Economic Snapshot: Global equity markets rise

In March, global equity markets rose after a tough February. The main themes during the quarter were concerns about peak inflation, a possible peak in Fed funds, weaker growth data, and lower bond yields.

Australian equities underperformed global equities, returning 0.8% for the financial year to date. Emerging markets did better, returning 5.3% in the quarter.

Bond yields declined, with the US 10-year yield falling to 3.47% at month-end, and Australian bond yields trading as low as 3.19% in March. The USD lost ground due to re-evaluations of the Fed interest rate expectations while the AUD fell almost 2% against the USD in the quarter.

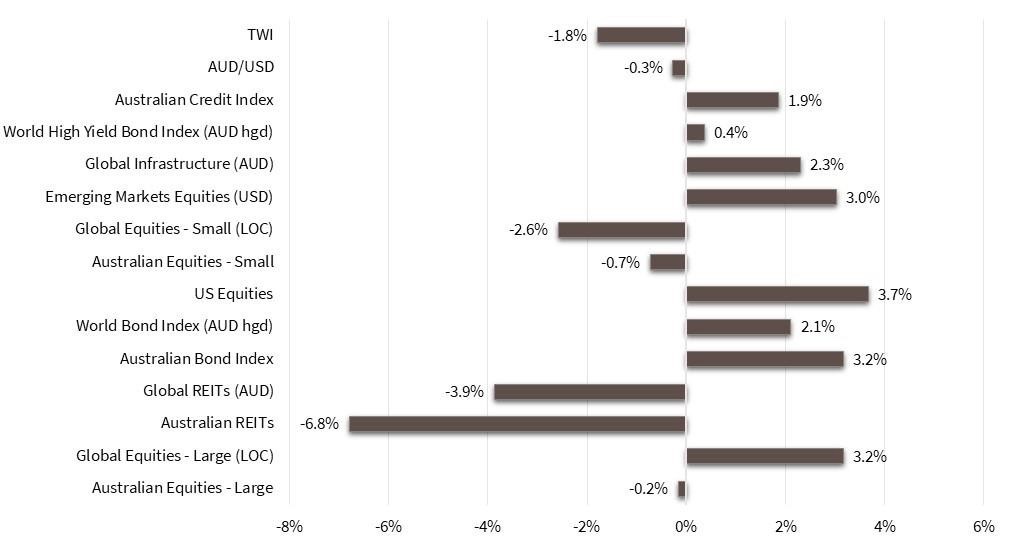

Chart 1: Asset Class Returns, March 2023

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, March 2023

Australian Equities

The Australian equity market decreased by 0.2%, while over the quarter there was an increase of 3.5%, which is the first time it has underperformed global equities since June 2022. The return for the financial year to date has been 13.6%, similar to global markets.

The bank sector has been weakening due to the issues seen in Credit Suisse and US regional banks. Although Australian banks are well-capitalized, their valuations reflect these broader challenges. Investors are now realizing that banks could be negatively impacted by movements in short-term rates beyond a certain threshold.

The miners, telcos, and healthcare sectors performed well in March, while REITs were sold down due to concerns over commercial property valuations and reliance of funding (borrowings) from regional banks.

The RBA lifted the cash rate for the 10th consecutive meeting to 3.6%, but expressed confidence that the risk of a wage- price spiral had decreased. Employment data improved, however the December quarter's national accounts showed that household disposable incomes contracted due to a rapid increase in mortgage rates.

Emerging Markets

The MSCI Emerging markets index increased by 3% in USD terms, making the March quarter a gain of 4% and the financial year to date advance 0.8%. In AUD terms, emerging markets were up by 3.7% in March and 5.3% in the quarter.Taiwan and Korea were key contributors, but India detracted by 6.4%. Brazil has been struggling with poor performance in Latin American stocks.

Compared to developed markets, emerging markets have a more favourable growth and inflation backdrop, especially in China. Purchasing Manufacturers Index (PMI) activity in China have increased since the end of lockdowns, while inflation remains low. Policies are being eased, as seen in the small cut in the bank reserve requirement ratio during the month.

Reits and Infrastructure

Australian REITs fell by 6.8% in March, resulting in a return of only 0.5% for the quarter and 4.6% for the financial year to date, significantly behind broader equities.

Global REITs also dropped by 3.9% in March, while infrastructure gained 2.3% during the same month, but it has lagged behind the recovery in global equity markets since June 2022.

Investors in REITs were mainly concerned about the risk of contagion to other smaller banks and property valuations following the collapse of SVB on March 10.

Global Fixed Interest

Global bond yields fell in March, with 10-year yields down 40- 50 basis points (0.4-0.5%), prompted by the collapse of Silicon Valley Bank and Signature Bank, fears of contagion, and tightening lending standards.

Market expectations of Fed funds rate hikes changed, with at least two cuts in 2023 and a further five in 2024 to 3.25 per cent now predicted. The market is now more focused on recession risk.

TIPs (inflation-linked bonds) yields fell, while UK gilts and German 10-year yields remained unchanged. Global bonds returned 2.1 per cent for the month and 2.4 per cent for the quarter, while investment-grade credit returned1.9 per cent.

Australian Fixed Interest

Australian bond yields traded low before edging up at month- end, while the Bloomberg composite bond index generated strong gains for the month and quarter after a poor 2022.

Weaker than expected GDP growth, slower wages growth, and signs of peak inflation caused rate hike expectations to lower, and the market lowered its peak cash rate estimate from 4.1% to 3.6%.

The RBA governor softened the language in response to weaker GDP and wages data but did not rule out further action in the future.

Employment data rebounded with 65,000 jobs added and a decrease in the unemployment rate. However, household disposable incomes contracted despite solid wages growth due to the impact from the surge in mortgage rates. Housing finance remains weak, and dwelling approvals are down, but house prices rose in March.

Commodities

Brent crude oil fell to US$72 per barrel due to concerns over global demand and the fear of bank collapses in the US. However, on April 2, OPEC+ members led by Saudi Arabia agreed to a surprise production cut of 1.16 million barrels per day, which caused the price of oil to rise to almost US$85 per barrel.

Gold prices increased by 8.1% in March, reaching US$1986.2 per ounce, benefiting from the decline in real bond yields and weakness in the USD. Iron ore prices were steady in March, ending the month at US$127 per tonne, while the RBA commodity price index fell 4.3% in the month, down 14% financial year to date.

Currency

The USD lost ground due to the reassessment of the outlook for Fed funds as the bank sector turmoil in the US and concerns over tightening lending standards prompted a re- evaluation.

The markets barely factored in a further Fed hike by month-end, with almost 100 basis points slashed off Fed funds rate projections for 2023-24. The USD lost around 2.5 per cent against the Euro and the pound, while the yen strengthened.

China's President pledged to adopt the renminbi for payments between Russia and countries of Asia, Africa, and Latin America, to displace the dollar. The AUD fell slightly against the USD in March, and expectations for RBA tightening were also reassessed.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by FMD Group and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at a personal level. No responsibility is accepted by FMD Group or its officers. Past performance is not an indication of future performance.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.