Economic Snapshot: A new quarter, a mixed month - September 2018

The Summary

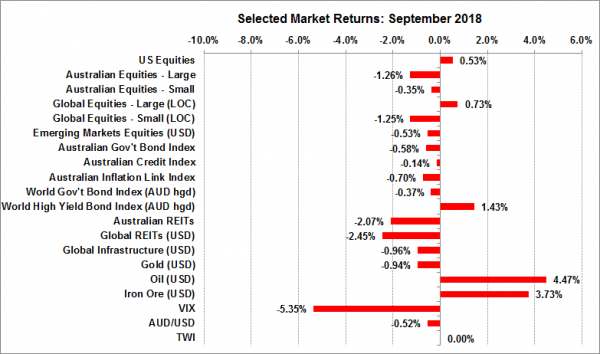

Following a strong rally in August, September proved to be a mixed month for world financial markets, with a modest retracement in a number of equity markets, including Australia. This level of volatility is expected to continue, with potential for further short-term swings. Bond sensitive equities such as Australian Listed Property also performed poorly following a US 10 ten-year bond yield rise. Snapshot has previously commented on the divergence between US monetary policy and that of other developed countries and this continued in September. During the month the US Federal Reserve lifted its cash rate by a further 0.25% and flagged its intention to continue doing so into 2020. Meanwhile other countries left their cash rates steady, including Australia, meaning a widening gap in real terms. This gap leads to pressure on the Australian dollar against the US$ which will, in time, help our exporting conditions. In this context the A$ finished August at US$ 0.726 and fell to US$0.71 by mid-September, before recovering to finish the month at US$ 0.72.

Figure 1: Following a strong August, most asset classes returned some profit in September

Source: Thomson Reuters, Bloomberg 1 October 2018

USA

At its September quarter meeting, the Federal Reserve lifted the benchmark US cash rate by 0.25%, as was widely expected, to just over 2.0%. The statements accompanying this decision reaffirmed the Reserves’ positive view about the US economy and plans to continue with gradual increases of the cash rate over the next few years, expecting to stabilise around 3.5%. Despite the commentary, financial markets stubbornly refuse to believe the Reserve will do so and have factored in a peak just below the 3.0% level. This is flagged as the Reserves long-run “neutral” rate.

Markets are renowned for double guessing and in some respects may do the hard work for the policymakers but this is contributing to the erratic equity markets we are now experiencing.

The significant difference of views between the Reserve and the market has important implications for a number of asset classes and investors. If the easier stance of monetary policy prevails (rates peaking at a lower level), then whatever remaining moves the Reserve makes with the cash rate is unlikely to significantly impact bond and equity markets. However, if a tighter stance of policy prevails (higher rates), then both equity and bond markets are likely to experience renewed volatility and losses.

While this is all happening, the US dollar could be expected to rise further than currently envisaged and this would put renewed pressure on the more vulnerable emerging market economies. Emerging markets are sensitive to a stronger US currency, and although some economists feel this is already factored into equity market risks, others are concerned by the Fed’s capacity to compound existing liquidity concerns.

Looking at the Fed’s view of the US economy over the next few years, the interest rate path outlined at their recent meeting makes sense. They hold the view that the economy is running very strongly, the unemployment rate is at historic lows and inflation has finally moved back to levels where the Fed desires it. This all suggests now is the time for monetary policy to continue tightening in order to not let inflationary forces get out of hand.

International

Elsewhere in the developed world, central banks continue to run relatively benign monetary policy settings. For example, in Australia the Reserve Bank (RBA) has once again left the cash rate at 1.5% and reiterated that it needs to see more progress on the labour market, and in particular on wages growth, before it considers changing its monetary policy position.

The RBA also said it continues to watch credit conditions, which are being affected by the USA quantitative tightening program as well as by the big 4 banks response to the Royal Commission’s criticism of their lending practices.

In Europe, the European Central Bank said it will keep its cash rate on hold well into 2019, but that its quantitative tightening program will begin sooner. The Bank of Japan tweaked its interest rate settings ever so slightly, but it is interesting to note that wage inflation in Japan is now stronger than it has been for many years and this may be signaling the beginning of the end of Japan’s long deflationary experience.

Emerging Markets

Circumstances remain more difficult among the emerging market economies, where a number of countries have found their exchange rates under pressure as tighter monetary policy in the US challenges their ability to finance their very large US dollar borrowings made since the Global Financial Crisis a decade ago. These countries have been lifting their cash rates in order to support their currencies, however, this has had the unfortunate side effect of undermining their equity markets. Last month saw further interest rate increases by India, Pakistan, Indonesia, Russia and Turkey.

Interest rates have also been drifting up in Korea, although only modestly, while in Argentina short-term interest rates are sitting around 45%! Some commentators are suggesting that emerging market assets now represent good value and should attract investors; time will tell.

In other news

- The Federal Reserve’s rate hike, coming on the back of further strong economic data, helped push the US 10-year bond yield back over the key 3.0% level. In particular, the US labour market remains steady with the unemployment rate at 3.9%.

- On the flip side, equity markets remain nervous about the 10-year yield reaching the low to mid 3% range, at which point it may start to undermine the expensive valuation of many US stocks.

- The US Administration’s ongoing trade dispute with other nations saw some progress with Canada, but not with China as further new tariffs on selected Chinese exports were proposed. The markets are very sensitive about how this issue might play out, but on the whole seem to be reasonably optimistic that at the end of the day an agreement will be met, and the US will get progress on its policy statements.

- Italy’s populist government continues to cause some anxiety in the Eurozone, with plans to increase government spending and debt. Local imprudent comments about Italy needing to have its own currency have not helped the situation.

- A feasible Brexit solution for the UK still seems out of reach as the March 2019 deadline rapidly approaches and Theresa May’s position remains tenuous despite her resilience. Meanwhile, Jeremy Corbyn in opposition has cemented his position as the leader of the most left-wing opposition the UK has experienced in decades

- The price of West Texas oil rose 4.5% to US$73/barrel by the end of the month, as OPEC signaled it in no hurry to increase supply.

- The Chinese economy slowed a shade further, led by weaker investment offsetting some stronger retail sales growth.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Paragem Pty Ltd [AFSL 297276] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at a personal level. No responsibility is accepted by Paragem or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.