Election Update Series: Changes to franking credits in SMSFs proposed if Labor is elected

18 May 2019 Update: With the Federal Election victory now confirmed for the Liberal–National coalition, we no longer need to plan around changes to franking credits, negative gearing, reductions in CGT discounts, reintroducing a ban on borrowing in super and further restrictions on superannuation contributions that the ALP were proposing. Read our latest Economic Snapshot for more post-election market insights.

In the lead up to the 2019 Budget in April and the Federal Election in May, our Election Update Series will keep you informed about proposed policy changes that may impact you from a financial planning perspective. These updates describe proposed changes in general terms. Please speak with your FMD adviser if you have any questions about how the proposed changes may impact your personal circumstances.

The current state of play

When an Australian company distributes dividends to shareholders, the Australian Tax Office (ATO) recognises corporate tax has already been paid on the profits before the dividends were distributed. To avoid investors paying tax on the same profits again, this pre-paid tax becomes a tax rebate for investors in the form of a dividend imputation (or franking credit). For those in the lowest tax brackets or with no tax to pay, such as retired pensioners, right now these franking credits can result in a tax refund.

The proposed changes to franking credits

On 13 March 2018 the Australian Labor Party (ALP) announced a policy to amend the current dividend imputation system to make excess franking credits non-refundable from 1 July 2019. The main impact of this policy if implemented, will be to eliminate cash refunds for excess franking credits received by SMSF’s that are wholly in pension phase and therefore do not pay tax. However, on 27 March 2018 the ALP announced an amendment to the original policy providing a ‘Pensioner Guarantee’ which means that SMSF’s with at least one member receiving Centrelink benefits on 28 March 2018 will be exempt from the change, allowing those in this position to continue to receive a refund of franking credits.

Superannuation is complex (you already knew that!) but one of the quirks of this change is that if your pension is not in an SMSF but in a pooled super fund, like an Industry Super Fund or a Super Wrap platform such as HUB24 or Asgard, you are likely to continue to receive a refund of franking credits, as these funds are net tax paying. This is because as well as having members in pension phase, these funds also have members still making contributions and the funds need to pay tax on the contributions and earnings of these members. Sound unfair? Well that is what many SMSF members are saying, but so far the ALP is unswayed.

While the proposal may change further, here are some options to discuss with your FMD adviser:

• Stay in your SMSF and consider changing the investment strategy to minimise the impact.

• Consider a move to an Industry Super Fund, however you lose control of your investments.

• Consider a move to a Super Wrap Platform and retain control of your investments.

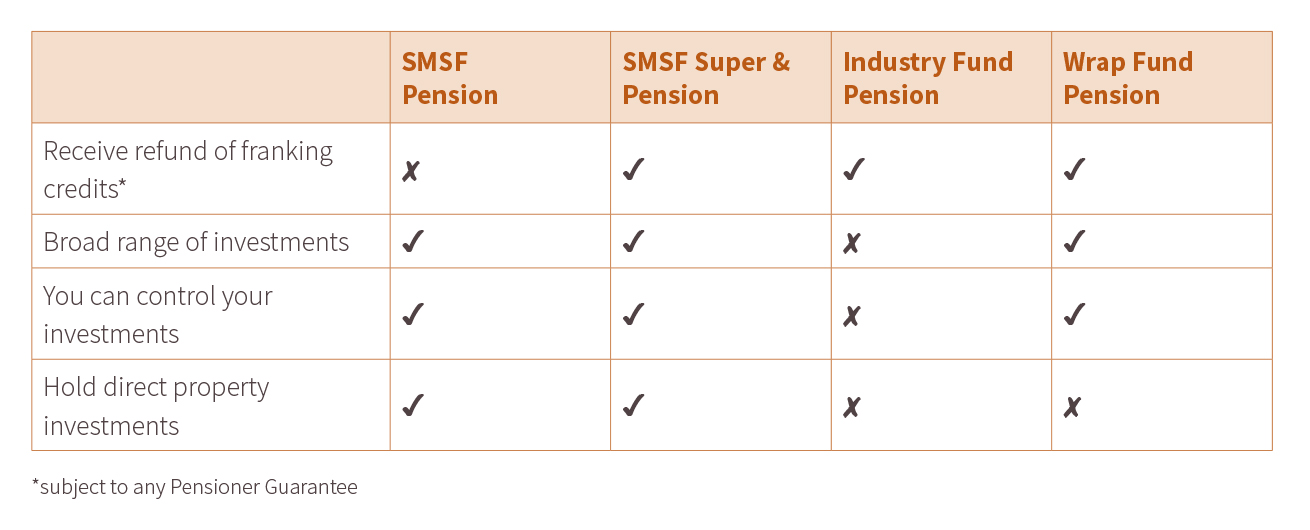

SMSF vs Industry Super vs Super Wrap Funds

This table demonstrates the likely pros and cons of different types of super funds in the event the ALP is elected and proposed amendments to the dividend imputation system are implemented. As indicated those who currently have an SMSF may benefit from moving to a Super Wrap Fund in the event of the change.

What to do now

If the ALP is elected, they propose that the changes will come into force from 1 July 2019. So we don’t recommend you take any action yet, but if you have an SMSF or know someone who does, it is a good idea to talk to your adviser and consider your individual circumstances to determine the best strategy should the changes come into effect.

Other changes on the horizon

The ALP is also proposing a number of other changes including limits to negative gearing, reductions in CGT discounts, reintroducing a ban on borrowing in super and further restrictions on superannuation contributions. We will bring you further information about these proposed policies in the coming weeks.

Take the first step to a wealthier future

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.