Economic Snapshot: Collapsing oil prices and rising interest rates - November 2018

The Summary

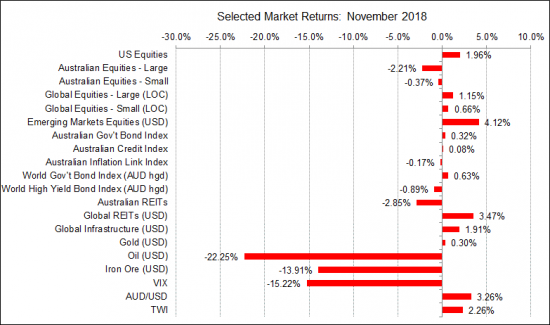

Speculation about US monetary policy was the key factor driving markets in November. Comments from senior Federal Reserve officials led the markets to think the Fed is close to the end of its tightening cycle. This triggered a rally in bonds and equities, along with a lower US$. The resulting flattening of the US yield curve prompted speculation the US is heading for a recession in 2020. A sharp drop in the price of oil and signs of slowing outside the US reinforced the view that the Fed cannot afford to tighten much further. However, the markets appear to be getting ahead of themselves and have been very selective in how they have interpreted the latest news from the Fed and the economy. The odds are that the Fed has more work to do than the markets expect and that we will see more volatility and weakness in both bonds and equities as we move into 2019. Furthermore, the weakness in the oil price has more to do with supply factors than demand, associated with slower economic growth.

Meanwhile conditions here in Australia show some slowing of economic activity, with weaker capital expenditure data, further falls in house prices and a weaker than expected GDP report for the September quarter. The labour market remains in reasonable shape, but wages growth is still muted. Under these circumstances, the Reserve Bank has kept the cash rate unchanged at 1.5%.

The trade dispute between the US and China waxed and waned through November, causing some volatility in equity markets. By early December progress had been made on working towards a deal. The Chinese economy is starting to feel the impact of US trade policy, with signs that growth is slowing significantly. The authorities have started taking steps to offset this.

Theresa May managed to agree on a Brexit plan with Europe, but now needs to get it through the UK Parliament. It looks like this will be unsuccessful and may even trigger a General Election. The US mid-term elections proved to be a bit of a non-event and had little impact on markets.

Figure 1: The oil price collapsed in November as the market coped with excess supply

Source: Thomson Reuters, Bloomberg 1 December 2018

Heightened risk of a US recession

November was another challenging month. The key theme was a growing concern the Federal Reserve may cause a US recession and will have to stop lifting interest rates. This sentiment was fuelled by mixed messages from the Fed about how they see the stance of monetary policy.

A focus of commentators and investors over the longer term is considering where central bank cash rate policy sits relative to its ‘neutral’ value i.e. the rate consistent with the economy at full capacity and with stable inflation. Policy is said to be ‘tight’ when the cash rate is above neutral and ‘easy’ when below. Unfortunately, this rate is not directly observable – the precise value depends on economic modelling assumptions. Current estimates of neutral interest rate levels are said to be somewhere between 2.5% to 3.5% (median 3%). The cash rate is 2.15%, so monetary policy is still considered easy.

In October, Fed Chair Powell threw the cat among the pigeons when he said monetary policy remains a long way from neutral. Markets immediately interpreted that to mean the Fed is going to lift the cash rate a lot more and equities sold off heavily. In November, the Fed backtracked on this. First, Vice Chair Clarida said the cash rate is “close to neutral” and that being at neutral would “make sense”. He also noted signs of slowing in other economies around the world. A couple of weeks later Fed Chair Powell reinforced this by saying the cash rate is “just below” neutral. Markets thought these comments meant the Fed was close to done with tightening.

These assumptions caused bond yields and the US dollar to fall. Global equities and the A$/US$ also got a boost, but the local equity market lagged as resource stocks were hit by lower oil and iron ore prices. As US bond yields fell, the yield curve (the spread between longer and shorter dated bonds) flattened, moving closer to zero. The markets took this as further validation of no more Fed tightening because flat to negative yield curves are seen as leading indicators of recession a year or so down the track. Markets are now talking about the US economy being in recession in 2020.

The dramatic fall in the oil price in October also contributed to this story. There is a popular belief that a falling oil price reflects slower demand driven by weaker economic growth. However, data provided by the New York Fed shows that supply factors drive the oil price much more than demand factors. At the moment, supply factors associated with the US embargo on Iran as well as pressure on Saudi Arabia, have been driving the oil price down. The current OPEC meeting may lead to steps being taken to reverse this.

The markets also ignored statements from Fed officials warning that the path of interest rates will depend on the state of the economy and that it is too soon to sound the all-clear on further tightening. The markets did not want to hear this because it does not fit the popular narrative. This is characteristic behaviour of markets from time to time and can lead to reversals and volatility when the prevailing narrative fades. Our reading of the US economy says the markets are underestimating the Fed and that rates will go up more than expected, which will likely lead to more weakness in equities and the A$/US$.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Paragem Pty Ltd [AFSL 297276] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at a personal level. No responsibility is accepted by Paragem or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.