Economic Snapshot: Markets rise as inflation eases

In February, the Reserve Bank of Australia (RBA) held steady on the cash rate at 4.35%, a move widely anticipated by market participants. Reflecting on the outcomes of the February meeting, RBA Governor Michele Bullock conveyed a nuanced perspective, emphasising the significance of declining inflation while remaining vigilant about its lingering presence above the target threshold (2-3%).

Bullock's cautionary remark underscored the bank's concern over the potential drift of inflationary expectations, highlighting the potential costs (leading to possibly higher interest rates) associated with addressing such a scenario. Amidst this backdrop, global equities rose by a further 5.9% in Australian Dollar terms for the month and an impressive near-30% surge over the past year.

This buoyant trajectory propelled several key market indices to reach new record levels. The enduring strength of economic indicators coupled with robust earnings growth provided a solid foundation for equities, despite the backdrop of rising bond yields spurred by market reassessment of the Federal Reserve's future rate adjustments.

Contrasting the global trend, Australian equities experienced a more modest uptick of 0.8% during the month and a 10.6% increase over the preceding 12 months.

Noteworthy performers included the Information Technology sector, boasting a 19.7% increase, and the Consumer Discretionary sector, which saw an uptick of 9.7%. Additionally, Real Estate Investment Trusts (REITs) and banks demonstrated resilience, registering gains of 4.8% and 3.5%, respectively.

Meanwhile, in the United States, bond yields continued their upward trajectory throughout the month. The 10-year Treasury yield increased to 4.25% by the end of the period, marking an uptick from 3.9% at the end of January. Similarly, Australian bond yields followed suit, peaking at 4.28% before closing the month at 4.15%, reflecting the broader market sentiment of reevaluating future interest rate adjustments.

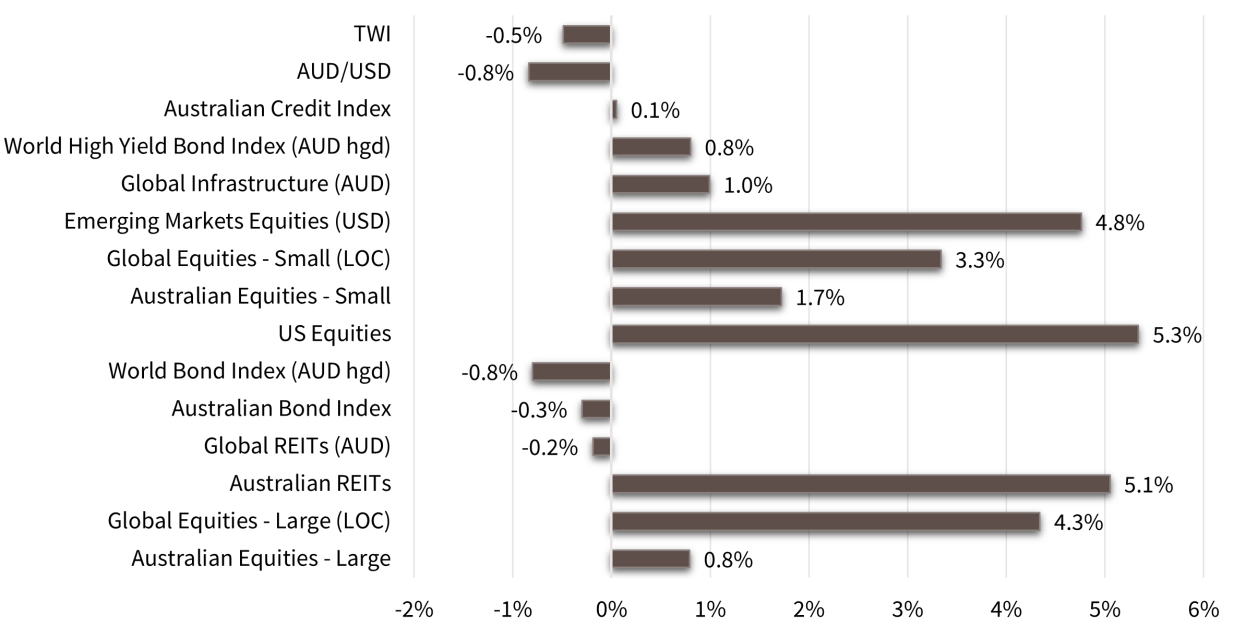

Asset Class Returns - February 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 120, February 2024

Global Developed Equities

Global markets continued to rise over February, with key indices hitting record highs, up 4.3%. This was supported by strong economic data and earnings growth, despite higher bond yields, as the market re-evaluated the Fed's rate cut timing.

The MSCI World ex Australia index rose 4.3% in USD terms, reaching a 25.3% annual gain. The S&P500 hit a record high of 5096, up 5.3%. The "Magnificent 7" stocks rallied, notably Nvidia with a 29% gain. Japanese TOPIX also rose to a record high, up 4.9%.

Earnings have generally exceeded expectations, with over 90% of S&P 500 firms beating forecasts. Despite a technical recession in Japan, the TOPIX saw a 34% annual gain. European markets underperformed, with MSCI Europe ex-UK up just 2% for a 14.8% gain over the year.

US economic growth remains solid, with resilient consumer spending. Inflation has paused, with the US PCE core prices showing a 0.4% rise in January. Markets no longer expect a rate cut in the first half of 2024, anticipating three cuts (or around -0.75%) in 2024 and 4-5 (-1.00 to -1.25%) in 2025.

Sector-wise, construction materials, retailing, and IT performed well. “Quality” stocks were the best performers for the year, up 39%, demonstrating the attraction to companies with lower borrowings, higher margins and more consistent profitability.

Australian Equities

Australian equities saw a modest return throughout the month, with the ASX200 up just 0.8%, underperforming global markets. Over the year, the market is up 10.6%.

IT and consumer discretionary sectors led performance, while materials, energy, and healthcare dragged the index down. The Mid Cap segment rose 5.3%, outperforming the ASX50.

The company reporting season showed stronger-than-expected results, with themes of a resilient consumer, strong cost management, and a positive economic outlook. Many companies beat market expectations, particularly in IT, consumer discretionary, and real estate.

The RBA left rates at 4.35%, with a potential cut by end-2024. January's labour market data was weak, with soft employment and higher unemployment. The NAB business survey indicates a softening economy, while inflation was steady at 3.4% in January, with core inflation above 4%.

Emerging Markets

Emerging markets had a strong month, driven by a rebound in Chinese equities. The MSCI China index rose 8.4% following government measures to support the market. The MSCI Emerging Markets index in AUD terms was up 6.4%, with EM Asia, Korea, and Taiwan performing well.

India has been a standout, up 37.3% over the year due to stable policy settings and solid growth.

Despite some improvements in Chinese economic data, the lead index for the manufacturing sector (PMI) shows a modest contraction. China's focus remains on supporting the household sector rather than traditional fiscal stimulus, given high debt levels. However, there are positive signs, such as recovering exports in sectors like autos and renewable energy.

From a price to earnings ratio perspective, emerging markets remain relatively cheap compared to developed markets. Sustained outperformance of emerging market investments in future depends on maintaining a higher growth premium over developed markets, along with easing monetary policy and a turn in the economic cycle, which seems more plausible now than in the past 12-18 months.

Property and Infrastructure

REITs rose 5.1% in February, with a 16.1% gain over the year, showing resilience despite rising bond yields. Global REITs, however, have not performed as well, with a marginal decrease in the month and a 0.1% decline over the year, lagging broader equity markets.

Specifically, New York Community Bancorp's reported loss raised concerns about the impact of higher interest rates on commercial real estate and the banks that lend to that sector. The FTSE Global Infrastructure index rose 1% in February, but for the year, the sector is up only 1%, trailing global equities.

Investors seem to view REITs as offering value despite the risks, while global REITs and infrastructure have faced challenges, possibly due to rising bond yields. Should rates ease, these sectors may provide opportunities for long-term investors.

Fixed Interest – Global

Bond yields rose in February due to slightly higher inflation data, ongoing economic resilience, and the Fed’s resistance to immediate rate cuts.

The US 10-year yield reached 4.25%, up from 3.99%. Market expectations shifted to “no cuts” until September 2024, with a total of three cuts in 2024 and 4-5 in 2025, reaching 3.5% by late 2025. In Europe, sticky inflation strengthened the ECB's resolve against rate cuts.

US economic growth showed mixed signals, with the manufacturing sector contracting but services remaining resilient. The labour market softened slightly from a tight starting point. Europe's manufacturing PMIs stabilized, while Japan entered technical recession in late 2023.

Most countries experienced a temporary halt to disinflation, with US core prices rising 0.4% in January. The Barclays Global Aggregate index returned -0.8% for the month. Corporate credit spreads remained stable, with high yield credit returning 0.8% for the month and 10.2% for the year.

Fixed Interest – Australia

Australian bond yields rose to 4.15% in February, with the Bloomberg Composite bond index returning -0.3% for the month and 3.5% for the year. The RBA kept the cash rate at 4.35%, noting concerns about inflation remaining above target and its impact on inflation expectations.

Markets expect one rate cut by the end of 2024, with a possibility of a second cut, projecting a cash rate of 3.65% by mid-2025. January's labour market data was weak, with only 500 jobs added and unemployment above 4% for the first time since January 2022.

Hours worked declined over the past 6 months, suggesting the labour market is rebalancing after the post-Covid surge. The NAB business survey indicates a softening economy, while inflation was steady at 3.4% in January, with core inflation above 4%.

Commodities

Despite losses in many commodities, Brent crude rose to US$83.6 a barrel in February, a 2.3% increase. Concerns over oil supply arose due to disruptions in Red Sea navigation caused by Middle East tensions and retaliatory airstrikes, impacting 15% of global sea trade.

Iron ore prices fell 11.7% in February, following a 6.7% decline in January, reaching US$117.5 a tonne. This drop was attributed to the lack of significant Chinese economic stimulus and lower-than-expected demand from steel mills.

Gold prices ended the month at US$2,048 an ounce, supported by expectations of future rate cuts.

Currencies

As markets delayed expectations of Fed rate cuts, the USD strengthened against most currencies.

The Euro closed at 1.08, and the yen weakened to 149.9, a 2.1% decrease. The AUD fell to 65 cents as markets adjusted their expectations.

The US-Australia two-year bond spread widened from around 50 to close to 90 basis points, supporting the USD's strength.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.