Choosing to be a rational investor in times of market volatility

Whenever market volatility increases, concerned investors naturally want to know if they should do anything different to protect and maximise their wealth. As an investor myself, I understand this. We all have a need to be reassured during periods of uncertainty, especially when our hard-earned money is involved.

At times like this, when inflation and interest rates are impacting all asset classes at once, it’s difficult to remember that it’s normal for investment returns to vary greatly from year to year and still grow sufficiently over the long-term to build significant or preserve existing wealth.

Yet, as behavioural finance experts like Australia’s own Simon Russell like to remind us, investors can inadvertently derail their long-term strategy by paying too much attention to the most recent market movements – especially if it’s a bad news story – and taking their eyes off the bigger picture.

It’s human nature, literally. The human brain is hardwired to avoid loss much more strongly than it is to value gains. You could say our reptilian brain was made for survival not prosperity. This means as investors we have to go out of our way to take an intellectual and analytical approach when it comes to weighing up short term losses versus potential long term gains.

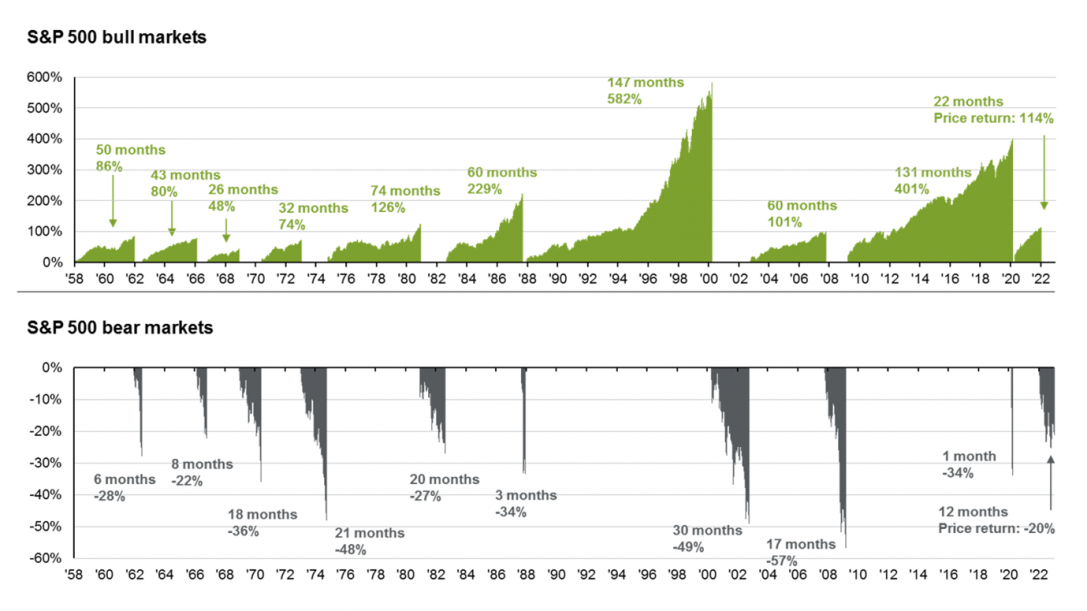

This chart shows that ‘bull’ markets have historically run much longer both in terms of length and depth than ‘bear’ markets when it comes to S&P 500 (US) shares. Yet, current equity market negativity, as well as challenges for fixed interest investment may be of concern in the short-term, so what’s an investor to do?

As Simon Russell points out in his books and videos, getting diversification and asset allocation right are the most important long-term factors, as is doing your best to keep emotion out of the picture. He also warns against the false confidence factor, where complicated things can feel easy.

When markets are falling it might seem sensible to move to cash or liquidate investments, but by the time our fear causes us to have that reaction, markets have usually moved on. Selling investments then can mean missing the inevitable upswing, so it’s important to remember that financial decisions that might feel easy or obvious – like timing the market – are typically much harder than you think. Instead, seek good advice from an adviser you trust with access to reputable research and a strong investment capability, set up the right investment strategy and keep a cool head.

As experienced investment advisers who have managed our clients’ wealth for two decades, through the GFC, the COVID pandemic and beyond, we know well-managed and diversified investment portfolios provide protection in a crisis. Volatile markets should not stop anyone achieve their long-term goals including funding retirement plans. However, not investing (and not doing it well) certainly does limit wealth. Markets may not be rational but as investors we can choose to be.

Here are three important things to keep in mind to reap the long-term benefits of sound, well-managed investments:

1. Remember that market volatility itself is NOT a bad thing

Market corrections can feel concerning, but they are a normal, healthy part of investing. While they may make investors nervous in the short term, they’re better for long-term market structure as they lower the risk of larger flare-ups. It’s also important to remember that the volatility seen in share markets is the price we pay for higher returns than most other asset classes over the long term.

Tip: Ignore the share market’s intra-day moves and up-to-the-minute investment news. They are largely irrelevant and lead to emotional reactions rather than considered decisions.

2. Remember why you started investing in the first place

Whether it’s to create your ideal retirement lifestyle, or to diversify your investment portfolio, your goals are not volatile like the markets. By focusing on your goals, you will be in a better position to drown out market noise.

Tip: Revisit your investment strategy to make sure it’s on track to achieving your goals. A financial adviser worth your time and money will help you do this and help you adapt to shifts in the market when required.

3. Remember to diversify your portfolio

A portfolio of diverse assets that perform differently in various market conditions is key to investment success.

Tip: Diversifying your timing is just as important as diversifying your asset classes. By making investments over a period of time, you reduce the risk of investing all your money at the top of a bull cycle.

How we do it

At FMD, our Investment Committee (IC) constantly reassesses portfolio allocations and our Active Management Service (AMS) enables us to move quickly to rebalance portfolios in response to market fluctuations, keeping our clients informed every step of the way.

Through our robust approach of active portfolio management and monitoring, we’ve successfully built long-term returns and wealth for our clients. But don’t take our word for it, see what they say.

Take the first step to a wealthier future

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.