Economic Snapshot: A retrospective of the year that was - December 2018

The Summary

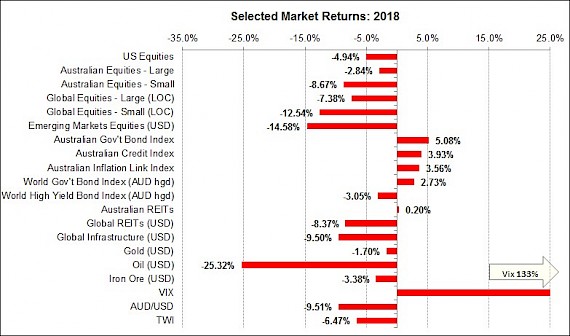

2018 was a year in which global investors significantly reduced their appetite for risk in the face of slower than expected growth, a tightening in US monetary policy, and the trade dispute between the US and China.

After a strong start to the year, the upward momentum of equity markets was dramatically broken by higher than expected US wage inflation numbers in February. Many equity markets then broadly moved sideways until early October. The US market was able to continue to outpace many other markets as tech stocks continued to rally, while emerging market stocks crumbled as the cost of servicing their US$ debt increased.

The December quarter saw equities, including those in the US, pummelled by fears the Federal Reserve would be too aggressive with interest rates and cause a recession. Intemperate remarks from President Trump about the Federal Reserve, along with a government shutdown, contributed to the markets’ bearish mood.

By the time the year was over, the US equity market recorded its worst December result since 1931. Bond markets benefited from the ‘flight to safety’ and posted positive returns for the year. The Australian dollar depreciated significantly as both interest rate differentials and commodity prices moved against it through the year.

2019 is expected to continue to provide challenges for global financial markets. Although the market’s most pessimistic expectations about an imminent recession in the US and other major economies are likely to prove unfounded, there will be further risks associated with slower growth and higher inflation in the US. In addition, the political environment in the US, the trade dispute with China, and Brexit will all cause ongoing uncertainty and therefore likely volatility for the markets. Positive expected returns across major asset classes are likely to be relatively small and could easily evaporate if risk factors dominate. The Australian dollar may slip further before ending the year near current levels. Well-diversified portfolios remain crucial.

Figure 1: 2018 started in a bullish mood and finished with the bears out in force.

Source: Thomson Reuters, Bloomberg 1 January 2019

2018 in retrospect – Global Markets

In our Year in Review note twelve months ago, we wrote:

“Markets started 2017 on the expensive side and most finished the year even more expensive. Logic suggests that for this to continue then the “Goldilocks scenario” of strong growth, low inflation and little or no interest rate increases also has to persist in 2018. Unfortunately, this may be a little too much to hope for.”

As things turned out, it was indeed too much to hope for, with the favourable economic conditions fading in 2018 and equity markets taking a beating.

Markets started 2018 in a buoyant mood. Global growth was strong and there was no talk of recessions. The US Federal Reserve was lifting interest rates, but markets saw this as more of a nuisance, largely because they did not believe US inflation was an issue. January saw big gains in global equities, especially tech stocks and emerging market equities. The A$/US$ was sitting near 0.81.

By the end of the year all this had reversed, with equities down sharply, bonds rallying, and the local currency (A$/US$) just under 0.71. Fears of a global recession caused by Fed policy mistakes and the US/China trade war came to dominate news headlines.

What happened to so dramatically turn the mood from excessive optimism to what is likely to prove excessive pessimism?

The problems started in February when news of higher than expected wage inflation in the US triggered a re-assessment of how far the Fed would have to lift interest rates. Equities and global bonds fell sharply, surprising many investors.

Although equities recovered a bit in the next few months, by the middle of the year most major indices were at levels close to where they started. From that point, things started to unravel with cracks appearing in the emerging markets (EM) complex. These countries had borrowed heavily in the post-GFC years when US$ debt was cheap and plentiful. With the Fed reversing those conditions, currency markets doubted some EM nations could manage the consequences. Argentina and Turkey were especially vulnerable and lifted their cash rates dramatically to protect their currencies. That in turn devastated their equity markets. Other nations to feel enough pressure to lift interest rates included Indonesia, Mexico and South Korea. The general contagion however had spread across the bloc and EM debt and equities underperformed sharply. By year end the emerging markets equity index was down more than 20% from its peak. China was one of the worst performers, down 30%.

For a while the US and Australian equity markets fared better than many other countries. The US had its tech stocks and Australia benefited from a big rise in the oil price as Saudi Arabia manipulated supply to the market. However, from the start of the last quarter the slide in risk assets resumed. Once again, markets became more worried by events in the US. This time it was Fed Chair Powell’s comments on 3 October, suggesting the Fed would be much more aggressive about further interest rate hikes than the market had expected. Although subsequent comments from other Fed Governors in following weeks sought to moderate this message, the damage was done, and equity markets fell heavily in the fourth quarter. This time, US tech stocks were not immune and fell sharply, with some dramatic one-day moves in headline names. The Nasdaq index entered bear market territory as the excessive valuations in that sector finally started to be addressed.

The markets’ concerns about the Fed’s actions were exacerbated by three key factors. First, growth was clearly slowing outside the US, increasing the vulnerability of the US economy to potential interest rate overkill. Second, the yield curve – the difference between short- and long-term interest rates – had flattened significantly through the year. Key measures of the yield curve were approaching zero and the markets thought they would move into negative territory. This is the so-called inverse yield curve, which many investors think heralds an imminent recession. Finally, President Trump made some very unwise criticisms of the Fed and Chair Powell, including comments about sacking Powell. This was like pouring petrol on the fire of the market’s fears and US equities fell harder while bonds rallied in a flight to safety move.

The Australian equity market suffered too, partly because the oil price collapsed by more than 40% as Trump pressured Saudi Arabia to increase supply, and partly due to the fall-out from the Hayne Royal Commission. Not only had Hayne publicly shredded the reputations of some big-name financial services firms, but those same firms reacted by significantly tightening lending conditions.

Property investors, already concerned about weaker house prices, felt the impact of this tightened lending. Commentators started talking about the housing market dragging down the rest of the economy. By the end of the year, the ASX200 price index was 11% down from its peak of 6345 on 20 August.

Australia

Despite global setbacks, the local economic backdrop through the year was not bad. Headline GDP growth was around 3% for much of the year, enough to see the unemployment rate fall further to touch 5% by the end of the year. However, the underemployment rate did not fall enough to spur much in the way of wages growth. This, combined with the negative impact of falling house prices, led markets to think the Reserve Bank has no room to lift the cash rate any time soon. Markets had been expecting the RBA to start a tightening cycle in the second half of 2019, but this has now been pushed into 2020. Softer business conditions and inflation stuck just below 2%. Not surprisingly, the A$/US fell steadily to finish at 0.706, nearly 10% lower than a year earlier.

Global political environment

Political developments around the world added to tensions and volatility. Here in Australia, we changed the Prime Minister (yet again). At least the fallout wasn’t widespread; we did not have the violence unleashed on the streets of Paris, or the unlikely coalition trying to remake Italy and causing tensions with the ECB along the way. But the real trouble lies in the UK, where Brexit has become a rolling nightmare with little prospect of a good resolution for any party involved. We cannot help but feel that the potential magnitude of the disruption and damage to be caused by Brexit is still being seriously under-estimated and should be closely monitored in the period ahead.

Looking ahead

What are we to make of all this as we move into 2019? Is the US inexorably heading into recession? Will it drag the rest of the world, including Australia with it? Are the markets right to be so pessimistic?

We suspect that just as the markets were too optimistic at the start of 2018, they are now erring on the side of too much pessimism. In particular, we believe the markets have been reading too much into the flattening of the yield curve in the US. In the post-GFC world, the Fed’s QE programme has artificially pushed bond yields below where they would otherwise have been given the state of the economy. In other words, a literal reading of the yield curve understates current and prospective growth in the US economy. While we will not say that a recession is impossible in the US in the next few years, we would be surprised to see it before 2020.

Although there are clear signs of slower global growth, this was to be expected after the unsustainably high pace of growth at which the world entered 2018. Some further slowing through 2019 seems a reasonable expectation, however, the US economy still has a lot going for it:

- the US labour market is very strong and likely to stay that way through most of 2019; low unemployment will support consumer confidence;

- fall in oil prices will cut the cost of fuel to US households and boost disposable income; and

- US monetary policy has been tightened much less than previous cycles

We do not expect to see a recession in Australia in the coming year, although growth is expected to be slower. This is likely to prevent unemployment reducing much further and will limit any further pickup of wage inflation. We think CPI inflation will still be around 2% through 2019 and that the Reserve Bank is most likely to leave the cash rate at 1.5% for the entire year. The prospect of a new government in Australia with a more stimulatory approach to fiscal policy adds upside risk to growth, but not necessarily to the equity and housing markets given some of the proposed policies. Stronger growth might also bring forward expectations of interest rate rises and push up the A$ later in the year.

2019 will see more volatility and uncertainty, though some of the markets’ current pessimism is likely to prove unfounded. Nevertheless, investors should expect only modest returns, including from equities. Bonds are likely to underperform and the A$ may finish the year close to current levels.

Key risks that could tip the world economy and markets onto a less favourable path include:

- US inflation: the markets do not believe there is any inflationary pressure in the US, but a higher than expected wage and price inflation data could quickly undermine that view;

- ongoing tensions between the US and China, especially if they escalate into territorial disputes over Taiwan and the South China Sea;

- Brexit is an event that could trigger a deflationary shock to the UK and Europe; and

- US politics will continue to cause uncertainty and disruption which will unsettle markets from time to time. The antagonistic relationship between the White House and Congress will not help. Nor will the President’s propensity for unwise comments.

We wish readers a happy New Year and hope that 2019 is a successful investing year for you all.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Paragem Pty Ltd [AFSL 297276] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at a personal level. No responsibility is accepted by Paragem or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.