Economic Snapshot: A turbulent month for global markets

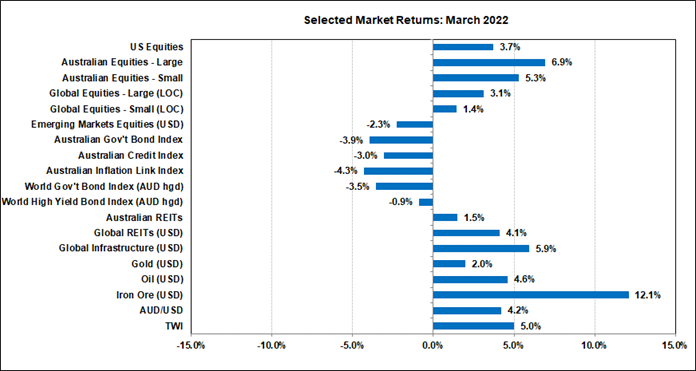

March was a turbulent month for global financial markets. Early in the month, the war in Ukraine and the US Federal Reserve’s (Fed) program of tightening monetary policy disrupted expectations about inflation and growth, leading to weakness in bonds and equities, along with a flight to gold, oil, wheat and the US$. As the month progressed and markets adjusted to developments in the war, some of these trends reversed.

Although government bond markets continued to sell off in the face of strong growth and high inflation, equity markets took things in their stride to reverse early losses and post gains for the month.

Australia’s geographic distance from Ukraine, combined with our role as a commodity exporter, helped our equity market to outperform and the A$/US$ to rally. Higher bond yields helped undermine the price of gold.

Chart 1: Equities beat bonds handsomely in March and Australian Equities Outperformed

Source: Thomson Reuters, Bloomberg 1 March 2022

Global Financial Markets

Equities fell quickly in the first half of March before bouncing hard in the second half. The prices of oil and gold fluctuated in wide ranges. Government bond yields rose sharply, causing significant losses in the associated bond indices. The two key drivers of these developments were the war in Ukraine and the US Federal Reserve embarking on a program of tightening monetary policy to deal with higher inflation.

Russia-Ukraine conflict

The Russian invasion of Ukraine came as a shock to financial markets. This is the most serious conflict in Europe in eighty years, with the potential to spiral into something much worse before it ends. The first week of March saw the prices of oil and wheat spike sharply because the war and sanctions will curtail the supply of these commodities. At the same time, investors turned to traditional safe-haven assets such as gold and the US$, both of which also rose early in the month. However, another traditional safe-haven, US government bonds, was shunned by the markets because of concerns about inflation and higher interest rates.

Equities

All of this was a very poor environment for equities. Global equity markets, especially those in Europe, fell sharply. The MSCI Emerging Markets index was hit especially hard as the Russian equity market collapsed and was later removed from the index. At its worst point, the MSCI EM index was more than 12% below its end-February level.

In contrast, the Australian equity market performed very well. The ASX200 index hardly fell at all and then rose steadily through the month. Our geographic distance from Ukraine, combined with our role as a commodity exporter, were key factors behind this outperformance. The A$/US$ benefitted for the same reasons and, after an initial fall as the US$ rose on safe-haven buying, rallied to US$0.75. This was the highest A$ level since late November 2021.

Monetary Policy

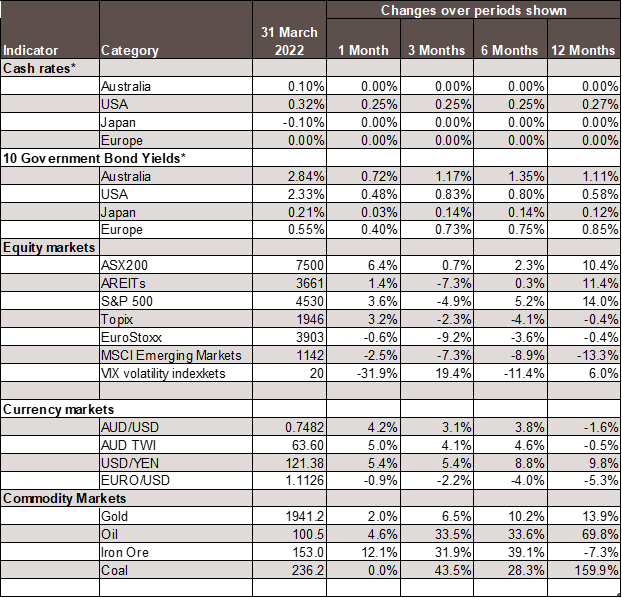

At its mid-March policy meeting, the Fed made good on its promise to start tightening monetary policy. The cash rate was raised by 0.25%, with the promise of more to come and the end of the QE program. The cash futures market rapidly moved to price eight more rate increases this year, plus another three next year to bring the expected US cash rate to 3% by Q3 2023.

US Bond yields and inflation

This, plus further data showing US inflation remaining high, pushed the 10-year government bond yield up through the month. The 10-year yield started the month at 1.71% and finished at 2.33%. The 2-year yield rose even more and closed the month at 2.35%. This means the yield curve inverted by 0.02%. This prompted some commentators to suggest that an inverse 10-2 yield curve means a recession is coming in the US.

Of course, these things are not as simple as that. First, an inverse 10-2 curve is a useful, but not infallible, indicator of recession 18-24 months in the future. It does not mean a recession is coming in the next few months. Second, the Fed’s QE program has pushed the 10-year yield down by around a 1% compared with what it would have been if the market had been setting the yield based on the underlying economic conditions. This means the 10-2 curve is artificially flat and could be giving a false signal. Third, the US economy is very strong now, and it is hard to see what would rapidly tip it into recession from here.

Global bond yields and inflation

Other bond markets followed US and pushed yields higher through March. Here in Australia, the 10-year government bond yield rose by 0.72% - quite a bit more than in the US – to reach 2.84% by the end of March. Cash futures priced tighter policy from the RBA, with a cash rate of 1.25% by the end of 2022 and 2.75% by Q3 2023. This is an aggressive profile of tightening, prompted partly by the strength of our economy and partly by a perception that the RBA will follow where the Fed goes.

However, some commentators think the market is being too aggressive on rates. Although the labour market is getting tighter, with the unemployment rate down to 4% and higher wage inflation only a matter of time, nevertheless our inflation rate is still well below that of the US. Even so, it is generally agreed the RBA will have to start lifting the cash rate this year.

Interest rates

Higher interest rates and bond yields are typically a threat to equity markets. Higher interest rates lead to weaker growth and lower company profits. Higher bond yields lead to lower price/earnings ratios. However, the balance of these forces tends to play out not at the start of a tightening cycle, but some way into it. In the early stages of tightening, the economy tends to be strong enough to support profit growth, as does the inflation that causes the tightening in the first place.

Investors grappled with these issues in March and concluded that higher interest rates will not undermine equities just yet. Indeed, a theme emerged of buying stocks that benefit from higher inflation. Overall, equities finished with a much better month than would have been expected in the first week of March.

Gold price

Higher bond yields did however help undermine the price of gold, which is sensitive to the US 10-year TIPS (inflation linked securities) yield. The latter rose from -0.8% at the end of February to -0.5% at the end of March and the gold price gave up its gains as it did so.

Chart 3: Major Market Indicators – March 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.