Economic Snapshot: Inflation pressures global outlook

Summary

Ongoing strength in the US economy, including higher than expected inflation, led the Federal Reserve to adopt a more aggressive stance on interest rates. After raising the cash rate by a further 0.75% the Fed said it would push rates a full 1% higher than previously planned by the end of the year.

Markets were caught by surprise and both bonds and equities sold off sharply. The UK government’s mini budget was seen as fiscal profligacy by the markets and added to the selling pressure around the world.

The US$ rose further on these developments, pushing the A$/US$ rate to its lowest levels since the depths of COVID-19. The price of gold also fell under the weight of higher real bond yields.

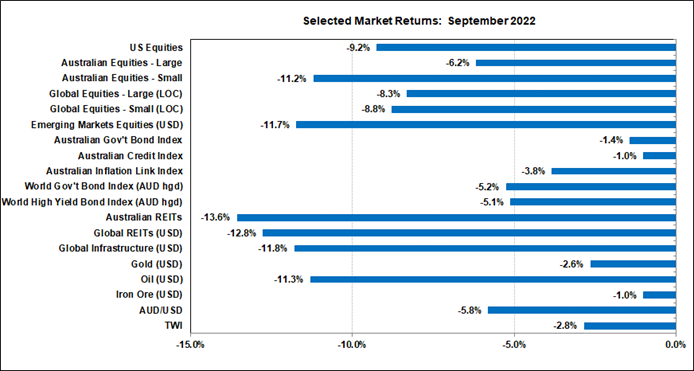

Chart 1: Inflation and higher interest rates undermined markets in September

Source: Thomson Reuters, Bloomberg 1 October 2022

Global Financial Markets

September was another terrible month for the global financial markets with all asset classes suffering losses. The primary factor driving this was the state of the US economy and the Federal Reserve’s response to that. However, the fiscal stimulus announced in the UK and Russia’s mobilisation of troops for the conflict in Ukraine also soured the markets’ mood.

Positive US Economic Indicators

Despite increases in interest rates in recent months, the US economy is still in pretty good shape. Indicators of activity in both manufacturing and services are well below their peaks of a year ago but have settled at levels indicating moderate ongoing growth. The labour market is still healthy, with another 315,000 jobs added in August and an unemployment rate of 3.7%. Housing construction and sales have slowed down, but so far house prices have been holding up. On the other hand, higher inflation has eroded growth of real household incomes and the volume of personal consumption spending has been declining.

Inflation

The least attractive part of this picture is inflation. Although there is evidence that supply chain pressures are easing and that inflation has peaked in parts of the economy, the CPI figures for August were disappointing. The markets had been hoping to see some progress on inflation slowing, but although headline inflation did moderate slightly in year-on year terms, core CPI inflation went up more than expected, both in the month (0.57%) and over the year (6.32%) to August. Part of the problem behind the inflation figures is that the US labour market is still too tight. Labour supply has not increased as the Fed had hoped it would, and while wage inflation in the manufacturing sector has peaked, in the services sector it has not. Ever wary of how the Fed will react to the inflation data, the markets were unnerved by August CPI figures and started to sell off again.

Federal Reserve Response

As it turned out, the Fed validated the markets’ fears. At the Federal Open Market Committee (FOMC) Governor’s meeting on 20-21 September, the Fed decided to raise the cash rate by a further 0.75% to 3.25% and lifted the forward path for interest rates by a full 1% for the end of 2022 (now 4.4%) and by 0.8% for end-2024 (now 4.6%) before signalling some easing to 3.9% in 2025. The Fed also revised its inflation forecasts up slightly and its growth forecasts down slightly. But the more significant change in the outlook was that the Fed now expects an unemployment rate of 4.4% in both 2023 and 2024. That would be an increase of 0.7% over the current unemployment rate. History shows that much extra unemployment in a year typically signals a recession.

Markets’ Reaction

The Fed Governors made numerous public statements in the weeks that followed, about the economy and the need for monetary policy to curb inflation. Although they did not explicitly say they are looking to engineer a recession, they did say jobs will be lost. All of this was much more aggressive than the markets had expected, which was not received well. Cash futures immediately priced the higher profile for the Fed funds rate while government bond yields spiked up. The ten-year yield finished September at 3.8% compared with 3.14% a month earlier. Yields on inflation-protected bonds (TIPS) rose even more. The 10-year TIPS finished at 1.68% compared with 0.67% at the end of August. However, the bond market’s implied expectations of inflation eased slightly in September, indicating that the market still believes the Fed will achieve its inflation objectives.

All this rapidly ricocheted through the rest of the markets. US equities, confronted both by higher bond yields undermining P/E ratios and recession risks undermining profit expectations, fell sharply. Large cap equities in other markets, including Australia, also fell, but small cap equities, emerging markets and REITs all fared worse. Small caps and EM equities are especially sensitive to economic growth, while REITs and infrastructure are sensitive to bond yields.

Currency markets also felt the brunt of the Fed’s moves. The US$ is heavily correlated with the TIPS yields and as the latter rose in September, so did the US$. It is important to recall that apart from higher US bond yields, the US$ also tends to rise when the global economy slows because investors see the US$ as a safe-haven asset. The Euro fell below parity with the US$ to its lowest levels since 2022. Europe continues to suffer from disruptions to gas supplies from Russia. Inflation in Germany is over 10% and the ECB raised its key interest rate by 0.75% to 1.25% with more to come. There are widespread expectations that Europe will be in recession by early next year.

United Kingdom

Sterling fell 5.2% to 1.103, approaching its lows of 1.05 nearly 40 years ago. Sterling suffered not only from the US$ strength but also from the UK mini-budget on 23 September in which the Chancellor of the Exchequer Kwasi Kwarteng, announced a range of tax cuts and investment incentives. Markets immediately saw the inconsistency between this and a central bank tightening monetary policy to contain inflation. The response was heavy selling of UK assets, not just sterling. The ten-year UK government bond yield was 2.8% at the end of August, but after the budget announcement the yield spiked to 4.5% before the Bank of England stepped in to calm the market by saying it would buy unlimited amounts of bonds as required. The ten-year yield finished September at 4.09%.

Australia

In our markets, cash futures fluctuated a bit through September, but finished the month close to where they started. The market is still expecting the cash rate to reach just under 4% by the middle of next year and then to stay there for the rest of 2023. Comments by Reserve Bank Governor Phillip Lowe suggesting the RBA might soon reduce the size of its interest rate increases encouraged the market. However, this also contributed to the weakness of the A$/US$ as the implied forward interest differentials out to next year fell sharply against the A$. The currency briefly fell below US$0.64 before closing the month down 5.8% at US$0.65, its lowest level since the depths of COVID. Our government bond yields also rose in September, with the ten-year yield rising 21 basis points to close the month at 3.9%. As in the US, our bond market’s expectations of inflation moderated in recent weeks.

Geopolitical Situation

Geopolitics was another unsettling factor for markets in September. Russia announced two initiatives which heightened concerns that the war with Ukraine is heading to further escalation. One was the mobilisation of 300,000 troops to be sent to the conflict. The other was bogus referenda in the occupied Ukraine territories to justify declaring them part of Russia, so that any further attacks on them could be claimed as attacks on Russia, with threats of a severe response potentially including nuclear weapons. However, the mobilisation is meeting resistance from within Russia and may prove to be a serious mistake. Conscription brings the war into Russian homes in a tangible and unwelcome way that was not previously evident and may do Putin more harm than good. Also, calling the annexed territories “Russian” means little to those who do not recognise the validity of the annexation. This will do nothing to slow Ukraine’s efforts, notwithstanding Putin’s threats.

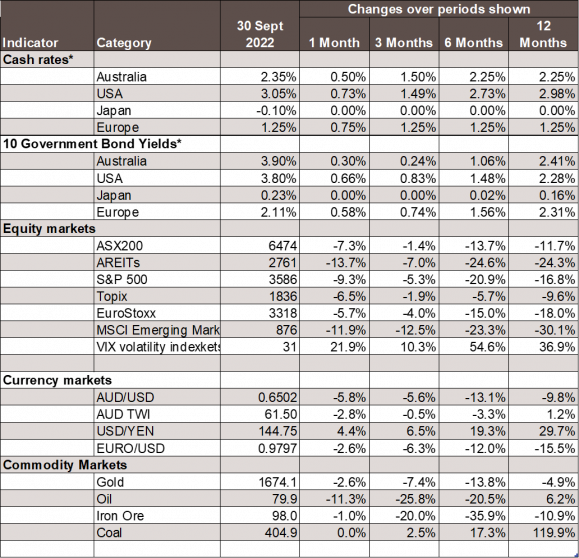

Chart 2: Major Market Indicators – September 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.