Economic Snapshot: Markets set a postive tone

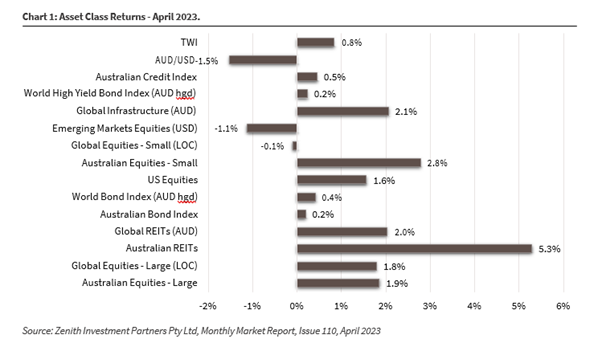

In April, global developed equities saw a slight positive tone, rising by 1.8%, with Europe ex-UK being the standout performer. Australian equities rose by 1.9%, with banks gaining 3%, but the materials sector declined 2.6%. The MSCI Emerging markets index fell by 1.1%, with China's uneven recovery from Covid lockdowns causing weaker performance. REITs rebounded, rising by 5.3%, but their annual return still lags broader equities.

Global bond markets were less volatile, with global bonds returning 0.4% for the month. Inflation dropped in the US but remained high. Commodities were also volatile in the month; Brent crude oil initially rose but fell by month-end due to concerns over the global growth outlook.

Global Developed Equities

In April, global developed equities experienced a slight positive tone as volatility in equity and bond markets subsided, leading to a 1.8% rise in equity markets taking the annual gain to 3.3%.

Factors contributing to the rise included declining inflation, expectations of a peak in central bank rate increases, and better than expected corporate earnings results.

However, there are still risks including that of a recession in certain developed countries. This is being watched closely by analysts with manufacturing PMI (purchasing manufacturers index) readings below the key level of 50 (contraction territory) in most jurisdictions and evidence of credit conditions and accessibility tightening in the aftermath of several US bank failures.

Corporate earnings have exceeded expectations so far this year, and the MSCI World ex-Australia index rose 3.2% in April, with Europe ex-UK being the standout performer, rising 3.8%.

The insurance, consumer staples, and healthcare sectors outperformed, while the IT sector was marginally down, and banks lost 2.2%. Defensives and quality have returned over 5% in the past 12 months, with momentum stocks down slightly.

Australian Equities

The Australian equity market rose by 1.9% in April, but the country's outperformance of global markets seemed to have ended as investors became more cautious about domestic banks and materials.

Banks gained 3% in April, but they have declined almost 7% over the past three months due to concerns over the household sector and the impact of further interest rate movements.

Meanwhile, the materials sector declined 2.6% in the month, partly reflecting the 17% drop in iron ore prices in April. REITs (listed property sector) gained 5.3% in April, while insurance extended its run, up a further 4.9% to take the annual increase to 18.5%.

The RBA kept the cash rate unchanged in April (but it surprised markets with a 25-basis point increase in early May). Recent data on employment had been strong, and the March quarter CPI data showed stubbornly high core inflation, although wages growth had shown signs of steadying at lower-than-expected levels.

Emerging Markets

The MSCI Emerging markets index fell 1.1% in USD terms in April, down 4.7% over three months and 6.5% over the year. China's uneven recovery from Covid lockdowns caused this weaker performance. MSCI Asia fell 2.4%, with MSCI China and Taiwan down 5.2% and 4.3%, respectively, while India rose 4.2%.

The outlook for emerging markets is uncertain, as it heavily depends on China's growth, which is volatile due to policy uncertainty and risks associated with the property sector.

Property and Infrastructure

AREITs (Australian listed property) rebounded in April, rising 5.3%, but their annual return of -9.9% still lags behind broader equities.

Global REITs increased by 2% during the month, but their 12-month return was -16.4%. REITs are sensitive to interest rates, but their focus is now on the uncertainty surrounding the revaluation of commercial and retail properties due to a combination of factors such as higher interest rates, lower occupancy rates post-Covid, and tightening credit conditions.

In contrast, the global infrastructure sector rose by 2.1% in April but has underperformed broader equity market returns over the past six months.

Global Fixed Interest

In April, global bond markets were less volatile with the US 10-year yield ending the month at 3.44 per cent. Shorter- dated bond yields slightly rose as markets predicted a May Fed funds hike. The US 2-year yield ended the month at 4.04%, little changed for the month.

Markets predict two interest rate cuts in the second half of 2023 with a further five cuts to just over 3 per cent in late 2024, which differs from the Fed's view.

Inflation dropped from 6 per cent to 5 per cent in the US but remained over 10 per cent in the UK. The service sector PMI's paint a stronger story reflecting resilient consumer spending on services post-Covid, backed by excess savings and solid income growth. However, there is growing evidence of recessionary conditions, particularly in the US after the failure of several US banks.

Global bonds returned 0.4 per cent for the month and 0.7 per cent for the quarter but still remain negative (2.3 per cent) for the year. Investment grade credit returned 0.7 per cent for April but has lost 1.9 per cent over the year, while global high yield was up just 0.2 per cent due to concerns over the banking sector and recession risk.

Australian Fixed Interest

In April, Australian bond yields remained stable, with the Bloomberg composite bond index returning 0.2% for the month and 2% for the quarter. Inflation-linked bonds gained 0.3% in April and have returned 4.2% for the past 12 months.

The market initially believed that the Reserve Bank of Australia (RBA) would not adjust interest rates higher in early May, but the RBA surprised investors with a 25-basis point hike to 3.85%, citing inflation concerns and the lack of productivity in the Australian economy.

The RBA noted that further tightening of monetary policy may be necessary to bring inflation back to its target range but acknowledged that it is near the peak of hiking rates in this tightening cycle. The surprise move led some to believe that there may be another hike in the future.

Commodities

In April, Brent crude oil initially rose to a high of US$87.25 a barrel due to OPEC+ producers curbing output but fell to US$79.42 a barrel by month-end due to concerns over the global economic growth outlook and uncertainty over the Chinese recovery.

Iron ore prices declined 17 per cent to US$105 a tonne due to weaker than expected growth in Chinese construction. Gold remained close to US$2000 an ounce, benefiting from the decline in real yields and the weakness of the USD. Copper prices declined over 4 per cent due to cyclical concerns outweighing the stronger structural story.

Currency

The USD had a mixed month, gaining against some currencies, such as the Japanese yen and the AUD, but losing ground against the pound and the euro. The AUD fell towards 66 cents due to the expectation of no change in RBA policy and a US hike (increasing the interest rate differential between Australia and the US).

The yen weakened as the new Bank of Japan governor was expected to maintain current policy settings. In early May, the surprise RBA hike caused the AUD to jump more than 1%.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by FMD Group and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the the information contained in this document. Advice is required before any content can be applied at a personal level. No responsibility is accepted by FMD Group or its officers. Past performance is not an indication of future performance.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.