Economic Snapshot: Concerns for equity markets

Summary

With high equity valuations and slowing global growth, markets are in a mood to be worried, and September provided them with plenty of opportunities. The potential impact of COVID-19 on economic activity continues to be a concern, but inflation has become an issue as well.

Markets had been reassured by central banks’ comments that inflation pressures would prove transitory, but a spike in energy prices has led to fears of higher inflation. Combined with the prospect of central banks tapering their quantitative easing programs, this pushed bond yields up around the world.

These conditions are challenging for equities, especially technology stocks, property (Real Estate Investment Trusts or REIT’s) and emerging markets, all of which struggled in September. Domestic resource companies also underperformed as the price of iron ore fell further.

Developments in China, including concerns relating to the Evergrande property company and the banning of crypto currencies, added to the markets’ nervousness. Squabbling in the US Congress about the debt ceiling and President Biden’s spending bills did not help.

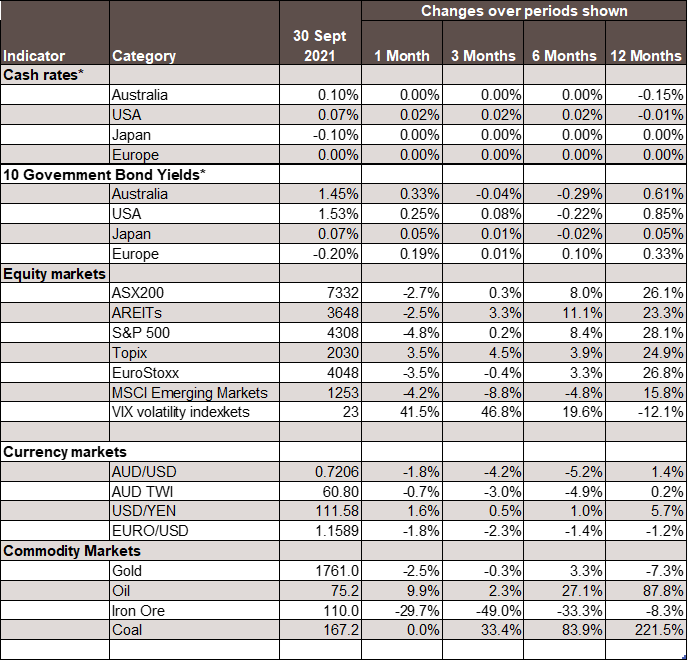

Chart 1: September saw nagative returns across the board

Source: Thomson Reuters, Bloomberg 1 September 2021

Overview

September 2021 was not a kind month for global financial markets. Bonds, equities, iron ore and the A$ all fell. Oil was an exception, registering a 10% increase in the month reflecting expectations of improving global demand. There were several factors at work during September which contributed to the poor returns in bonds and equities.

COVID-19

COVID-19 continues to be a source of concern for markets. Here in Australia, the number of new cases per week rose to a record high of just under 13,000, with infections in Victoria picking up as those in NSW started to ease. The national vaccination rate of around 45% is below government targets for reopening the economy. Globally the number of new cases is declining, though still at high levels, and a number of countries, including the UK, Canada and South Korea, are still trying to get their delta waves under control.

Inflation

Markets naturally worry about the impact of COVID on economic activity and are expecting softer conditions around the world in coming months. However, on top of this, markets started to worry about inflation again in September. Investors had been reassured by central bankers’ comments that inflationary pressures would prove transitory, but a spike in energy prices, particularly natural gas and oil, has led some commentators to talk about stagflation. This condition, characterised by simultaneously high inflation and weak economic growth, was prevalent in the late 1970’s and early 1980’s. However, the economic conditions now compared with then are sufficiently different to make a period of stagflation seem unlikely.

Bond yields

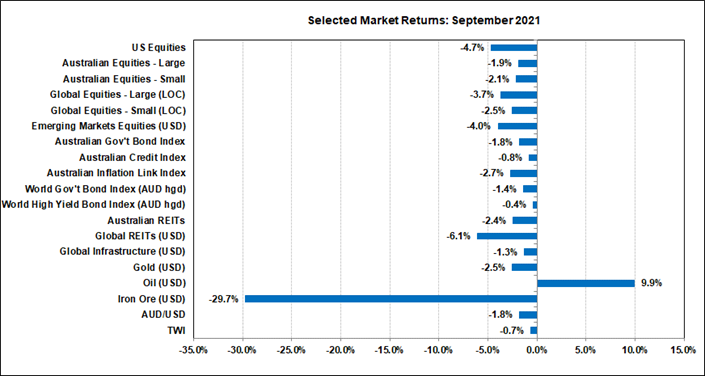

Nevertheless, the prospect of higher-than-expected inflation at a time when central banks are talking about tapering their liquidity programs was enough to push bond yields up around the world – keeping in mind that when yields increase, capital values decrease. In the US, the 10-year government bond yield rose from 1.3% at the start of the month to 1.53% by the end of the month. This was the highest level seen since mid-June. The yield on the equivalent Australian bond rose through the month from 1.21% to 1.45%. Yields in the UK and Europe also rose. However, we should note that while commentaries suggested that concerns about higher inflation helped push yields up, the inflation expected by bond investors in the US hardly moved in September. On the face of it this seems inconsistent but may in fact reflect an underlying heightened level of uncertainty in markets.

Equity markets

Equity markets are uncomfortable with the prospect of higher bond yields. This is especially the case for equities trading on very high P/E ratios that may have less of a positive outcome from the eventual reopening of economies when COVID retreats. Tech stocks in the US are a prime example of this and the Nasdaq index fell 5.3% in September. The local equity market fared better than many overseas markets, falling around 2% despite the impact of lower iron ore prices on mining stocks. Bank stocks outperformed as yield curves steepened with higher bond yields. Two of the weaker international equity complexes were emerging markets and global REITs, both of which are sensitive to rising bond yields.

China – Evergrande and crypto currencies

Adding to the general uncertainty and concerns of the markets were some developments in China and the US. In China, Evergrande, a massively indebted property developer and owner, felt the impact of recent government policy initiatives to curb the growth of property prices. This led to doubts the company would be able to service its debts and rapidly led to speculation about a “Lehman’s event” (that began the worst of the Global Financial Crisis in 2008) for China that would spill over into the global financial system.

However, this seems excessively pessimistic and a recent liquidity injection from the People’s Bank of China has somewhat quelled these fears. Whilst the prospect of a catastrophic collapse now looks less likely, a restructuring of Evergrande appears imminent, albeit with investors likely sustaining significant losses.

The extent of the impact for investors will depend on whether the restructure is orderly although the consensus suggests that the CCP will act to prioritise social stability. It’s expected there will be impacts within the high-yield credit sector in China, particularly anything related to the property sector. To date there has been some mild contagion effects, with lenders, insurers, and suppliers most exposed to Evergrande understandably suffering the most. Broadly, the domestic situation in China appears highly volatile with property prices most exposed to asset deflation – although given the negative implications for social cohesion, the likelihood of the CCP allowing this to transpire appears low.

Evergrande will impact the Chinese economy to some extent, but it is likely to remain largely a local problem. At a broader level, the crackdown on property developers may have contributed to weaker demand for iron ore and in turn the sharp drop in the price of iron ore recently. This was also aided by policy makers initiating steps to ensure steel production this year did not exceed last year’s output.

There is also talk of an energy crisis in China and speculation this may have contributed to the recent decision to ban all crypto currencies. The “mining” of crypto currencies is extremely energy intensive, but it seems likely that a stronger motivation for the ban is simply that the authorities do not want currencies they cannot control. In any case, the price of Bitcoin fell 7.6% in September.

United States – Debt ceiling

In the US, political problems did not help the mood of the markets. The US is going through one of its periodic debt ceiling episodes. That is, Congress must approve how much debt the government can have and once the existing ceiling is reached there are questions about whether the US government can pay its bills. In the past we have seen temporary shutdowns of government services because of this. Not surprisingly, both sides of politics try to gain leverage out of these situations when dealing with legislation in front of Congress at the time.

In the current case, the legislation in question is President Biden’s infrastructure bill, plus his other bills for a range of social welfare spending. However, the disagreements are not just between Democrats and Republicans, but also between the Moderate and Progressive wings of the Democratic party. At this stage a temporary extension of the debt ceiling has been agreed, allowing the matter to be pushed into December, but the markets are still waiting for the spending bills to be passed. In a world where markets are worried about the outlook for global growth, some big US spending bills would be very welcome.

Despite the political issues in the US, the US$ rallied in September. This contributed to a 1.8% fall in the A$/US$ rate and 2.5% fall in the price of gold.

Chart 2: Major Market Indicators – September 2021

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.