Economic Snapshot: Equity market momentum

After finishing 2023 on a strong note, momentum continued in equity markets. Australian equities rose further in January with a 1.2% lift, taking the 3-month advance to 14 %. Banks continued to lead the charge, rising 5.3% with insurance up 5.9% and energy 5.2%.

Global Equities rose a further 4.5% in AUD terms, taking the 3-month gain to 11.2%. Corporate earnings trumped a rise in bond yields to help push the US equity market to a record high around mid-month.

At its first meeting of the year (February), the RBA kept rates on hold at 4.35 % as expected. RBA Governor Michele Bullock noted that there was still a “job to be done” and that consideration of policy easing was possible once the RBA was confident in the progress to the 2-3 % inflation target.

US bond yields oscillated around the 4% level for most of the month, before declining on the back of indications that the core PCE price index (Personal Consumption Expenditures – a measure of inflation in the USA) was tracking towards the Fed’s 2% target.

Australian bond yields followed global bond yields with the 10-year yield rising to 4.17% before ending the month at 4.02%.

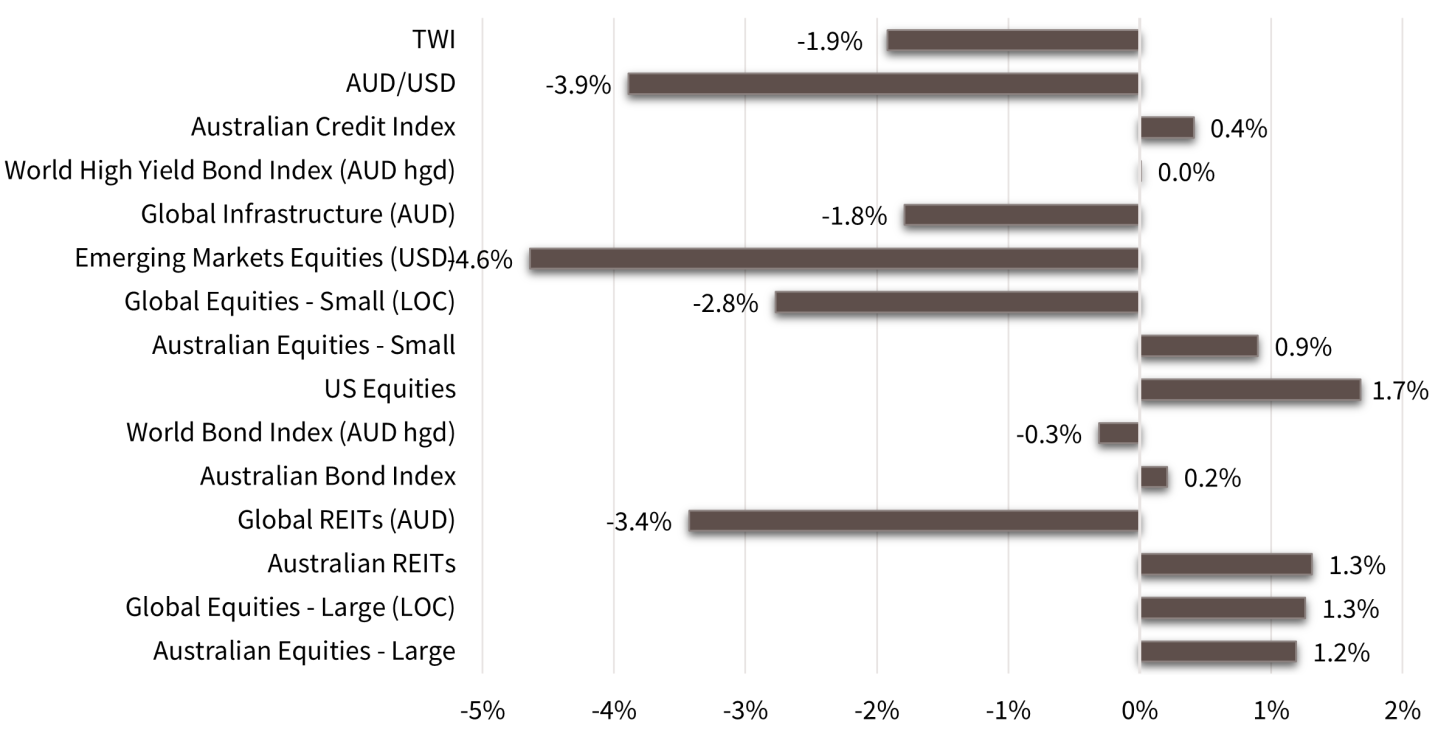

Asset Class Returns - January 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 118, December 2023

Global Developed Equities

In January, global markets saw positive movements, with US equities hitting record highs despite rising bond yields. The MSCI World ex Australia index rose by 1.3% in USD terms, with a quarterly gain of 16.1%.

Core inflation slightly decreased to 3.9%, aligning with the Federal Reserve's target. However, concerns arose due to Middle East tensions potentially affecting oil prices and global trade.

The Fed signalled the option of maintaining rates at a higher level for some time, aiming to stabilise inflation around 2%. Market projections anticipate Fed funds rate cuts by mid-2024, reaching 3% by 2026.

Earnings growth varied across sectors, with strong performance in communications and IT but declines in financials and energy. The US economy expanded by 3.3% in the December quarter, while Europe's growth remained weak.

Japan's market stood out with a 4.6% increase, supported by governance reforms and a low yen.

Hong Kong's market declined by 9.7%, reflecting poor growth and policy uncertainty. Notably, momentum and quality stocks performed well, while value stocks saw minimal gains.

Australian Equities

In January, Australian equities continued their strong performance from 2023, with a 1.2% increase, mainly driven by banking and insurance sectors. However, concerns over weaker iron ore prices and Chinese economic stability impacted the resources sector negatively.

The Reserve Bank of Australia (RBA) maintained interest rates at 4.35%, with a focus on achieving the 2-3% inflation target. Economic indicators such as the NAB business survey and labour market data showed mixed signals, with declining retail sales and dwelling approvals offset by robust jobs markets.

The Australian domestic economy faces challenges balancing strong jobs and wages growth with rising debt servicing costs. Earnings growth remains modest, with the banking sector leading the rally.

Overall, market outlook suggests cautious spending amid uncertainty.

Emerging Markets

Emerging markets experienced a decline, particularly Chinese equities, due to ongoing issues in the property market and concerns over policy response.

In January, emerging markets fell 4.6% in USD terms or 1.6% in AUD terms, but over three months, they rose by 7% or 2.5% in AUD terms, trailing behind global developed and domestic equities.

Chinese equities notably declined by 10.6%, totalling a 29% drop over a year, mainly due to challenges in the property market. However, Chinese exports show signs of recovery.

Asia dropped by 5.2% while Latin America fell by 4.8%. India has been a standout performer, rising by 2.4% for the month and reaching an annual gain of 27.5%.

Despite being relatively inexpensive compared to developed markets, emerging markets require global economic shifts and a weaker USD to perform better. Some EM central banks are easing policies, and inflation is declining, but sustained outperformance awaits a turn in the global cycle.

Property and Infrastructure

REITs saw gains driven by bond yield rallies, while global REITs were less successful. Infrastructure indexes experienced mixed performance.

Real Estate Investment Trusts (REITs) gained 1.3%, totalling a 3-month increase of 25.4%, mainly due to rising bond yields. Property valuations, especially in offices, are adjusting, likely impacting REITs. Global REITs, however, fell by 3.4% in the month but rose by 14% over three months.

The FTSE Global Infrastructure index decreased by 1.8% in January, yet gained 8.3% over three months, influenced by slightly higher bond yields.

Fixed Interest – Global

In January, US bond yields hovered around 4%, initially rising due to strong growth and the Fed's reluctance to cut rates in March, then falling as core PCE price index approached the Fed's 2% target. Market projections suggest four or five Fed rate cuts by end-2024, reaching 4.2%.

The European Central Bank and the Bank of England kept rates steady, hinting at future rate cuts due to declining inflation. Japanese bond yields remained at 0.72% with the BOJ maintaining accommodative policies. Despite higher headline CPI, core PCE index is aligning with the Fed’s 2-3% inflation target.

Concerns over Middle East tensions impacting oil prices and global trade via the Red Sea route. The Fed's Board Governor, Christopher Waller, sees potential for achieving sustainable 2% inflation but advocates cautious policy. Chairman Powell held rates at 5.25-5.5%, citing persisting high inflation.

Barclays Global Aggregate index returned -0.3% for the month. US 10-year TIP yields stabilised at 1.73%, with inflation expectations at 2.2%. Corporate credit spreads are low, with investment grade credit returning 8% over three months, the highest since 2009.

Fixed Interest – Australia

Australian bond yields increased to 4.17% before ending at 4.02%, with the Bloomberg Composite bond index returning 0.2% for the month and 6% over three months, the strongest since late 2008.

The RBA maintained rates at 4.35%, aiming to reach the 2-3% inflation target despite core CPI still above target at 4.2%.Market expectations suggest the RBA may cut rates by mid-year due to the Fed’s expectations and progress toward inflation targets.

Economic data indicates declining confidence, with a drop in employment and retail sales. The outlook depends on household spending, influenced by income growth versus rising debt costs. Scheduled mortgage repayments now exceed 10% of income for many households, signalling tighter budgets compared to previous years.

Commodities

In January, Brent crude rose to $81.71 per barrel due to disruptions in the Red Sea, which handles 15% of global trade, including vital commodities like grains and oil. Iron ore fell to $133 per tonne due to concerns about China's growth, although it performed better than expected.

Gold dropped to $2053.25 per ounce but has risen by over 13% annually, despite higher real yields typically seen as negative for gold.

Currencies

The AUD traded back down to 65.7 cents from above 68 cents as the Fed’s push back on a potential March rate cut lifted the short end of the US yield curve.

The euro also lost ground, ending the month at 1.082 while the yen dropped more than 4% to 146.9 to the USD.

The Bank of Japan maintained its accommodative policy stance although markets expect a change in the first half of 2024.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.