Economic Snapshot: A tug of war for financial markets - July 2018

The Summary

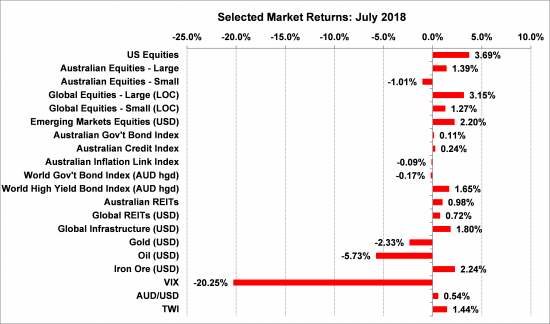

Diversified portfolios performed well in July with all major markets producing solid returns. US shares did particularly well and some underperformance in emerging markets proved to be short-term and joined the rally. Overall the background was something of a tug of war for financial markets. On the one hand, investors had reason to be concerned about tariff disputes escalating into trade wars which would undermine global growth. On the other hand, the latest data showed the US economy still running very strongly and some good corporate earnings reports. This news explained the monthly returns. Market sentiment waxed and waned throughout the month according to how these factors played out, but on the whole, there was sufficient good news to win sway with equity markets.

Economic data released during the month showed the Australian economy operating at a reasonable pace but still without signs of emerging inflationary pressures. Growth in the US continues to add pressure for a higher inflation outlook over the coming year. The Chinese economy showed signs of slowing once again and this led the authorities to respond with customary stimulatory measures.

The A$ traded within a fairly narrow range around US$0.74 through the month, with recent upward momentum stalling due to trade disputes and President Trump criticising the Federal Reserve. In early August the A$ slipped further meaning year on year (August) it has fallen from 0.81c to 0.73c.

Once again, the Reserve Bank of Australia left the cash rate unchanged at 1.5% at its monthly meeting. The European Central Bank also indicated that it is likely to keep interest rates low until well into 2019. The one noticeable change was the Bank of England, lifting its cash rate from 0.5% to 0.75% while carefully controlling expectations by indicating there is unlikely to be much more to come.

Figure 1: Positive equity returns through markets in July, particularly for global shares

Source: Thomson Reuters, Bloomberg 1 August 2018

Australia

In Australia, retail sales data for the May period was announced and turned out to be a bit better than expected, however business conditions and confidence in June were little changed from the previous month. Business conditions are still running at an above average pace, however, the upward momentum seen earlier in the year now appears to have peaked.

An interesting feature of the business conditions survey was that measures of growth in labour costs, purchasing costs and final product prices all moderated in June. This lack of inflationary pressure was confirmed by the second quarter CPI report which showed underlying inflation only running at 1.9%, still a bit below the bottom of the Reserve Bank’s target range.

Unsurprisingly there were also further reports of softer prices in the housing market with capital city prices reducing modestly during the quarter, and year on year. As noted in the media, if these conditions persist across the economy, the Reserve Bank will be in no hurry to lift the cash rate.

USA

The US Federal Reserve left the cash rate unchanged in July but reiterated their intention to continue gradually lifting the cash rate over the coming year. The Fed noted this was justified by the ongoing strength of the economy and rising inflationary pressures. The Chairman, Jerome Powell, noted the US economy is doing very well, and although they are monitoring the progress of trade talks, they are not yet ready to adjust monetary policy plans because of this factor. The US economy grew at a 4.2% annualised rate in the second quarter. The strength of these figures was not entirely unexpected by the markets, but there was a sense that this may represent the peak of the cycle for US growth. Indeed, the latest readings for the key economic activity indicators showed significant declines in both the manufacturing and service sectors. Employment growth does remain strong however, and the unemployment rate stands at 3.9%.

The reporting season in the US generally went well, with many companies reporting solid, if not positive results.

However, the big news was sharp falls in some of the most prominent technology stocks after they issued disappointing earnings reports. Intel fell nearly 9% after its earnings report and Twitter and Facebook both fell by more than 20%. These results led to debate amongst analysts as to whether the tech stocks, which had performed so well, may now be revealing their vulnerabilities and the extent of their overvaluation.

The US Administration’s ongoing dispute with its trading partners about tariffs and market access continued in July. On the plus side, the US and Europe agreed to negotiate rebalancing trade relations between them without resorting to imposing new tariffs. This news boosted equity markets, but the discussion between the US and China hasn’t made as much progress and is quite unnerving for some.

China

Concerns about the state of China’s economy and the potential impact of a trade dispute contributed to weakness in the Chinese currency and equity markets. Latest data showed economic activity slowing across a number of sectors. The authorities have responded by providing extra monetary stimulus to help calm the markets. They have also promised additional fiscal spending, which helped support Australian resource stocks. So far it seems China is happy to have some currency depreciation as long as it does not become disorderly.

In other news from China, Wintime Energy, a major energy provider, defaulted on a portion of its US$11 billion of debt. This was one of China’s biggest corporate debt defaults this year and reflects the impact of the authorities’ policies cracking down on excessive corporate borrowing.

China and Global Markets

More corporate defaults are expected in China this year and if this happens volatility should be expected as nervousness will creep into the growth story. Some commentators believe the debt defaults are simply exposing the underdeveloped nature of the corporate debt market in China which they believe had grown too quickly - resulting in inappropriate levels of risk being allowed to build up. The concern is that further unwinding of some of these debts will slow the economy and disrupt markets. Given the importance of the size of the Chinese economy driving global markets, this continues to be a significant shadow for investors as it has been for the last decade.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Paragem Pty Ltd [AFSL 297276] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at a personal level. No responsibility is accepted by Paragem or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.