Economic Snapshot – Bond markets cause volatility

Summary

February was a re-run of January in that markets started on a strong note, with equities posting very good gains in the first half of the month, only for conditions to reverse later in the month. However, while online trading caused the volatility in January, it was the bond market that caused the trouble in February.

US government bond yields have been rising for a few months as investors price in expectations of higher inflation, but in February it was more a case of expectations of higher growth. This spilled over into bond markets around the world. Here in Australia, the 10-year government bond yield rose from 1.11% at the start of February to 1.87% at the end of the month.

Higher bond yields are a threat to the expensive valuation of equity markets, especially tech stocks. Equities fell in the second half of the month, with emerging markets and growth stocks hit the hardest. AREITs underperformed in the month.

The A$/US$ rose to just over US$0.80 on 25 February before dropping back to close the month at US$0.783. The A$ was supported by a higher iron ore price and a wider differential of Australian bond yields over US bond yields.

The price of gold fell 7% in February as US real bond yields rose. The price of oil rose 18%, driven by expectations of stronger demand for oil as global growth improves, and by the reduction in supplies caused by the extremely cold weather across US oil producing states.

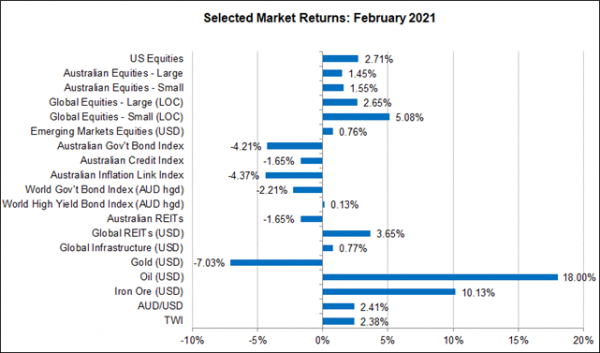

Chart 1: Pressure from bond markets undermined equity markets in the second half of February

Source: Thomson Reuters, Bloomberg 1 March 2021

Continuing impact of COVID-19

February was a re-run of January in that markets started on a strong note, with equities posting very good gains in the first half of the month, only for conditions to reverse later in the month. However, while online trading caused the volatility in January, it was the bond market that caused the trouble in February.

Bond Markets

US government bond yields have been drifting up for a few months, but the pace increased sharply in February. The 10-year bond yield started the month at 1.08% and finished at 1.45% with most of the move occurring in the second half of the month. These pressures spilled over into bond markets around the world. Here in Australia, the 10-year government bond yield rose from 1.11% at the start of February to 1.87% at the end of the month. The Australian government bond index posted a loss of 4.2% for the month. Yields rose so quickly that it looked like a degree of forced selling was involved and not just a re-assessment of underlying economic conditions.

Inflation expectations

Since late last year the US bond market has become increasingly concerned about the risk of higher inflation. This comes in the wake of a massive spending program from Biden on top of the already huge Federal Reserve stimulus. This was reflected in the difference between nominal and real yields, which rose from around 1.7% in late November to 2.1% at the end of February. These figures indicate how much inflation the bond market expects. Importantly, this increase in inflation expectations was driven by nominal yields rising, while real yields were quite steady.

What was interesting in the second half of February was that real yields started rising as well as nominal yields. Real yields are a guide to market expectations about real GDP growth. The higher real yields reflected markets upgrading their expectations of US growth this year. So, while the market’s inflation expectations were unchanged between the start and end of February, its growth expectations went up.

Interest rates

On the face of it, that should sound like good news. A stronger economy would be a good sign for employment, incomes and profits. However, the markets worry that a stronger economy will lead the US Federal Reserve to lift interest rates sooner than the indicated timeframe of 2-3 years from now. Higher interest rates and bond yields can adversely impact the valuation of other assets like equities, especially the higher growth stocks such as tech, which are trading at very expensive levels.

Equity Markets

The market’s focus on valuations rather than profits led to a sharp drop in equity markets in the second half of February. The developed market equity indices, including Australia, fell 2% - 3.5% in this time, while the emerging equity market index fell nearly 7%. Value stocks, which do better in a rising interest rate environment, beat growth stocks by a big margin. AREITs, which are sensitive to higher bond yields, fell in February.

Australia

In other markets, the A$/US$ rose to just over US$0.80 on 25 February before dropping back to close the month at US$0.783. The A$ was supported by a higher iron ore price and a wider differential of Australian bond yields over US bond yields. The Reserve Bank will not be pleased about the strength of the A$ and will likely resume its program of buying local government bonds to keep yields down and thereby limit further A$ appreciation.

Commodities

The price of gold fell 7% in February as US real bond yields rose. Higher bond yields do not help the gold price, especially when the higher yields start to reflect expectations of stronger growth rather than higher inflation.

The price of oil had a big month, rising 18%. This was driven partly by expectations of stronger demand for oil as global growth improves, and partly by the reduction in supplies caused by the extremely cold weather across US oil producing states. These weather conditions will pass, and OPEC is meeting in a few weeks to consider increasing the supply of oil. It is likely the price of oil will retrace some of its recent gains rather than rising to US$100 per barrel as some commentators have suggested.

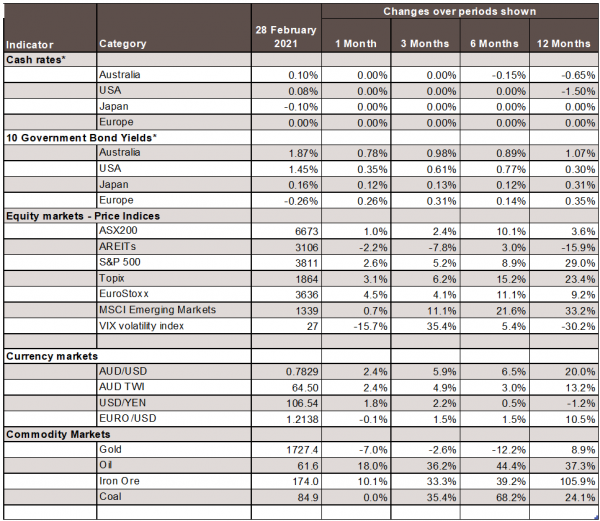

Chart 2: Major Market Indicators – February 2021

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.