Economic Snapshot: A harsh month for financial markets

April was a harsh month for financial markets. High inflation, aggressive rhetoric from the US Federal Reserve Bank, the Ukraine war and COVID lockdowns in China, all combined to sour investor sentiment and drive bond and equity indices down. Real bond yields rose through April as part of the necessary process of normalising monetary policy settings. This flowed through to other assets, with equity Price/Earnings (P/E) ratios and the gold price declining. Resource stocks and the A$/US$ fell in response to China’s COVID lockdowns. Russia’s decision to suspend oil supplies to Poland and Bulgaria pushed the oil price up again.

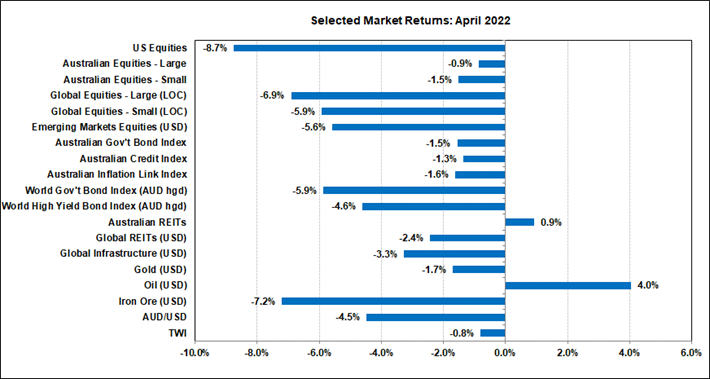

Chart 1: Bonds and equities had another bad month, but Australia fared better than overseas markets.

Source: Thomson Reuters, Bloomberg 1 April 2022

Global Financial Markets

April was a harsh month for financial markets. High inflation, aggressive rhetoric from the US Federal Reserve Bank, the Ukraine war and COVID lockdowns in China, all combined to sour investor sentiment and drive bond and equity indices down.

Australia

Here in Australia, the March Quarter CPI report showed headline inflation rose 2.0% in the quarter and 5.2% over the year. Core inflation rose 3.7% in the year to the March quarter. Both these readings were well above the Reserve Bank’s 2% - 3% target range, and the headline inflation figure was the highest since 2001.

Key contributors to these results were higher prices for fuel following the spike in the price of oil with the Ukraine war, and housing construction costs, which have been impacted by offshore supply chain pressures. Looking at the data more closely, we can see inflation is being pushed up by tradeable goods prices more than by services sector prices.

Inflation

The Australian inflation figures were higher than expected, which prompted the markets to expect a more response from the Reserve Bank, which occurred in early May – even in the face of the forthcoming election. The markets now expect the cash rate to be 0.5% in June, compared with the current 0.35%, after the RBA decided to increase rates by a standard 0.25% at it’s May meeting, the first increase since 2010.

Inflation remains elevated in the US as well. The headline CPI rose 8.6% in the year to March, and the core CPI by 6.4%. These were the highest readings since the early 1980’s, and markets revised up their expectations for interest rates in response. The Federal Reserve contributed to this with some hawkish remarks about how quickly the cash rate should be increased.

The markets were expecting a 0.5% rate hike in May, which was enacted, and then further increases each month to bring the cash rate to around 2.75% by December. Some Fed Governors suggested a more aggressive profile than this is required, but Chair Powell indicated that the market’s view seems appropriate.

Bond Yields

These developments helped push bond yields higher. The Australian 10 year government bond yield rose from 2.84% at the end of March to 3.08% by the end of April. This was the first time the 10-year yield exceeded 3% since 2015. However, the bond market’s expectations of inflation over the next 5-10 years remained steady at 2.5%. In the US, the 10-year yield rose from 2.3% at the end of March to 2.9% at the end of April.

The US 2 year yield also rose and briefly exceeded the 10 year yield early in the month. This meant the yield curve was inverted, which has been seen as an indicator of recession, generally a year or so later. The early April inversion attracted quite a bit of attention, with some commentators warning the Fed will go too far and tip the US economy into recession. While this was not helpful to sentiment in equity markets, the warnings were not taken too seriously, especially when the yield curve steepened again later in the month.

Perhaps of greater significance, real bond yields have been rising as well as nominal yields. In Australia, the real yield rose from 0.13% at the end of March to 0.38% at the end of April. In the US, the real yield rose from -0.52% to 0.01%. This is important because it is not standard practice for real yields to be as low as they have been, especially in negative territory, when economies have been growing as well as they have been coming out of COVID. Lifting real yields is a key part of the central banks’ plans with raising interest rates.

Bond yields rose in most countries around the world, causing the world government bond index to drop another 5.2% in April and bringing its losses for the year to date to 11.7%. These are exceptionally large figures for bond markets and reflect the significance of current events.

Equity Markets

Equity markets also found April to be challenging. Higher real bond yields tend to push equity market P/E ratios down, which happened in April, leaving expectations of earnings growth to sustain equity performance. Concerns about possible recession and the ongoing impact of the Ukraine war undermined those expectations in April. Given this, the US company earnings season was particularly important with investors keen to see firms’ outlook on profits. Although there were some high-profile disappointments, such as Amazon and Intel, the vast majority of firms reported results that exceeded the markets’ expectations.

Global developments

Other developments on the economic growth front included:

- News that US real GDP fell slightly in the March quarter, driven mainly by a drop in exports and a jump in imports. Consumer spending and business investment remained strong;

- China extended lockdowns across major cities to try to curb the spread of COVID;

- Russia cut off oil supplies to Poland and Bulgaria, sparking fears this could spread to other countries and undermine European growth.

Of these, the markets were least concerned about the US data and most concerned about the situation in China, which is expected to slow growth there even more, and to prolong global supply chain problems. The A$ felt the brunt of this and quickly fell from around US$0.76 to US$0.715. Resource stocks fell 4.2% for the same reason. The developments with Russian oil supplies helped push the oil price up to make it one of the few markets registering a positive return in April.

Higher real bond yields undermined the gold price, which fell nearly 2% in April.

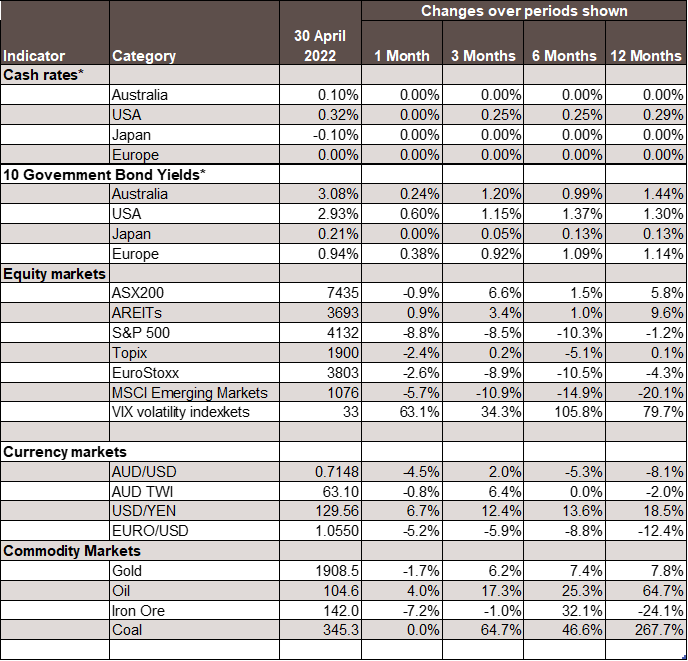

Chart 3: Major Market Indicators – April 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.