Economic Snapshot: A volatile ride for markets

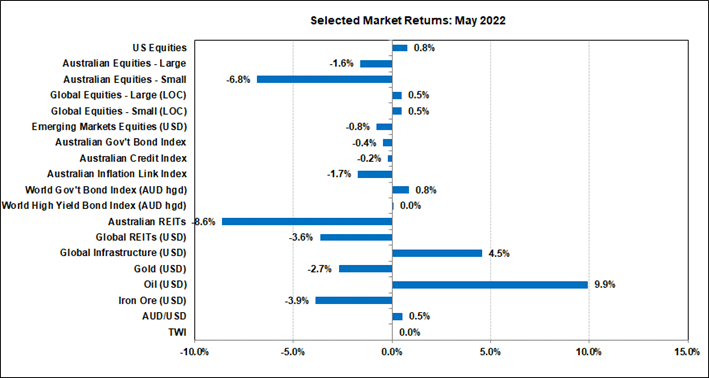

May was a volatile month for global financial markets. The first half of the month saw significant losses in both equity and bond markets as investors continued to grapple with the array of risks confronting them. These included fears of a US recession, weak growth in China, tighter global monetary policy, and the Ukraine war. However, as the month unfolded some of these concerns eased and a number of markets recovered much of their losses.

The markets’ mood at the moment hinges on the outlook for inflation. Data which suggest that inflation, and therefore interest rates, will be higher for longer is bad for bonds and equities, while data suggesting the opposite is welcomed by the markets.

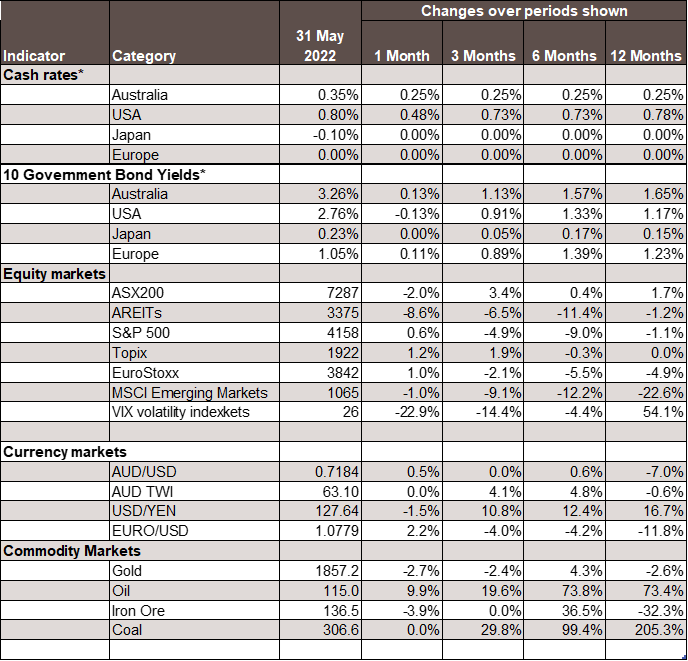

Central banks, including the US Federal Reserve and the Reserve Bank of Australia, lifted interest rates in May and flagged more increases to come. Bond market expectations of inflation declined. Higher US real yields undermined the price of gold. Coal and iron ore prices declined in response to the weakness of the Chinese economy. The A$/US$ broadly tracked the iron ore price, but still managed to close slightly higher.

Chart 1: Headline figures for May disguise just how turbulent the month was for financial markets.

Source: Thomson Reuters, Bloomberg 1 June 2022

Australia

Here in Australia the latest data showed softer business and consumer confidence, with the latter sharply down in May. Factors contributing to this included uncertainty around the Federal election, cost of living pressures, and the prospect of higher interest rates leading to lower house prices.

Employment increased at a much slower pace than in recent months, but the unemployment rate fell to 3.85%. This is the lowest unemployment rate since the mid-1970’s. Wages growth remains subdued. The wage price index rose only 2.4% in the year to the March quarter, well below the 3.5% rate the RBA had previously flagged as consistent with their target CPI inflation rate.

Nevertheless, on 4 May the Board of the Reserve Bank bowed to the inevitable and raised the cash rate by 0.25% to 0.35%. This was the first increase in the cash rate since November 2010. The RBA also flagged more rate hikes to come and that the cash rate might “normalise” around 2.5%.

US Economy

There were mixed signals about the US economy. The key Institute for Supply Management (ISM) manufacturing and services activity indicators both declined in April, but retail sales posted good results, to be about 8% higher than a year earlier.

The labour market remains in good shape, with 428,000 new jobs in April and the unemployment rate steady at 3.6%. However, the participation rate eased in April while job openings rose nearly 2%. These figures are not consistent with the Fed’s objective of balancing labour supply and demand to contain wage inflation. Nevertheless, average hourly earnings grew more slowly in April than in previous months.

CPI inflation also slowed in April but was still higher by 8.2% over the year. The Personal Consumption Expenditure (PCE) measure of inflation favoured by the US central bank slowed at both the headline and core (which adjusts for more volatile items) levels in April. The markets liked these results with both bonds and equities rallying thereafter.

China

China’s stringent lockdowns to curb the spread of Covid hit economic activity hard. The manufacturing Purchasing Managers’ Index (PMI) fell to 47.4 in April and the services PMI fell to 41.9. Not only were these readings below the key 50 expansion/contraction level, but they were also the lowest since the initial outbreak of Covid in 2020. Authorities there pledged further support for the economy, including a massive fiscal stimulus program.

Interest Rates

As May opened, the markets’ attention focused on the Federal Reserve’s meeting on 3-4 May. There had been a lot of speculation among global investors about how much the Fed would lift the cash rate and what message the central bank might convey about future interest rate hikes. Expectations focussed on a 0.5% increase in May, although some thought a 0.75% increase possible. The Fed duly delivered a 0.5% increase to bring the Fed funds rate target to 1%. Chair Powell noted that further 0.5% increases are on the table in coming months but signalled that a 0.75% increase is unlikely.

He also suggested the Fed may be able to moderate the pace of tightening if inflation declines by the end of the year. The Fed provided more details of plans for reducing its balance sheet of Treasury bonds and mortgage-backed securities as it unwinds it Quantitative Easing program. This helped push bond yields up.

In the face of all this, the markets’ expectations about interest rates fluctuated significantly. Early in May the markets decided interest rates would likely rise by more than previously expected. This flowed through to higher bond yields, especially here in Australia. Our 10-year government bond yield rose by 0.45% to 3.6%, more than double the yield at the start of the year. Equivalent yields rose by lesser amounts in the offshore markets. However, as the month progressed bond yields declined as the markets revised down their interest rate expectations.

The US inflation data were key to these moves. By the end of May, the US 10-year yield was close to where it was at the end of April, while the Australian 10-year yield closed about 0.25% higher. US bond market expectations of inflation fell further in May to sit between 2.5% and 3.0%.

Equity Markets

Equity markets took their cue from the bond markets, with sharp declines early in the month followed by recoveries later in the month. Some equities, including Australian small caps and AREITs, were unable to recover as much and finished May with larger losses. Overall, the declines in equity markets seen this year have brought valuations down from the lofty levels reached last year so that markets now look much less expensive on these measures.

The ASX 200 P/E ratio is now back around its longer run average, while the Small Ordinaries P/E is now below its longer run average. European markets tell a similar story, but the US equity market P/E ratio is still above its long run average.

Commodities

Commodities had a mixed month, with softness in the prices of coal and iron ore as the markets reacted to the weaker Chinese economic data. The price of oil jumped nearly 10% with the ongoing impact of the Ukraine war and talk of an EU-wide ban on importing oil from Russia. Better news on US inflation and higher real bonds yields helped push the price of gold down.

Exchange Rate

The A$/US$ broadly tracked the iron ore price, but still managed to close slightly higher for the month. This likely reflected the balance of interest rate expectations between Australia and the US shifting in favour of the A$ through May.

Chart 3: Major Market Indicators – May 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.