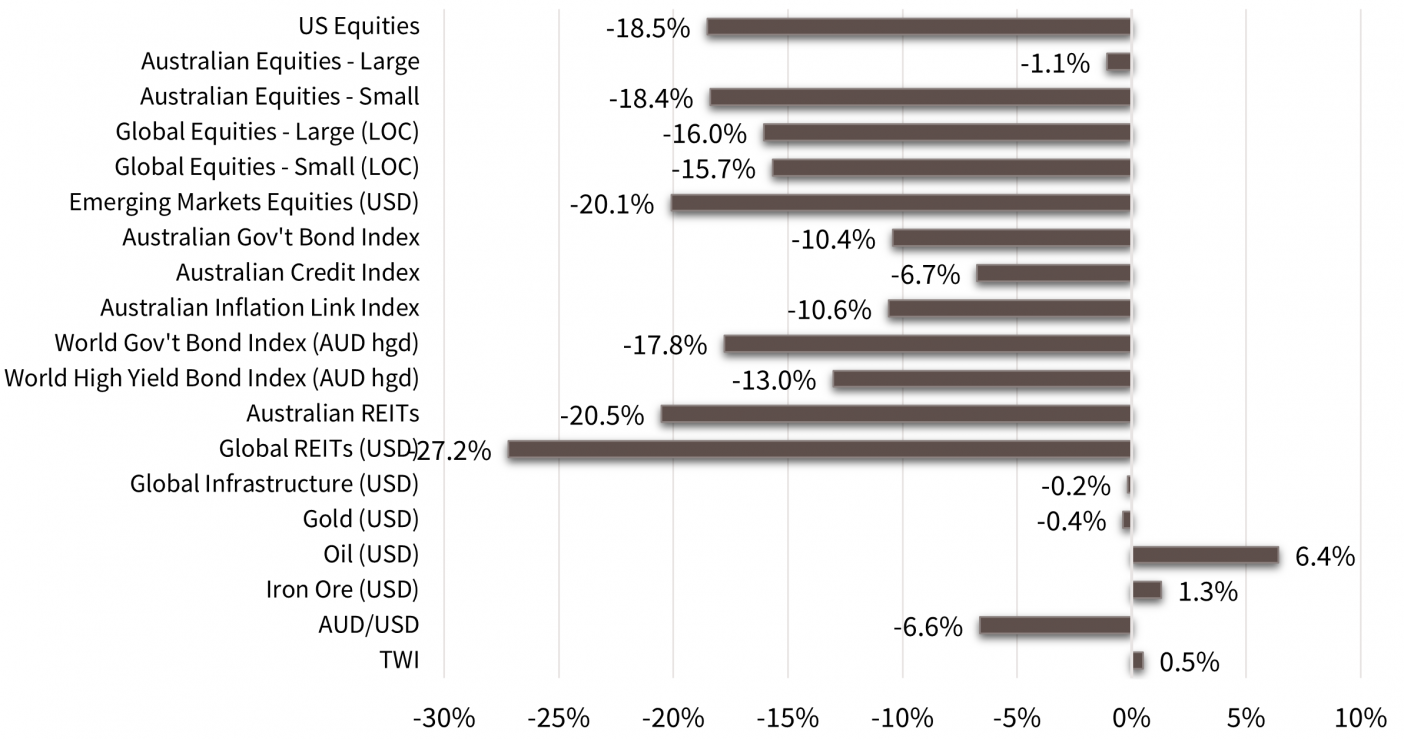

Economic Snapshot: 2022 a difficult year for global financial markets

2022 was a very difficult year for the global financial markets, with nearly all asset classes posting negative returns for the year (see Chart 1 below). The cause of this was the rapid tightening of monetary policy (interest rate increases) to deal with the worst global inflation shock in forty years.

Although the outlook for inflation is now better than it was a year ago, the big question for 2023 is how much damage has been done to economic growth by the higher interest rates designed to tame inflation.

Recessions are generally expected for several Northern Hemisphere countries, but Australia may fare better, and China could see stronger growth as it moves past the current wave of COVID and related lockdowns.

Bonds seem well-placed for better performance in 2023, but the prospect for equities depends on the profiles of profit growth. Better news on that front may be a story for later in 2023 rather than sooner.

Chart 1: Nearly all assets generated negative perfromance in 2022 under the weight of higher inflation and interest rates.

Source: Thomson Reuters, Bloomberg, 1 January 2023

Inflation

As the 2022 year opened, it was apparent that inflation was going to rise as increased demand caused by COVID support payments and ultra-low interest rates collided with shortages caused by supply chain pressures. Investors hoped the US Federal Reserve’s view that higher inflation would be “transitory” might prove correct but were not convinced.

Although some key supply chain indicators began to improve in late 2021, it was still unclear how quickly this would continue and then show up in lower inflation.

The Russian invasion of Ukraine in February seriously compounded the inflation problem. The supply of key commodities, including oil, gas and grains, was immediately restricted, especially to Europe. This quickly caused a surge in the prices of these commodities. For example, the price of oil started the year at US$76/barrel and by 8 March had risen to US$124/bl. By mid-May the price of wheat peaked 70% above its end-2021 level. These disruptions and price hikes caused significant problems for European energy supply, and for emerging market nations dependent on imported grain.

Food and energy prices make up the difference between headline inflation and the underlying inflation rate that central banks target for monetary policy. Typically, central banks prefer to let food and energy inflation run its course because there is nothing monetary policy can do to manage it. However, when higher food and energy inflation start to spill over into core inflation, then the risk of more persistent inflation worsens, and central banks must respond.

Interest Rates

As the first half of the year unfolded, it became increasingly clear that inflation would not prove transitory and that central banks would have to do more with interest rates than previously expected.

It also became apparent that labour shortages caused by COVID were continuing and leading to an excess demand for staff. This was particularly prevalent in the case of the services sector, as people - freed from lockdowns - sought to restore their lifestyles. This fed into higher wage inflation, in turn pushing up underlying inflation.

These forces were prevalent in the US. At the start of the year the US Federal Reserve had noted the excess demand for labour and hoped that increased supply of workers as the economy re-opened would address the problem. However, for reasons that are still not clear, this did not happen, and the labour market remained very tight.

The US unemployment rate has been below 4% since February and finished the year at 3.5%. In this situation the Fed had no choice but to lift interest rates aiming to slow the economy and reduce the demand for labour, even at the risk of recession. Although the US labour market remains tight, there are now clear signs the economy is slowing. Also, inflation has peaked and is heading down, but core inflation around 5%-6% is still well above the Fed’s objectives, closer to 2%.

Interest Rate Outlook

As the inflation story developed through 2022 and investors revised up their views on how high it would go, the expected interest rate profile also lifted as markets priced in central bank responses. For example, at the start of the year, the markets expected the Reserve Bank of Australia’s cash rate would be around 1.25% by mid-2023.

They now expect it to be 3.75%, rising further, to 4% by the end of 2023. In the US, markets had expected a cash rate of 1% by mid-2023 and 1.35% by the end of the year. They are now expecting 5% in June and 4.65% in December.

The US and Australian cash rates were increased at a pace not seen by historic standards. Our cash rate was 0.1% at the start of the year and 3.1% by December. In the US the corresponding figures were 0.07% and 4.3%. These levels were reached by both frequent and sizeable moves, including 0.75% increments. A reason the central banks moved so quickly was that they felt they could not afford to let inflation expectations get out of control. If that happens, then rates would have to go even higher and for longer.

Global Financial Markets

Bonds

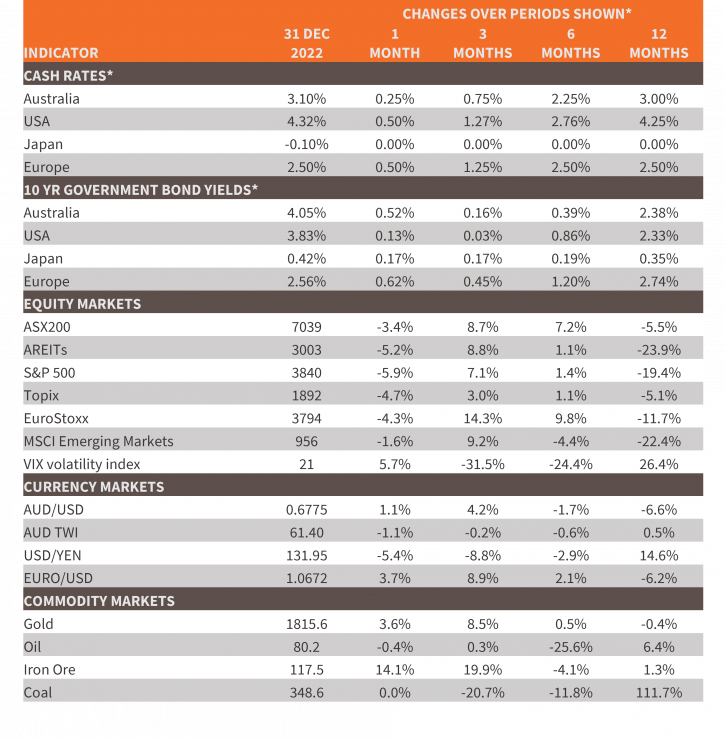

These rate increases had wider repercussions through financial markets. Government bond yields rose sharply across the spectrum of maturities. For example, the 10-year Australian bond yield rose from 1.67% at the start of the year to 4.05% at the end of December.

The US equivalent yield posted similar performance, and yields rose sharply in most other countries, except for Japan where the Bank of Japan continued to suppress the long end of the Japanese yield curve. The size and speed of the increase in bond yields was so serious that key bond indices posted the worst losses seen for many years.

Inflation linked (real) yields rose from negative to positive territory. For example, the US 10-year TIPS yield was -0.97% on 1 January and 1.58% at the end of December. Negative real interest rates are highly stimulative, exactly what an economy with an inflation problem does not need. Central banks are not just trying to get inflation under control, but also when that task is achieved, they want to be left with a higher rate structure than at the start of 2022.

Equites

Real bond yields are important for other assets too, including equities, gold and currencies, as well as speculative instruments such as cryptocurrencies.

In the case of equities, price/earnings (P/E) ratios are closely linked to real bond yields – when yields rise, P/E ratios fall. Given equity markets started the year in expensive territory with relatively high P/E ratios, there was plenty of scope for valuations to be marked down as bond yields rose. The impact of this within equity markets varied, with growth stocks - notably tech companies - hit especially hard. The tech-heavy NADSAQ index fell 33% in 2022, compared with -18% for the broader S&P500 benchmark. Other interest rate sensitive sectors, such as real estate investment trusts (REIT’s), suffered more than other sectors. The Australian REITs (AREITS) sector fell 20.5% in 2022 compared with -1% for the ASX200.

Emerging market equities underperformed developed market equities in 2022, under the weight of higher US yields and the higher US$. For much of 2022, the Fed was seen as being at the forefront of the rate hiking cycle and this drove the US$ up against other currencies. The A$/US$ fell from US$0.726 at the start of the year to a low of US$0.623, before recovering to US$0.678 at the end of December as the US$ started to soften.

The stronger US$ and higher real yields pulled the gold price down after it spiked with the Russian invasion of Ukraine. After peaking around US$2,056/oz in early March, the gold price fell to US$1,628/oz before recovering to around US$1,800/oz by the end of the year.

Cryptocurrencies had a terrible 2022 and showed they are just as vulnerable to economic fundamentals as anything else. Bitcoin fell nearly 65% as rising real yields pushed the price down.

2022 In Review

Overall, 2022 was a bad year for multi-asset portfolios. Traditional portfolio diversification says bonds rally to help offset equity losses as economies slow. However, this does not work so well when inflation is a problem and yields are starting from abnormally low levels.

Looking ahead into 2023

As we move into 2023, financial markets continue to focus closely on the path of interest rates and the key drivers of inflation and growth.

Markets are now more confident about inflation than they were a few months ago. Signs of inflation peaking, especially in the US, have encouraged markets to believe the worst has been seen and that inflation will be lower at the end of 2023 than it is now. There are some open questions about just how much lower and whether it will be close to central bank targets, but lower is better than higher.

Markets have also been reassured by recent central bank moves to moderate the pace of further interest rate hikes while they assess the impact of their actions so far. The markets know that more rate hikes are yet to come, with another 1% expected in Australia to take the cash rate to 4% and a further 0.6% in the US to take the Fed funds rate to 5%, but with inflation falling there are less upside risks to these rate expectations than there were through 2022.

Chart 2: Major Market Indicators – December 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.