Economic Snapshot: A dramatic month for global markets - March 2020

Summary

March was the most turbulent month for global financial markets since the onset of the GFC. Evidence of COVID-19 spreading into Europe triggered a sharp fall in equities and other risk assets, combined with a liquidity squeeze as demand for US$ cash rocketed. Volatility rose across many asset classes, with equities moving up and down by 10% a day. The A$/US$ fell nearly US$0.10 to around US$0.56 as it was sold to provide US$ in exchange.

These conditions continued until around the middle of the month when central banks stepped in to cut interest rates sharply and implemented programs to supply trillions of dollars of liquidity to global markets and banking systems. However, equity markets did not really take heart until a few days later when governments around the world, including Australia and especially the US, announced fiscal packages amounting to trillions of dollars in total.

After a bounce in equity markets (some of which was retraced towards the end of the month) the question now is where to from here? Do we have a fast drop in the economy and an equally fast recovery to be back on track by early 2021, or are we in for a more protracted downturn? The mood among economists seems to be swinging from the former to the latter as the virus accelerates in the US and the economic data looks to be deteriorating dramatically. As one commentator said, we have seen maximum panic (the liquidity squeeze) but we have not yet seen maximum pessimism (the economic/virus damage).

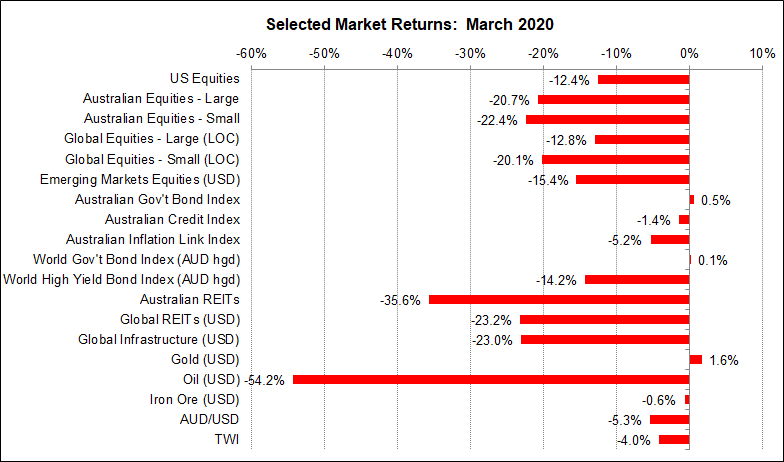

Chart 1: A dramatic month for global markets in a world rocked by COVID-19

Source: Thomson Reuters, Bloomberg 1 April 2020

Global Financial Markets

March was the most turbulent month for global financial markets since the onset of the GFC. The trouble started at the end of February when cases of COVID-19 started appearing in Europe, especially northern Italy. Financial markets immediately started to worry about how the impact of the virus, already seen in China, would impact the broader global economy as more and more countries implemented social distancing policies.

This sparked a sudden rush to safety and liquidity among global investors and traders. Equity markets fell very sharply, at times moving 10% or more in a single day. The A$/US$ fell heavily from around US$0.65 to just under US$0.56 as investors sold whatever they could to raise US$ cash. Even gold and government bonds, traditional safe havens in times of turmoil, were sold to raise US$ cash.

Global Oil Supply

In addition, and separate to the already sensitive situation, Saudi Arabia and Russia stepped away from their existing agreement to limit the supply of crude oil and quickly increased the supply onto global markets. Coming on top of reduced demand for oil caused by COVID-19 shutdowns, the price of oil collapsed from around US$47/bl to a low of US$14/bl. This in and of itself would have been enough to trigger a bout of market volatility and clearly exacerbated the challenging market conditions once combined with the uncertainty related to the COVID-19 virus spread.

Monetary Policy Response

In the first half of March, global financial markets were facing a potentially systemic liquidity crisis. However, having learnt from their experience with the GFC, central banks quickly stepped in with substantive policy initiatives to ease monetary policy and supply liquidity to the financial system. For example, the Reserve Bank cut the cash rate to 0.25%, as did the Federal Reserve with a rate cut of 1% in a single day. At the same time central banks announced massive programs to buy government bonds, support the banking system and help provide relief to corporate debt markets. Later in the month some central banks extended these support measures which now amount to trillions of dollars in total.

While it’s difficult to portray the importance of these measures with words, this co-ordinated action around the world is significantly important to ensure the effective functioning of many different global financial markets. The aim of the measures was to stabilise bond and currency markets in particular, but equity markets were still very edgy, because monetary policy alone was not going to solve the problem of the big negative shock to global growth caused by abruptly shutting down the global economy.

Government Support Packages

Governments announced support packages in the early part of March, but by the third week of the month the scale of these measures was ramped up significantly. For example, in Australia the Federal Government announced a wide range of measures including cash payments to households, wage subsidies, suspension of tax payments and increased spending on health and welfare. The government’s fiscal support amounts to $214 billion in the near term, with another $11.8 billion from the States and Territories, all on top of nearly $100 billion in liquidity support from the Reserve Bank. These are extraordinarily large numbers, amounting to around 20% of GDP. Similar big moves were announced in other countries, including the US where Congress enacted at US$2.3 trillion (!) package. Equity markets rallied sharply in response to these measures before giving back some of these gains but nevertheless ending around 10%-15% above their intra-month lows.

Impact of COVID-19

On the virus front, as March unfolded, we saw:

- The infection rate picking up again modestly in China and South Korea, the two countries which showed infection peaks the soonest.

- Having relaxed social distancing measures, China is now starting to reimpose them.

- In Australia, a combination of testing and social distancing has kept the infection rate very low by global standards, helping to “flatten the curve”.

- Nevertheless, the government has said social distancing is with us for 6 months to get past the winter flu season.

- New cases appear to be peaking in Italy, but are still rising in the rest of Europe, where several countries have extended distancing policies.

- The US is in trouble with very rapid spread of the virus and nearly 220,000 cases so far; on its current trajectory the US will have 500,000 cases in less than a fortnight.

- The virus is just starting to spread through several emerging market nations, including India.

Economic Indicators

On the economic data front, it is still early days for the figures to be showing the impact of the virus and containment measures. Data we do have includes:

- US unemployment benefit claims rose from 282,000 on 13 March to 6.6 million on 27 March, the biggest such move in the history of the series. This heralds a big jump in the unemployment rate in April, which will signal the US is in recession;

- Data from the New York Fed estimates that at the end of March, US real GDP growth (year on year) was -6%, compared with +2% at the end of February and -4% in the depths of the GFC.

- Early figures on activity in manufacturing and service sectors around the world, including Australia, show sharp falls in March.

- These indicators for China showed a sharp bounce up in March after extreme weakness in January/February, but the authorities said they should not be relied on and another 3 months of data would be needed to get a better picture.

- Other reports show China’s manufacturing sector running at about 80% of capacity, which is not enough to deliver growth at the rate they need.

Where to from here?

While many of us are stuck at home, this is a (may not feel like it) fast moving situation with many dynamics; we may find that there is an easing in some restrictive measures, if the virus spread looks to be contained, but we’ll need to await formal guidance from authorities before we can take confidence from this view.

The big question for financial markets is where to from here? Ultimately, the answer to this hinges on the spread of the virus and the impact of social distancing policies. We must keep in mind that Investment markets are forward looking and will be seeking signs that the virus spread is easing. One school of thought says that when the virus peaks, easing of social restrictions will soon follow and economies can get back to work. This is the so-called “V shaped” recovery in which we have a bad Q2 2020 and then bounce back fast in Q3. Another view says the virus will be with us for another 12-18 months before a reliable vaccine is available and that social distancing policies will have to stay in place for some time to come. in this case, the economic downturn will last for more than a quarter. This is the so called “U shaped” recovery.

In coming weeks, we will get data showing more clearly the impact on global growth and unemployment. The numbers are likely to be very bad indeed, but they will largely reflect conditions before the stimulus packages were announced. Nevertheless, we are more likely to be facing an extended period of difficulty which leans increasingly towards the “U” rather than the “V” for the shape of recovery.

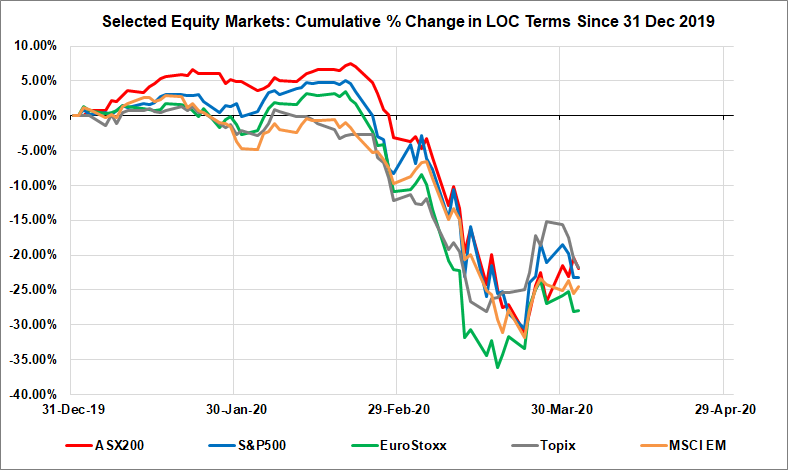

Chart 2: Market trough, or bear market rally?

Source: Thomson Reuters, Bloomberg April 2020

Conclusion

Markets are still coming to grips with all this from one day to the next. In particular, they are wondering if the recent bounce in equity markets is the start of something bigger or just a bear market rally. So far, we have gone through the first phase of the equity downturn: the liquidity squeeze, which ended with central bank support. We are now in the second phase of trying to assess the balance between containment policies and fiscal stimulus. Equity markets are not clearly cheap after the recent rally, which leaves them vulnerable to further downside.

As one commentator said, we have seen maximum panic (the liquidity squeeze) but we have not yet seen maximum pessimism (the economic/virus damage).

An important aspect of the situation at this point is that we are moving into a phase where we will get more information about both COVID-19 and its impact on the global economy. Scientists outside China will be able to observe the virus firsthand, which will help give a clearer picture of how the virus operates and how the risk must be managed. Also, we will start getting economic data which will shed light on just how much trade and growth are being impacted. There is a risk that the news flow gets worse before it gets better, but it will get better, though no-one knows exactly when.

In the meantime, central banks and governments have begun to act, with many policy changes announced in mid-March. For now, the authorities in China are sticking with their policies of support rather than stimulus. That is, they will assist firms to survive the virus and get back to work, but they will not risk compromising progress to date on fixing bad debts and other problems in the financial system, which were created by too much stimulus in previous years.

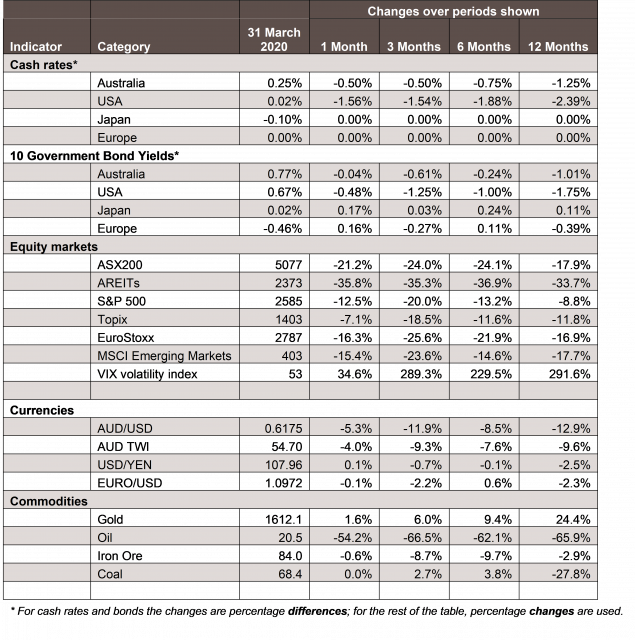

Chart 3: Major Market Indicators - March 2020

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.