Easter Economic Snapshot

In Summary

In Summary

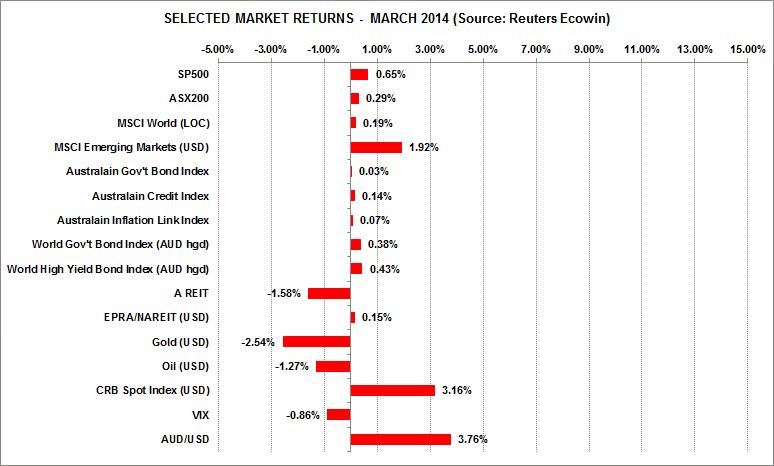

March 2014 proved to be a relatively benign month for investment portfolios as conflicting market outcomes neutralised diversification. In particular there was an unexpected strengthening of the A$ which impacted negatively on unhedged international allocation. We also saw the United States unemployment rate flat rather than falling, which resulted in volatility with the United States share market. The nervousness was palpable with losses then a recovery over a few days. Conversely we experienced better than anticipated unemployment figures here in Australia and a surprise positive return in emerging markets. Some may recall how unpopular Emerging Markets have been with most fund managers the past 6 months and if anything, this is a timely reminder that diversification often outplays economic forecasting and predictions.

There was also some weakness in equity markets in the first half of March, reflecting concerns about developments in the Ukraine. Russia’s annexation of Crimea after a referendum of dubious validity and partial sanctions from the West against Russian interests initially eased the market’s concerns but they have resurfaced in early April. In Australia, the Reserve Bank left the cash rate unchanged at 2.5%. Diminishing expectations of any further reductions in the cash rate and this was a factor supporting the bounce in the Australian dollar to back over US$ 0.92. At time of posting this has increased above US$0.93.

Australia

In the world of statistics here in Australia, the Reserve Bank Board left the cash rate unchanged at 2.5% at its meeting in early April. This will be an ongoing challenge with fast rising residential property prices, particularly in the Eastern States. If anything, the outlook is trending toward a rise which would traditionally spell problems for the A$ in that it would strengthen further and hurt exports yet again. Retail sales rose a seasonally adjusted 0.2% in February after a very strong 1.2% increase in January. The latest national accounts statistics also showed the economy grew by 0.8% in the December quarter 2013 and by 2.8% in 2013 as a whole.

Although a reasonable result, this is still below the longer run trend pace of growth. Business investment fell 3.5% in the December quarter while consumer spending rose 0.8% and dwelling investment was up 1.0%. Net export growth was better than expected in the December quarter.

As outlined in the summary, the latest employment data showed a further 47,300 jobs were added in February with the unemployment rate holding steady at 6.0%. However, it is still generally expected that the unemployment rate will rise further in coming months. The Australian Bureau of Statistics warned that the latest employment numbers may be artificially boosted by statistical effects.

In a sign that activity in the housing sector continues to expand, residential building approvals rose a further 6.8% in January. Overall, the latest data support the view that economic growth is gradually shifting from the mining sector to other parts of the economy. Given the robust response of the housing market it is not surprising that the Reserve Bank is happy to leave the cash rate where it is.

Figure 1: The $A bounced back in March and Emerging Markets contributed positively

To learn more about markets, investing and what they can mean for your current financial position, visit www.fmd.com.au/news or book in for a FREE financial health check.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Paragem Pty Ltd [AFSL 297276] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Paragem or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.