Economic Snapshot: Another stellar year for equities

Despite ongoing COVID waves, equities had another stellar year. Re-opening helped REITs and infrastructure in particular. However, supply chain problems caused pockets of excess demand that led to inflationary pressures. Bond yields rose on expectations that central banks would have to tighten monetary policy sooner rather than later.

By the end of 2021 the Federal Reserve had capitulated on this and said interest rates will start rising in 2022. The Reserve Bank held fast to its view of no rate increase before 2024, but the markets lost faith in this as the year progressed. Bond markets underperformed as yields rose. However, the impact of this on equity price to earnings (P/E) ratios was nowhere near enough to offset the impetus from strong profits growth.

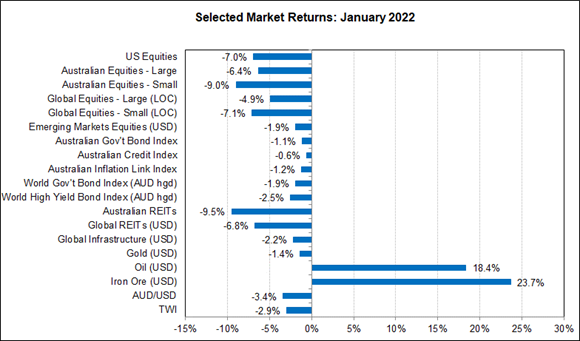

In January, concerns about inflation and higher interest rates triggered a bout of volatility in global markets. Bond yields rose and equity markets fell as investors re-assessed how far central banks may have to tighten monetary policy and the associated risk of possible recession. Further reports of high inflation, including here in Australia, added to these concerns and bond and equity markets saw losses for the month.

Those equities most sensitive to higher bond yields, including tech stocks and AREITs, underperformed. The A$/US$ fell as investors saw the Fed being more proactive with interest rates than the RBA. Gold fell as US bond yields rose. Growing tensions between Russia and NATO over Ukraine added to investors’ general nervousness. The coming year will be dominated by the inflation/ interest rate theme. Markets want to see just how far central banks will have to move. If COVID does not dissipate as hoped for, then the risks would be skewed to even higher interest rates.

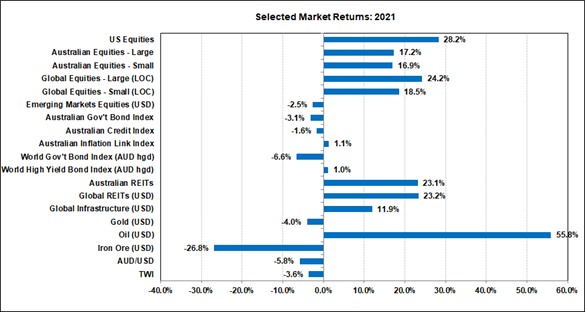

Chart 1: Equities perofrmed very strongly in 2021, while bonds underperformed

Source: Thomson Reuters, Bloomberg 1 Janaury 2022

Chart 2: Concerns about inflation and interest rates hit bond and equity markets hard in Janaury 2022

Source: Thomson Reuters, Bloomberg 1 February 2022

Key Developments in 2021

COVID-19 remained a disruptive influence in 2021 with the Delta and Omicron variants spreading around the world. The persistence of COVID helped drive a reassessment of how it should be managed. By the end of 2021 it had been decided that suppression would not be feasible and that living with the virus under the protection of vaccines would be the preferred longer run solution.

Global Growth

Against this backdrop, the global economy continued to recover in 2021. Despite some volatility and disruptions along the way, global growth is estimated to have been around 5.6% last year, in sharp contrast to the negative growth recorded in 2020.

Stimulatory fiscal and monetary policies contributed to the improvement, as did a recovery in consumer and business confidence as households and business started to see better conditions ahead.

Spending on retail sales, motor vehicles and housing was strong. Demand for services improved through the year as lockdowns were removed. For example, the US Institute of Supply Management (ISM) Services activity indicator surged to its highest levels on record and well above the ISM Manufacturing indicator.

Supply Chain Pressures

However, it soon became apparent that supply could not keep up with demand. This was partly due to difficulties in finding staff and partly to a shortage of inputs to manufacturing processes. In the case of staff, lockdowns removed workers from the labour force so that firms were unable to hire as many people as they wanted. Also, workers in high demand sectors became more willing to quit their jobs to find better conditions elsewhere.

In the case of manufacturing inputs, COVID disrupted supply chains around the world through lockdowns and quarantines. On top of this, the Chinese economy slowed in 2021 which contributed to shortages of key components. Developments in China were driven by a program of government reform to curtail excesses in some parts of the economy and to promote equality across society. The property development sector was particularly hard hit by these reforms, leading to the difficulties experienced by the Evergrande group later in the year.

Inflationary Pressure

These supply chain pressures showed up in higher wage inflation, shipping costs and measures of both producer and consumer prices. This was most apparent in the US where headline CPI inflation rose from 1.4% at the start of 2021 to 6.9% in November. Core CPI inflation was also 1.4% in January 2021 and rose to 5.0% in November. This was the highest rate of core inflation since 1991.

Not all countries experienced as much inflationary pressure as the US. In Europe, headline inflation rose from 0.75% to 4.75%, but the rise in core inflation was much less. Japan saw headline inflation rise, but core inflation fell. Here in Australia, headline inflation rose to 3% and core inflation to 2%. These figures were at the top and bottom of the RBA’s policy range respectively. However, in the UK, inflation rose sharply enough to prompt the Bank of England to raise its base rate in December.

Higher inflation is one of the most important outcomes from 2021 because of its implications for interest rates. After an extended period of historically low interest rates and bond yields, markets are quite understandably nervous about the potential consequences of higher inflation.

The recent bout of inflation is unusual and hard to pin down. Some of the headline inflation has clearly been driven by higher commodity prices, especially oil, but the supply chain pressures pushing core inflation up are spread unevenly across economies, which makes it hard to form an overall view.

In these conditions, central banks talked about inflation being transitory rather than permanent and played down the need to lift interest rates. Some of the inflation pressure will likely prove transitory, including non-oil commodity prices. Supply chain indicators for the US peaked in May and suggest pressure on producer prices should also ease. Furthermore, international shipping costs have fallen sharply from their peak a few months ago.

Nevertheless, central banks are looking at strong economies with ongoing fiscal stimulus and the prospect of higher core inflation becoming embedded in the system. The US is further down this track than most other countries. By late 2021 the US Federal Reserve had announced that it would commence lifting the cash rate and scaling back its bond purchasing program in coming months. However, although the Reserve Bank flagged the phase-out of bond-buying, it continued to insist interest rates will not go up before 2024.

Financial Markets

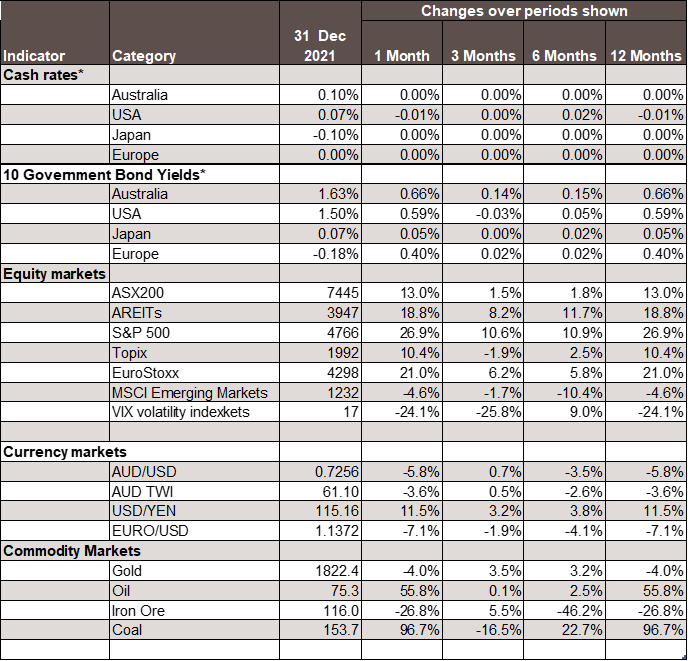

Throughout 2021 financial markets grappled with the prospect of higher US interest rates and what this would mean for different asset classes. Bond yields rose in many countries, which caused bond indices to have their first annual negative returns for several years. Inflation linked bonds outperformed as investors sought protection from higher inflation.

Despite higher bond yields and elevated valuation measures, equity markets had another very strong year. Strong profit growth and a lack of other attractive investment opportunities propelled equities to another year of double-digit returns. The US market outperformed with a return of 28.2%, driven by the economy, the election of President Biden and the popularity of tech stocks. The ASX200 posted a very respectable 17.2%, helped by stronger banks, consumer and telecommunication stocks. REITs and infrastructure performed very well as re-opening economies allowed these sectors to recover.

Commodities

Gold had a lacklustre year driven by the path of real interest rates. Oil spiked on OPEC supply restrictions in the face of recovering global demand. The iron ore price shot up in the first half of the year and then dropped back just as sharply, all driven by fluctuating demand from China. The A$ largely ignored commodity prices in 2021 and was driven more by interest rate factors. Nevertheless, the A$ was considerably weaker than the bond differentials implied. This was most likely due to expectations of US interest rate increases.

Key developments in January 2022

Inflation

Inflation, and how central banks may respond to it, put the cat among the pigeons for markets in January. The first month of the New Year saw sharp declines in both bond and equity markets as investors grappled with the implications of a sea-change in monetary policy settings. Investors have been thinking about this for a while, but data released in January changed expectations of how fast and how far central banks might have to move.

In the US, data showed the economy performed very well as 2021 closed. GDP growth in the last quarter of 2021 was stronger than expected and running at the fastest pace since the early 1980’s. The labour market also saw gains in December and the unemployment rate fell to 3.9%. This was the first time the unemployment rate had been below 4% since February 2020. Not surprisingly, wages growth remained elevated at just under 6% in year-on-year terms. Inflation was also high, with headline CPI inflation at 7.1% in the year to December and core inflation at 5.5%. While higher oil prices and supply chain pressures contributed significantly to these results, broader inflationary pressures have also picked up.

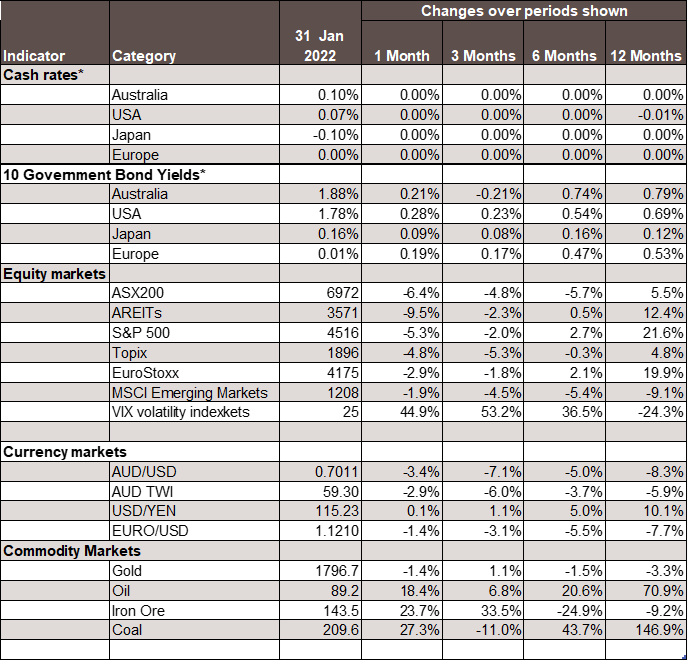

The US Federal Reserve had already dropped the notion that higher inflation will be “transitory”, but the rhetoric surrounding the FOMC’s 25-26 January meeting highlighted a potentially more pro-active approach to ending the Quantitative Easing (QE) program and starting to raise interest rates. Markets started to wonder if the FOMC might even go so far as to impose a 0.5% rate hike in March, rather than the more usual 0.25% increase. Futures markets priced a faster pace of tightening in the US, with an expected cash rate around 1.2% by the end of 2022 and 1.5% by mid-2023. These figures are 0.5% higher than they were at the start of January and compare with a cash rate of 0.1% now. The bond market followed the interest rate market and 10-year government bond yields rose to 1.78% at the end of January, which was the highest level of yields since the start of the pandemic.

The impact of this immediately flowed through to other financial markets in the US and around the world. The US$ rose and equities fell. Higher bond yields can be a serious challenge to equity markets trading on high P/E ratios, as has been the case for the past year or so. As bond yields rose, equity prices and P/E ratios fell sharply. Tech stocks are among the most susceptible to these forces and the NASDAQ fell 9% in January, compared with a fall of 7% for the S&P500.

Australia

Our markets were never going to be immune to these developments, but the situation was worsened by the CPI report for the December quarter which was released late in January. Headline inflation rose 1.3% in the quarter and 3.7% in the year to the quarter. Underlying, or core, inflation rose 1.0% in the month and 2.6% over the year to the quarter. These figures were higher than the market had expected. Core inflation was in the middle of the Reserve Bank’s 2.5% - 3.5% range, while headline inflation was just over the top of the range. Housing and transportation costs were two of the biggest contributors to the higher inflation readings.

The Australian markets took the CPI news badly. Already nervous about the Fed’s intentions, the news of higher inflation here immediately cast doubt on the Reserve Bank’s ability to avoid lifting interest rates sooner rather than later. Futures markets priced in a faster pace of tightening, starting in May. By the end of January, markets were expecting a cash rate around 1.0% by the end of the year and 1.5% by June 2023.

The 10-year bond yield rose to 1.9% at the end of the month, compared with 1.65% at the end of December. The ASX200, AREITs and Small Ordinaries Index all fell sharply before recovering some ground at the end of the month. The A$/US$ also fell, closing the month at US$ 0.701, reflecting expectations that the Fed could be more aggressive than the RBA with interest rates, as well as the impact of higher local inflation on real bond differentials.

Looking ahead – issues for 2022

Growth Prospects

Solid growth is expected for the world economy in 2022, although at a slower pace than in 2021. Australia is an exception, with growth expected to be slightly higher in 2022 than it was in 2021 (due to extended lockdowns in 2021). China is also an exception, with growth expected to be significantly below 2021’s pace. There is some upside risk to growth in the developed economies if households deploy the massive pool of savings accumulated over the past couple of years. Ongoing growth should help drive unemployment rates down, but unless this is matched by improvements in labour supply, we could see higher wage inflation.

COVID-19

Much depends on what happens with COVID. The base case assumption is that progressive weakness of new strains, combined with high vaccination rates, will significantly reduce the disruption to economic activity from COVID. This would allow supply chain bottle necks to ease and labour market participation rates to recover. However, if this assumption proves wrong, then economic activity may be slower than expected and supply chain disruptions more persistent than expected. The consequence of this would be greater inflationary pressure for a longer period.

Interest Rates

Markets expect most central banks to lift interest rates in 2022. For the US and UK this would be in the first half of the year, while for Australia and Europe it would be in the second half of the year. Japan is not expected to lift interest rates at all in 2022. Some emerging market nations have already begun lifting interest rates and will continue to do so in 2022. The upside risk to inflation noted above means there is also an upside risk to interest rates. Central banks, including our Reserve Bank, will wind back their bond-buying programs this year too.

Bonds

In this environment, government bonds will fare poorly. Higher bond yields will deliver capital losses both here and overseas. Inflation-linked bonds are an exception and are expected to deliver modest positive returns. Credit and high yield will not do as well as in 2022 because slower growth should cause yield spreads over government bonds to widen.

Equities

Equity markets will benefit from another year of good, though slower, profits growth. On the other hand, rising bond yields will undermine high P/E ratios and offset some of the impact of higher earnings per share. On balance, equity markets are expected to deliver single digit returns, with Australia, Europe and emerging markets outperforming the US and Japan. The rotation from growth (tech) stocks into cyclical value stocks is expected to continue.

Commodities

Slower growth also means that commodity prices are unlikely to have as good a year as 2021. However, the oil price may remain elevated if OPEC continues to restrict supply. The price of gold is expected to decline as interest rates rise. The outlook for crypto-currencies is completely unpredictable - the best forecast is more volatility. The A$/US$ is expected to rise moderately in 2022.

Geopolitical activity

On the geopolitical front, there will a number of key issues to watch. In the US, both domestic and international developments have weakened President Biden’s position since his election. If this is not reversed, the November mid-term elections may see the Senate returned to Republican control which would limit the scope for further reform and spending programs. In Europe, Russia has sent troops into Kazakhstan and is poised to do the same with Ukraine. This, plus pressure from Russia over its gas supplies to Europe, could cause volatility in European markets in 2022. In Asia, China is expected to continue the program of internal reforms to alleviate inequality and thereby remove potential threats to the position of the Communist Party. Efforts by China to advance its claims to Taiwan will likely result in further consolidation of the Western alliance seeking to counterbalance Beijing.

Summary

What does all this mean for markets in coming months? Will inflation be such a problem that central banks will have to tighten policy enough to induce a recession? Are we at the start on an equity bear market? Much of the answers to these questions hinges on the balance of forces driving inflation.

There is still a general expectation that supply chain pressures will ease as the year unfolds, easing that source of pressure on prices. However, ongoing strength of economies and tighter labour markets means traditional cyclical inflationary pressures will emerge. Central banks will see these conditions as an opportunity to start normalising monetary policy settings, especially through higher interest rates.

However, at his stage, there is no indication that central banks see inflation as such a problem that a recession will be required to fix it. Policy normalisation means the era of ultra-low interest rates is over and that bond yields will rise further. As a result, P/E ratios are also likely to contract some more. But in the absence of a recession, a period of low equity returns seems more likely than a bear market. Risks to this outlook include even higher inflation than expected, another new and more virulent strain of COVID, or the situation in Ukraine falling into open military conflict between NATO and Russia.

Chart 3: Major Market Indicators – December 2021

Chart 4: Major Market Indicators – January 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.