Economic Snapshot: Equities push higher as rate cuts loom

August was shaped by competing forces: optimism around rate cuts and lingering inflationary concerns. In Australia, the RBA lowered the cash rate to 3.6% as expected, offering support to bonds, though July’s higher inflation reading tempered enthusiasm. Looking ahead, markets still see rates trending towards 3% by mid-2026.

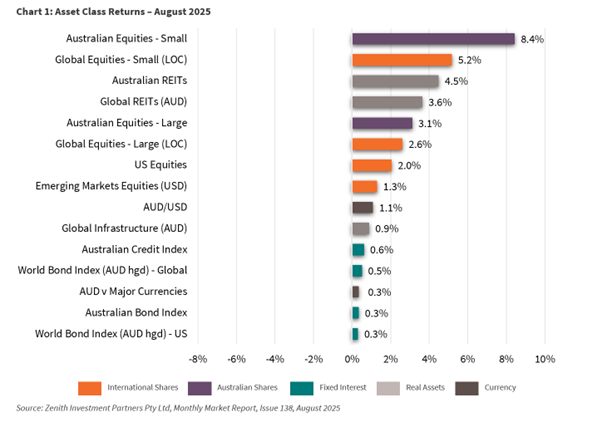

Global shares advanced on the back of stronger US earnings and growing confidence that the Federal Reserve could begin cutting rates as early as September. Currency moves, however, limited offshore gains for Australian investors. Closer to home, the Australian market outperformed, with the ASX reaching record highs on the strength of resources, consumer sectors and property trusts. Bond markets remained steady, with US and Australian yields little changed as investors weighed rate-cut hopes against fiscal and political risks.

Global Developed Equities

Global share markets had a strong August, supported by solid company earnings in the US and growing expectations that the Federal Reserve may start cutting interest rates as early as September. The MSCI World index rose 2.6% for the month, bringing gains this year to 13.7%. A stronger Australian dollar meant unhedged investors saw smaller gains of 0.9%, though they remain up 7.6% for 2025.

US company profits surprised to the upside, with overall earnings about 12% higher than a year ago. The “Magnificent 7” tech giants were standouts, delivering more than 26% growth, while other companies posted a respectable 8%. European and Japanese markets also performed well, with Italy and Spain leading thanks to strong growth and earnings.

The main economic news was softer US jobs data, which fuelled expectations of rate cuts. Markets now anticipate several Fed reductions by 2026, though concerns about Fed independence and US policy credibility have unsettled bond and currency markets.

At the sector level, materials, banks, healthcare, and communications were strong performers. Interestingly, higher dividend and value stocks outpaced growth stocks, despite ongoing enthusiasm for AI-related themes.

Australian Equities

The Australian share market outpaced global peers in August, reaching record highs. The ASX200 rose 3.1% for the month, taking year-to-date gains to 12.3%, driven by strength in materials, consumer discretionary stocks and property trusts.

Smaller companies were the standout, with small-caps up 8.4% and mid-caps 5.5%, well ahead of the largest 50 stocks at 2.1%. This divergence reflected better conditions for smaller firms and weak results from several large caps, including CSL, James Hardie and Woolworths. Banks gained nearly 4% as investors rotated out of CBA into other lenders.

Earnings season was volatile but the outlook is improving, supported by lower rates and stronger consumer confidence. Inflation lifted in July due to electricity prices, with CPI at 2.8%. Despite this, markets expect further RBA cuts, with rates projected to fall to around 3% by mid-2026.

Emerging Markets

Emerging markets gained ground in August, led by a rally in Brazil which hit record highs on the back of rate cut expectations and improved politics. The MSCI Emerging Markets index rose 1.3% in USD terms, taking year-to-date gains to 19%. In AUD terms, returns were slightly weaker at –0.4% for the month but still up 12.6% in 2025.

Latin America was strongest, with Brazil up 10.3%. In Asia, results were mixed: the MSCI China index rose 4.9%, while the China A index surged 12.1% and is now up 20.3% this year, helped by tech strength and new stimulus measures such as subsidised consumer loans.

Still, weak household confidence remains a challenge. Korea and Taiwan fell, while India slipped another 3.3%, taking year-to-date losses to 2.6% as trade tensions, high valuations and foreign outflows weighed on sentiment.

Property and Infrastructure

Australian listed property trusts (AREITs) extended their rally in August, rising 4.5% for a strong 14.3% gain so far in 2025. The sector has been supported by a brighter domestic outlook, the prospect of further rate cuts, and signs that property valuations may be bottoming. Global REITs also advanced 3.6% on easing rate expectations, though they have trailed their Australian counterparts in recent months.

Global infrastructure underperformed broader equities as investor risk appetite lifted but still posted a modest 0.9% gain in August and is up 8.4% year to date. The sector continues to find support from persistent inflation pressures and the possibility that real yields are peaking.

Fixed Interest – Global

Global bond markets were caught between optimism over potential US rate cuts and concerns about fiscal discipline and Fed independence. By month-end, the US 10-year yield was steady at 4.25%, while the 2-year fell to 3.63% as markets grew more confident in a September cut. Real yields edged lower with softer growth, though inflation expectations lifted slightly.

Weak July payrolls data, together with sharp downward revisions to earlier months, highlighted a cooling US labour market. This triggered a bond rally and reinforced expectations of Fed easing. Futures markets now anticipate a cut in September and further reductions to around 3% by 2026. However, political interference remains a concern, with recent resignations and dismissals raising the risk that Trump appointees could dominate the Fed board, undermining perceptions of independence.

Longer-dated yields reflected these tensions. The US 30-year once again approached 5%, while European and Japanese yields also moved higher, driven by stronger growth, fiscal expansion, and above-target inflation. In the UK, unexpectedly high inflation and fiscal doubts pushed yields upward. Credit markets remained steady: high-yield spreads stayed near historic lows on confidence in economic resilience, while investment grade spreads continued to narrow.

Fixed Interest – Australia

Australian bond yields ended the month at 4.29%, little Australian bond markets were steady in August, with 10-year yields ending at 4.3%. The RBA’s widely expected rate cut to 3.6% provided support, though higher-than-forecast July inflation tempered optimism. Markets still expect rates to fall further, towards 3% by mid-2026.

Recent data suggests the economy is holding up. The NAB business survey showed conditions and forward orders remained solid, while business confidence improved. The labour market has softened slightly but not enough to disrupt the recovery.

The RBA’s updated forecasts point to underlying inflation of 2.6% over the next two years, unemployment steady at 4.3% and GDP growth of around 2%. These projections reflect weaker productivity and slower population growth. Despite the mixed backdrop, the Bloomberg Composite Bond Index gained 0.3% in August and has delivered a 4.3% return year to date.

Commodities and Currencies

Commodities had a mixed month. Oil slipped to US$68 a barrel as increased OPEC output met modest demand. Gold strengthened, climbing to US$3,448 an ounce and up more than 30% this year, supported by lower rates, geopolitical uncertainty, central bank buying and doubts over Fed independence.

Iron ore rose above US$100 a tonne, while copper gained 2% in August and is now almost 13% higher year to date despite softer global growth.

In currencies, the US dollar weakened as markets focused on a more dovish Fed and questions around its independence. The euro has gained nearly 13% against the USD this year, with the Swiss franc, yen and Australian dollar also stronger. By month-end, the euro was at 1.168 and the yen at 147.

The AUD has risen against the USD, helped by firm commodity prices, but has slipped against other majors given expectations of further RBA cuts.

Key Takeaways for Investors

- Global share markets continued to rise, supported by strong company earnings, particularly from large US tech firms. Europe and Japan also performed well, though political risks in some regions remain.

- The Australian market hit record highs, with small and mid-caps outpacing larger stocks. Banks gained, while several major companies faced earnings setbacks. Overall outlook has improved with lower rates and stronger confidence.

- Emerging markets outperformed, led by Brazil’s rally and strong gains in Chinese equities, supported by stimulus. India, Korea and Taiwan lagged on trade and valuation concerns.

- Australian listed property trusts extended strong gains on improved sentiment and rate cut prospects, while global REITs and infrastructure posted more modest returns.

- Bond markets reflected expectations of Fed and RBA easing, but political pressures on the US central bank and fiscal concerns kept long-term yields elevated. Credit spreads stayed tight, showing confidence in economic resilience.

- Gold surged on lower rates and geopolitical uncertainty, while iron ore and copper strengthened. The US dollar weakened as the Fed turned more dovish, helping the AUD, though further RBA cuts could limit its gains.

Bottom Line for Investors

Overall, markets remain constructive, supported by resilient earnings, lower interest rate expectations and improving confidence in Australia. However, risks around inflation, central bank independence and global politics mean volatility is likely to persist. A diversified approach - balancing growth opportunities with defensive assets - remains important in navigating the months ahead.

Looking for Personal Financial Advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.