Could technology innovation and demographics be the best investment indicators?

Could technology innovation and demographics be the best investment indicators in a uncertain world?

Recently the Australian head of one of the most forward thinking global investment firms spoke at an FMD event in Melbourne and shared some fascinating insights into finding growth stocks in low growth world.

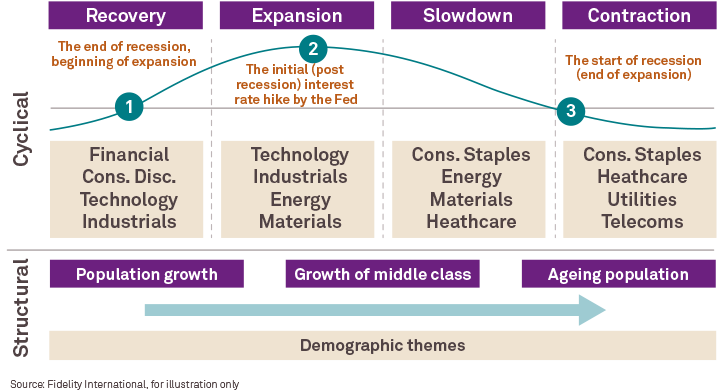

Traditionally, fund managers have used macro-economic cycles combined with company fundamentals as investment indicators. Conventional wisdom says when markets are expanding, sectors like technology, industrials and energy provide growth opportunities. When the cycle turns and markets contract, the focus shifts back to nondiscretionary sectors like consumer staples, healthcare and utilities. Yet, in this unprecedented era of low global growth and financial and geopolitical uncertainty, these cyclical measures are no longer enough.

Moving from cyclical to structural investment indicators

Historically and persistently low global interest rates are being driven by structural and demographic changes in the economy. Global demographic changes like population growth, the expanding middle class, and ageing populations are all set to drive demand for new products and services and offer more certainty due to the longer time frames involved. At the same time, the rapid adoption of technology is disrupting a wide range of industries and creating new business models, seemingly overnight.

Platform based innovations like Airbnb and Uber are creating sharing economies that raise new conundrums for valuing stocks. For example, how can a traditional hotel be valued if the extent of possible competition from the likes of Airbnb can’t be quantified? These developments put fund managers in uncharted territory. So Fidelity are looking to the intersection of demographic change and technology to find strong, long-term investment opportunities. Industries like healthcare, biotechnology and robotics are all good examples; driven by the needs of ageing populations living longer in greater comfort, health and mobility.

Education and employment technology stocks are also growth areas as we shift to a multi-stage life cycle where we move in and out of different careers and retrain for new technologies in between.

Whatever the future holds, FMD’s Investment Committee is focused on maintaining strong relationships with leading fund managers to provide our clients with new opportunities for growth.

Our financial advisers can help you understand if you are on track for a future that is frugal, comfortable or no compromises. From salary sacrificing to investing within your superannuation, there are many ways to get more money behind you earlier.

Take the next step in maximising your investment returns

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.