Economic Snapshot: A dramatic year in review

Summary

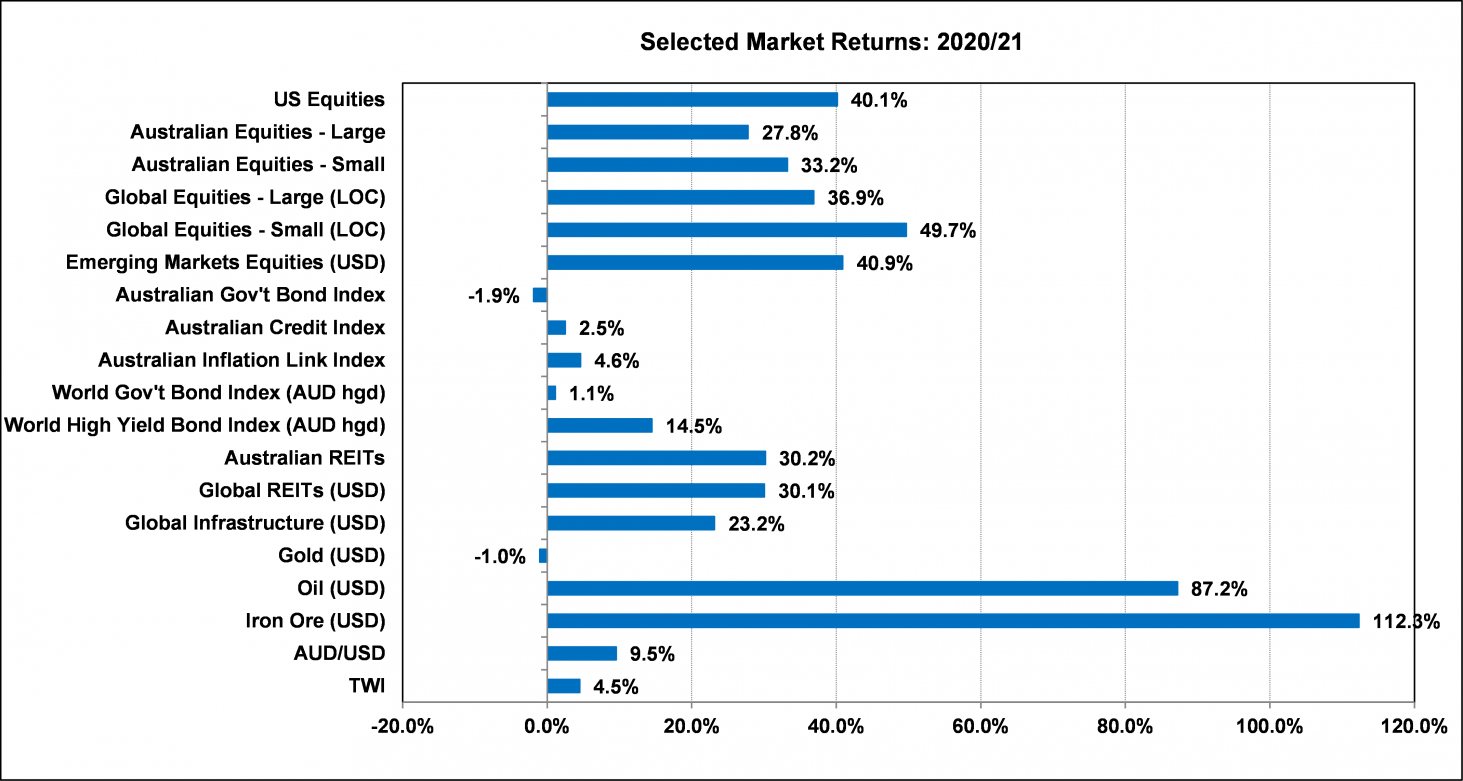

2020/21 was a dramatic year that started with serious concerns about public health and the global economy and finished on an optimistic note, delivering historic gains in equity markets along the way. Although COVID continued to cause problems in many countries through the year, progress on developing and distributing vaccines helped mitigate concerns about the impact of further lockdowns.

Most importantly however, the massive fiscal and monetary stimulus applied across the world raised expectations of economic recovery. As the second half of 2020 unfolded the impact of this stimulus became apparent, with indicators of business conditions and activity improving and unemployment rates starting to fall. Equity markets rallied further on this news. The election of President Biden, with the promise of more big fiscal packages, also helped push equity markets higher. Bond yields were drifting higher at the same time, and Bitcoin rallied very aggressively.

In the first half of 2021, markets started to worry that there might be too much growth and that economies could overheat and cause inflation. Bond yields rose quickly and there was a rotation within equity markets from growth stocks to value stocks. Bank share prices outperformed strongly in this phase as yield curves steepened on expectations of interest rate increases. Central banks, especially, the US Federal Reserve, assured the markets there would be no sudden changes to monetary policy, but it is now clear that normalisation of monetary policy from the emergency COVID settings will begin sooner than previously expected.

Chart 1: 2020/21 saw very big equity returns as economic conditions improved

Source: Thomson Reuters, Bloomberg 1 July 2021

Key investment themes for 2021/22:

- Central banks will begin normalising their monetary policy settings, starting with tapering their quantitative easing (QE) programs. This will have to be handled very carefully to avoid disrupting markets.

- Base case economic outlook suggests equities and credit will beat bonds, and the rotation from growth to value will continue.

- Returns across asset classes will be lower than in 2020/21. In this environment, active investment management will be important.

Key risks include:

- If inflation goes up more than expected, both bond and equity markets would suffer.

- Success with global vaccination programs will be essential to put lockdowns behind us.

- If China’s ambitions to take back Taiwan lead to overt military action, equity markets would react very badly.

The Financial Year in Review

2020/21 was one of the most dramatic years we have ever seen. At the start of the year, there were many questions and concerns about how the global economy would recover from the COVID-recession.

By the end of the year, these had shifted to whether economies are now at risk of overheating and generating too much inflation. How did we get from one end of the spectrum to the other in so short a time and what did it mean for financial markets?

Continued disruption from COVID-19

A year ago, it was already clear that central banks and governments would inject unprecedented amounts of stimulus into their economies. Interest rates had been cut to historic lows and budget deficits had ballooned, with the prospect of more to come. Financial markets, especially equities, had already reacted positively to this on the expectation that stimulus would deliver better growth, while at the same time bond yields had also fallen to historic lows, which supported higher valuations.

However, it took a while for concerns about COVID, vaccinations and economic growth to start to dissipate, especially as the virus continued to spread widely around the world. After a second wave here in Australia in Q3 2020, the infection rate declined and remained under control. However, in many countries including the US, UK, parts of Europe, Japan and India, infections rose dramatically and in multiple waves over several months. This led to lockdowns and restrictions of varying degrees, with the UK implementing an extended national hard lockdown, and the US adopting a very mixed regional approach. This naturally raised fears that economic activity would continue to be disrupted and that policy makers might run out to ammunition to counter this.

Vaccines and renewed confidence in markets

It was not until late in 2020 that there was enough good news about a number of successful vaccines in final development, and signs of economic improvement, for markets to gain enough confidence that the combination of policy measures and vaccines would be enough to overcome the impact of COVID. During this time markets were characterised by very low bond yields and higher equity prices.

Within equities, there was pronounced outperformance by so-called growth stocks which tend to do better in slow growth, low inflation and low bond yield environments. This included many well-known technology companies, especially those seen to benefit from the increase in working from home and online shopping. Conversely, stocks adversely impacted by these working and shopping trends, including real estate investment trusts (REITs), underperformed. Bank stocks also lagged during this phase under the impact of flat yield curves and concerns about risks of high unemployment in a lockdown scenario and overall lending growth.

Commodities and resources

Commodities and resource stocks performed very well in this phase. This was partly due to weakness of the US$ caused by the Federal Reserve’s ultra-easy monetary policy and partly by stimulus measures in other countries around the world. For example, strong demand for iron ore from China helped push the price of iron ore up by more than 100% in 2020/21.

Naturally, this helped both Australian resource stocks and the A$/US$ exchange rate, which rose nearly 10% in the June-December period. The price of gold also did well, rising 25% over six months. This was partly due to the weaker US$, but also partly due to speculation that traditional currencies would be less reliable in a post-COVID world.

Online trading & cryptocurrency

Another phenomenon that took off in this phase was the rise of online traders. Cooped up at home, with money to spare and cheap new share trading platforms, these traders poured billions of dollars into the markets. Social media gossip exacerbated this activity and created so-called “meme stocks”. This contributed to pushing equity market prices and valuations to historic levels. However, equities were not the only focus of these traders’ attention. Cryptocurrencies became hugely popular, with Bitcoin rising from below US$10,000 in June 2020, to over US$63,000 in April 2021 before falling back to around US$35,000 by 30 June 2021.

Cryptocurrencies attracted much debate and disagreement. Are they money? Are they safe investments? Are they the way of the future? Whatever the answer, the volatility of cryptocurrencies showed they are not for the faint-hearted. Their performance over the past six months has many of the hallmarks of speculative mania.

Improving economic performance

As 2020 ended equity markets were buoyed by signs of better economic performance – notably very high (positive) readings of business conditions and activity surveys as well as good progress on reducing unemployment rates. Adding to the positive sentiment was the fact that the US election was out of the way and promising news about vaccines continued. Mr Biden made it clear during his campaign that he would be enacting major fiscal programs, of which the first is underway and a second was sent to Congress.

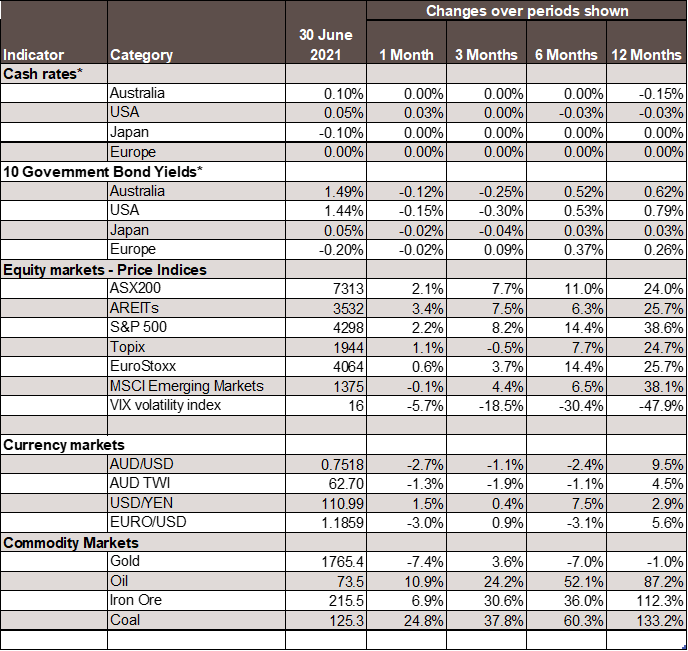

This, plus ongoing loose monetary policy, the prospect of economies opening-up and upward revisions to official economic forecasts, all helped investors start shifting their focus. In bond markets, investors started to worry that economies would overheat and cause inflation, leading to an earlier tightening of monetary policy than previously expected. From December through to March/April government bond yields in the US and Australia rose quickly to levels seen just before COVID started. Part of this rise on bond yields reflected an increase in expectations of inflation in the US.

Equity market response

In equity markets, this environment produced a rotation away from the growth stocks noted above, towards value stocks, which benefit more from an environment of higher inflation and bond yields. The improved growth outlook also benefited cyclical stocks more than defensive stocks. In the Australian equity market, banks did very well in this phase. Also, although equity indices, including the ASX200, posted new highs in this phase, stronger earnings growth allowed P/E ratios to ease back and start unwinding some of the very high valuation that had concerned investors.

Exchange rate

Although iron ore rose further in the first half of 2021, the A$/US$ lost ground. After climbing as high as US$0.797 in late February, the currency finished June 2021 around US$0.752. Despite a brief rally in April and May, the price of gold maintained its overall decline from the peak seen in August last year.

Looking ahead

The coming year will hopefully be less eventful than 2020/21, but there will still be important themes and issues for markets to deal with, including:

Monetary policy:

It is becoming increasingly apparent that conditions in Australia, the US, and some other countries are improving faster than central banks had expected. As a result, there is debate about how soon the RBA and the Fed will lift interest rates. The central banks had said this was unlikely to happen before 2023, but markets now expect rates to start increasing next year. Before that happens, the central banks will have to start slowing the pace at which they are buying bonds in the open market. This is called “tapering” and, if not handled carefully, has the potential to disrupt not only bond markets but also equity and currency markets. This will be a key issue to watch in the coming year.

Bond and credit markets:

Economies are unlikely to slow down enough to cause bond yields to fall much, if at all. With inflation risks probably skewed to the upside, central banks are moving ever closer to the point where they must start normalising monetary policy. At this stage it seems likely that bond yields will not rise so much as to deliver large negative returns on bond portfolios. However, returns are likely to be very low. Credit investments are expected to do better than government bonds, in line with equities outperforming, but also with relatively lower returns than last year.

Equity markets:

Equities a have had a great rally but now need to adjust to the balance between high valuations and stronger profit growth. As equities rallied ahead of the economic recoveries, so P/E ratios have risen to historically high levels which may be hard to sustain in the face of higher bond yields as central banks start to wind back QE programs. Equities need enough profit growth to offset the risk to valuations. At times, this will be a tricky balancing act.

Other issues for equities to grapple with include global regulatory pressure on big tech companies and, in the US, policy moves by the Democrats to increase labour’s share of national income at the expense of capital’s share. This would result in lower future profit growth for the equity market.

If current conditions – of cyclical economic recovery with modestly higher inflation – continue, then it is likely the rotation from growth stocks to value stocks will continue in both domestic and international equity markets.

Overall, equities are likely to outperform bonds in the coming year, but overall returns from equities are expected to be much lower than in 2020/21. There will also be bouts of volatility in equity markets from time to time.

Currency markets:

Monetary policy will probably be the key driver in the coming year. A simple rule of thumb will be that countries where growth and inflation require central banks to tighten, monetary policy faster will see their currencies rise.

Risks:

Inflation

This is one of the biggest questions for 2021/22. Central banks are saying current inflationary pressures are transitory, but markets are aware of the risk that inflation may prove more sustained and stronger. In that case, markets would price even more aggressive monetary tightening, leading to higher bond yields, potentially lower equity prices and a higher currency for the country seen to be needing the most monetary tightening.

US fiscal policy

It is unclear just how big the next US fiscal package will be, but the larger it is and the sooner it starts, the greater the risk that the US economy does overheat and cause sustained inflationary pressures. That in turn would likely undermine bond and equity markets, as well as drive the US$ up.

COVID

The markets are clearly much less concerned about COVID now than they were a year ago. The Delta variant is causing some concern but not enough to derail economies and equity markets. However, the persistence and variability of COVID reminds us of the risk that a vaccine resistant variant, or some problem with the distribution of vaccines, would likely cause volatility across markets.

China

The Communist Party has just celebrated its 100th anniversary amid much nationalistic rhetoric. China remains resolute in its determination to take back Taiwan, as well as assert itself as a global power. Global equity markets, especially in Asia, would react very badly to overt hostilities against Taiwan.

Chart 2: Major Market Indicators – June 2021

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.