Economic Snapshot: A steady climb, but uncertainty lingers

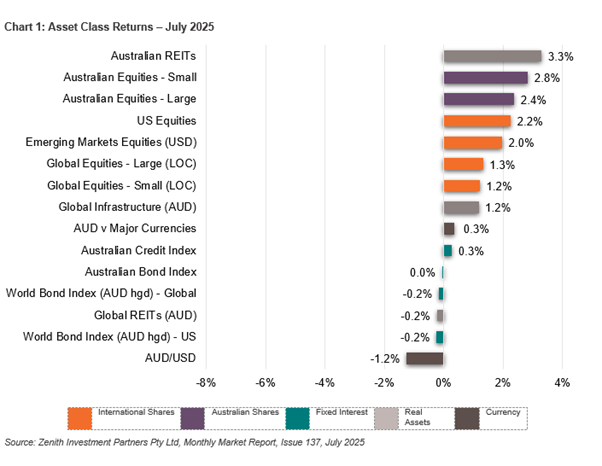

Markets extended their positive run in July. Both Australian and global share markets delivered solid gains, driven by strong corporate earnings, particularly in the US.

The RBA held interest rates steady during the month, despite growing expectations for further easing.

Signs of moderating inflation and a softer labour market helped reinforce this view (with the next rate cut delivered since – in mid-August – as part of a continuing easing cycle).

Bond markets moved in response to shifting expectations around growth and inflation, while commodities and currencies delivered a mix of signals. Optimism is building, but it’s underpinned by a fragile global backdrop.

Global Developed Equities

Global equities rose again in July, led by a strong showing from US technology and AI-related companies.

The S&P 500 and Nasdaq reached record highs, with four of the “Magnificent Seven” tech giants reporting better-than-expected results. Financials also surprised on the upside, supporting a broad lift in sentiment.

US earnings for the June quarter are now tracking more than 10% higher than a year ago — a notable turnaround from earlier forecasts. However, momentum was not universal. European equities dipped, and Japanese markets also edged lower. Despite this, Europe continues to lead year-to-date, helped by a 31.9% rise in German shares.

Underlying conditions remain mixed. US growth is easing, with GDP estimates revised lower and July’s job numbers coming in softer than expected.

Political pressure on the Fed, coupled with tariff uncertainty, continues to shape the market outlook. In Europe, earnings expectations have faded slightly as trade concerns and currency strength re-emerge.

Australian Equities

Australian shares rose 2.4% in July, taking the year-to-date return to 9% — slightly ahead of global markets on an unhedged basis. Miners and CSL drove gains, while banks gave back some earlier strength. Investors began rotating toward mid-cap stocks that appear better positioned for a potential rate-cutting cycle.

While the RBA chose to hold rates steady, recent inflation and jobs data have reinforced expectations that cuts are approaching.

Business conditions are improving, housing activity is picking up, and consumer sentiment has begun to recover. Despite these signs of progress, earnings forecasts remain subdued, and valuations across the market are looking stretched.

Emerging Markets

Emerging markets had another strong month, with China, Korea, and Taiwan each gaining between 4–5%. The MSCI Emerging Markets Index rose 3.8% in Australian dollar terms, lifting its year-to-date return to 13%. A weaker US dollar, steady growth, and ongoing rate cuts have supported the sector.

China’s economy showed further signs of stabilisation, with industrial output up 6.8% and retail sales growing 4.8%, although the property sector remains under pressure. Korea continued to perform well despite facing 15% tariffs on some exports.

In contrast, Indian equities fell 5.1% in USD terms, with tariff concerns weighing on sentiment and contributing to currency weakness.

Property and Infrastructure

Australian listed property (AREITs) gained 3.2% in July, supported by falling bond yields and signs of stabilisation in unlisted property valuations. Goodman Group and traditional REITs led the sector higher. Year-to-date, AREITs have returned 9.4%.

Global REITs were flat for the month, while global infrastructure rose 1.2%, bringing the year-to-date gain to 7.5%. Infrastructure underperformed broader equities in July as investor appetite shifted toward higher-growth sectors, though inflation protection and yield stability continued to support the asset class.

Fixed Interest – Global

US bond yields were volatile in July, moving in a wide range before ending slightly lower. Concerns about fiscal policy, rising tariffs, and questions around Fed independence pushed yields higher mid-month, before weaker economic data prompted a reversal.

The Federal Reserve held rates steady at its July meeting, with two governors dissenting in favour of a cut.

Growth in the US slowed to an annualised rate of 1–1.5% in the first half of the year, below potential. July’s payroll numbers came in at just 73,000, with downward revisions to prior months. Core inflation rose to 2.9%, complicating the Fed’s path forward.

In Europe, the ECB paused its easing cycle with inflation nearing target, while high yield markets held firm, supported by strong risk appetite and tight credit spreads.

Fixed Interest – Australia

Australian bond yields ended the month at 4.29%, little changed overall. Pressure from higher US yields was offset by domestic indicators showing a gradual cooling in inflation and employment.

Core inflation fell to 2.7%, and the jobs market softened slightly, precipitating an RBA cut in August.

The broader economic outlook continues to improve. Real wages are rising, housing activity is recovering, and mortgage rates are edging down. While business sentiment remains cautious, forward-looking indicators have started to firm. The Bloomberg Australian Composite Bond Index was flat in July but has returned 3.9% for the year to date.

Commodities and Currencies

Commodities and currency markets presented a mixed picture in July. Oil prices rebounded to over US$72 per barrel on concerns around Russian supply, before softening as OPEC+ signalled increased production. Gold held near US$3,300/oz, supported by ongoing central bank buying, lower interest rates, and geopolitical tensions.

Iron ore rose nearly 5% to just under US$100 per tonne amid speculation around Chinese stimulus, while copper declined 4.3% due to uncertainty around global trade policy. The US dollar strengthened against major peers, buoyed by robust corporate earnings and investor demand.

The Australian dollar fell 2.4% to US$0.643, weighed down by expectations of domestic rate cuts and subdued global commodity demand.

Key Takeaways for Investors

- Central banks remained cautious in July. The RBA held rates steady but followed through with a cut in early August as signs of easing inflation and softer labour market data strengthened the case for further easing. US yields were volatile but ended lower, reflecting shifting growth expectations. Bond markets in both regions now price in additional cuts heading into 2026.

- Global share markets advanced, supported by strong US earnings, particularly in technology and AI-linked sectors. The S&P 500 and Nasdaq reached record highs. Europe remains the strongest performer year-to-date despite July softness due to currency strength and trade concerns.

- The Australian market rose 2.4% in July and 9% year-to-date. Gains were led by miners and mid-cap stocks, while banks pulled back from earlier highs. The outlook for rate cuts supported housing and sentiment, though earnings expectations remain modest and valuations elevated.

- Emerging markets outpaced developed peers, rising 3.8% for the month and 13% year-to-date in AUD terms. China, Korea, and Taiwan posted solid gains, underpinned by policy support and a weaker US dollar. India underperformed, with trade uncertainty weighing on the rupee and market sentiment.

- Australian listed property added 3.2% in July, supported by falling yields and signs of valuation stabilisation. Global REITs were flat, while global infrastructure modestly outperformed, though trailed equities as risk appetite shifted.

- Oil prices rose on supply risks before easing. Gold remained flat but held on to strong year-to-date gains. Iron ore advanced on Chinese stimulus hopes, while copper declined on trade-related uncertainty. The US dollar strengthened, and the Australian dollar slipped, reflecting diverging rate expectations.

Bottom Line for Investors

Equity markets maintained momentum in July, led by strong US tech earnings and resilient global growth. The Australian market kept pace, driven by improved sentiment around rates and rotation into mid-sized companies. Bonds traded in a tighter range, as inflation data softened and rate cut expectations firmed.

Emerging markets continued to deliver strong performance, while commodities and currencies reflected mixed signals across supply, stimulus, and macro risk. The outlook remains shaped by central bank policy paths, corporate earnings, and evolving geopolitical dynamics. Diversification across regions, sectors, and asset classes continues to play a key role in managing risk and capturing opportunities.

Looking for Personal Financial Advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.