Economic Snapshot: A turbulent month comes to a close - August 2019

Summary

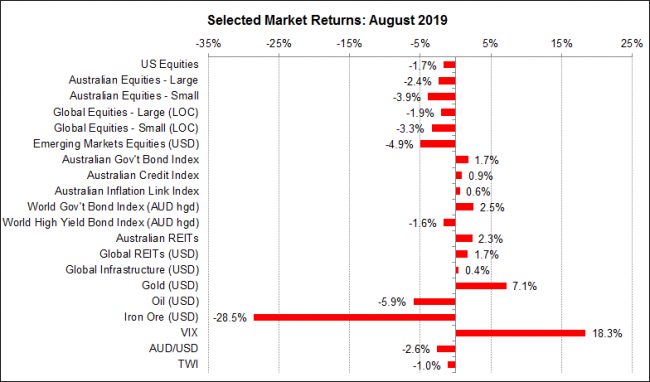

August was a turbulent month for global financial markets with heightening concerns in relation to the ongoing trade dispute between the US and China, and about how much the Federal Reserve might cut interest rates. However, by the end of the month equity markets had recovered much of their losses to finish the month only a few percent down.

The volatility we saw in August was exacerbated by the seasonal slowdown in market activity with the Northern Hemisphere summer holidays, and by a litany of sensationalist headlines in the popular media. Underlying all this is a high degree of uncertainty among investors about what is happening with the global economy.

The general air of uncertainty and caution around global markets has been compounded by developments in Hong Kong, in the UK with Brexit, in Italy with the government collapsing and in Argentina with surprise election results triggering a fall of over 30 percent in the equity market in a single trading session.

Figure 1: August was a difficult month for equities as trade wars reignited fears of global recession

Source: Thomson Reuters, Bloomberg 1 September 2019

Global Financial Markets

August was a turbulent month for global financial markets. The concerns that re-emerged at the end of July about the trade dispute between the US and China, and about how much the Federal Reserve might cut rates, picked up through August. Fears of a risk of a global economic recession intensified, interest rate yield curves flattened even further, and equity markets suffered some significant falls. Emerging equity markets lagged developed markets in August, partly because of developments in Argentina.

The volatility we saw in August was exacerbated by the seasonal thinness of trading conditions with the Northern Hemisphere summer holidays. Underlying all this is a high degree of uncertainty among investors about what is happening with the global economy. Although the “inverse yield curve means recession in the US” story has had a lot of mileage in the media, not everyone is convinced. There is a tug-of-war going on in investors’ minds between:

- data showing the US economy is still in good shape, but signs that Europe and China are slowing down; and

- central banks offering more policy easing, but fears that low interest rates do not work anymore.

On top of this, there is the erratic nature of President Trump‘s handling of the trade dispute. This reflects both his personality, and also a deliberate tactical approach to try to keep the Chinese off-balance. Of course, this also keeps the markets off-balance and precipitates bouts of both selling and buying of equities according to the tweet of the day. Unfortunately, this does not look like it's ending any time soon. The trade dispute is part of a long-run process between the US and China and we are likely to see more developments, like the retaliatory tariff increases in August and further gradual depreciation of the Chinese currency.

Long-term implications

The trade dispute, as well as Brexit, is causing businesses to delay investment spending, which compounds any impact on growth from disruption to exports. Manufacturing sectors around the world are bearing the brunt of this; with most indicators already suggesting this sector in different parts of the world is in a recession. Service sectors on the other hand, are in better shape. That in turn helps households and supports consumer spending, which is a larger part of the US economy, but a much smaller part of the Chinese economy. If the slowdown in manufacturing spills over into households via rising unemployment, then things will look much more worrying. However, that is not the case yet. Latest data shows unemployment rates in major economies such as the US, Germany and Japan still remain at historically low levels.

Australia

The unemployment rate is expected to rise in coming months, but the Reserve Bank again made it clear the cash rate can fall further to support employment and wages growth. Further rate cuts were made more likely by the Reserve Bank cutting its forecast for both growth and inflation. Senior RBA officials also said they have been looking at other steps they can take, such as quantitative easing type policies. There is also a range of infrastructure projects being planned from state and national governments here to help stimulate some growth.

International

Other central banks around the world have also moved to an easing approach. The Reserve Bank of India cut its cash rate again and the European Central Bank said it is preparing a stimulus package bigger than the markets currently expect. In China, the authorities announced some interest rate reforms which, in conjunction with their currency moves, create room for more monetary easing.

Of particular interest was a report in the German press that the government would be prepared to suspend its balanced budget rule and take on new debt to counter a possible recession. The US administration also flagged the idea of fiscal stimulus through capital gains and payroll tax cuts.

Geopolitical events

Developments in August added to markets’ general concerns:

- Tensions between China and Hong Kong escalated further with some signs of tensions easing;

- Brexit continues to consume the UK body politic. Boris Johnson’s latest moves to prorogue Parliament is a risky gambit that could end in a general election which may see a change of PM again;

- The Italian government collapsed, and talks are underway to form a new coalition;

- Surprise election results in Argentina pointing to a change in government triggered panic in markets there, with the equity market falling more than 30 percent in one day.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.