Economic Snapshot: A strong 1st quarter across the globe - April 2019

The Summary

With the Federal Election victory now confirmed for the Liberal–National coalition, we no longer need to plan around changes to franking credits, negative gearing, reductions in CGT discounts, reintroducing a ban on borrowing in super and further restrictions on superannuation contributions that the ALP were proposing. Well, at least not for another three years. While we canvassed these issues pre-election, our guidance was to wait and see and that’s turned out to be a good approach. As they say, a week is a long time in politics.

Markets reacted well to the news with the reduced uncertainty allowing domestic investors to move forward to watch other prospective market events. It looks like one of the first items of business for the new Morrison Government will be legislating the tax offset for low to middle income earners, although Prime Minister Scott Morrison is already flagging a delay due to the likelihood that Parliament will not be convened before 30 June. However, the Government is also reviewing options to account for the promised tax relief.

In other news, April was a good month for equity markets, with latest data showing the US economy performing better than expected. The US labour market remains very strong, with unemployment around 50-year lows, but inflation is still below the Federal Reserve’s target. The bond market believes the Fed will need to cut interest rates in order to lift growth enough to stop inflation slipping further. Overall, the combination of better growth, low inflation and expectations of rate cuts helped push the S&P500 to a new record high by the end of the month.

The inflation/interest-rate narrative carried over into Australia in April, when Q1 underlying CPI inflation was reported at 1.6%, compared with the Reserve Bank’s 2-3% target range. The most bullish forecasts have the RBA making a 25-basis point cut in the next two months. However, the RBA has indicated that it would prefer to see a sustained upward move in the unemployment rate before it would consider cutting interest rates. The A$/US$ fell in reaction to the CPI data and declined for the month.

Growth is improving in China and Europe, although the latter remains quite subdued. Brexit remains unresolved and Europe has given the UK another extension to the end of October to find a solution.

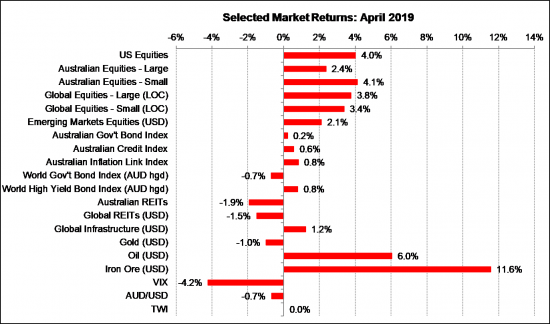

Figure 1: Signs of better growth and low inflation boosted equities in April

Source: Thomson Reuters, Bloomberg 1 May 2019

Global Markets

The latest data shows signs of improving growth and ongoing low inflation globally. Financial markets continue to expect central banks, especially the US Federal Reserve and the RBA, to cut interest rates in coming months. After the very strong performance of equity markets in the first quarter, investors have been grappling with the question of whether the rally can continue. As a result, the April corporate earnings reports in the US were the focus of much attention.

Analysts had downgraded their expectations for earnings growth after the sharp slowdown in recent months. However, as things turned out earnings were better than expected and the S&P500 price index closed April at a new record high.

Other economic data from the US also gave a more positive tone. For example, GDP growth in the first quarter was stronger than expected, and latest data on retail sales and construction spending showed signs of improvement. Importantly, the US labour market remains very strong, with nearly 200,000 jobs added in March and the unemployment rate at 3.8%, the lowest in nearly 50 years. Leading indicators of unemployment, particularly unemployment benefit claims, fell to their lowest levels in more than 50 years and suggest further declines in unemployment are possible in coming months.

Elsewhere in the world, both China and Europe saw some better news on manufacturing activity. First-quarter GDP growth in China was 6.4%, better than expected, as were the latest figures on both retail sales and industrial production. However, the Chinese authorities have indicated they do not intend to be as aggressive with fiscal and monetary stimulus compared with their efforts in the past. The trade dispute between the US and China continues, but the markets seem more confident that it will be resolved soon. Comments from Trump that he may now turn its attention to imposing tariffs on Europe is a new source of potential concern.

Australia

The Australian labour market performed well in March, with 48,300 new full-time jobs offsetting a decline of 22,600 part-time jobs. The participation rate rose slightly as more people were encouraged to enter the workforce, and the unemployment rate remained at 5%. Over the past year, 305,000 jobs have been created in Australia, of which 290,000 were full-time. Notwithstanding this, wages growth remains modest by historic standards. Inflation also remains low. The March quarter CPI figures showed headline inflation of 1.3% in the year to the Q1 and underlying inflation of 1.6% over the same period. Both figures were below the bottom of the Reserve Bank’s 2% - 3% target range.

The wages and CPI data have boosted the markets’ expectations that in coming months the Reserve Bank will start cutting the cash rate by as much as half a percent. However, the RBA has indicated it would prefer to see a sustained upward move in the unemployment rate before cutting interest rates. Forward indicators of employment growth, including data on job ads and business employment intentions, suggest the unemployment rate may indeed rise between now and the end of the year but it is not yet clear whether this will be enough to make the RBA act.

USA

A similar story is playing out in the US now, where inflation remains below the Federal Reserve’s 2% target. The markets think the Fed will have to cut interest rates to support growth enough to lift inflation back to target. The markets see this as a “precautionary cut” to stop inflation slowing even further. However, the Fed has said it thinks the current softness in the inflation data is temporary and that they are not yet ready to make decisions about changing the cash rate. Overall, the Fed remains optimistic about the US economy. The better run of data recently helps them push back against renewed calls from Trump to ease monetary policy.

It was noticeable that when the Australian CPI data were released, the A$/US$ quickly fell from just under 0.72 to just over 0.70, despite further strength in the prices of both iron ore and oil. The A$ is being driven by interest-rate expectations rather than commodity prices. The iron ore price was reacting to supply constraints following the recent mine disaster in Brazil, while the oil price was responding to Trump’s announcement that he would be withdrawing the waivers allowing selected countries to buy oil from Iran. The increase in the oil price in recent months has helped boost production in the US, which is now the world’s biggest oil producer ahead of Russia and Saudi Arabia.

Outlook

While the interest rate outlook shows possible cuts on the horizon, there are some noteworthy risks to be mindful of in the months ahead. While the pressure point for ‘Brexit’ has been extended until the end of October, there remain challenges in getting this outcome over the line. This could lead to general elections before the end of the year in the UK. Mix this with the trade tensions between China and the US, who is also heading into another election cycle and there could be added volatility in markets, even though 2019 has started very strongly.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Paragem Pty Ltd [AFSL 297276] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Paragem or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.