Building and renovation costs head for the stratosphere

Homeowners face plenty of tough choices in challenging economic times.

House prices are falling across the country, auction clearance rates are down 15% on the same time last year and mortgages repayments are steadily on the rise following consecutive interest rate rises by the RBA. This is causing many to put off property decisions until the long term outlook becomes clearer.

Often, when delaying buying or selling due to market uncertainty, renovating or adding an extension to add value to your home while markets stabilise, can be a great option. Unless of course, the building industry is also facing a perfect storm of supply chain challenges, increases in raw materials prices, labour shortages and a serious profitably squeeze. Then it’s time to look closely at home building or renovation plans and their potential risks and be mindful of and how that may impact on your overall finances.

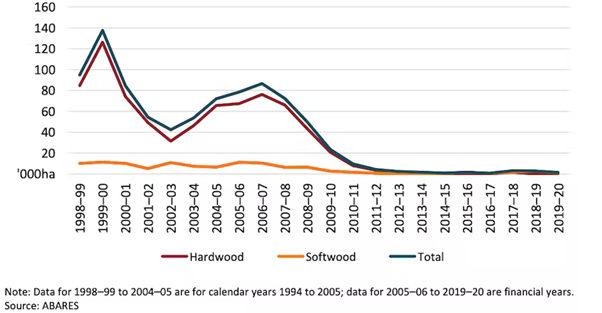

Raw materials availability remains one of the greatest drivers of increased cost and delays for builders and their clients. Timber is in particularly short supply, with natural disasters like bushfires and floods reducing local supplies, while challenges in international supply chains and shipping prices are increasing the cost and delivery timeframes of imported products. There are no quick fixes to the problem either. Trees have to be grown and it typically takes 20 years to harvest product from each new plantation. This chart shows how few new plantations have been established since 2012 and as a result, high timber prices are expected to persist in the face of supply and demand issues.

With timber in short supply, builders might be inclined to turn to steel as an alternative, but supply chain woes can be found there too. Steel prices rose 42% in the year ending March 2022 and Australian builders are at the mercy of limited local suppliers where a monopoly-like grip over the steel frame market in Australia exists.

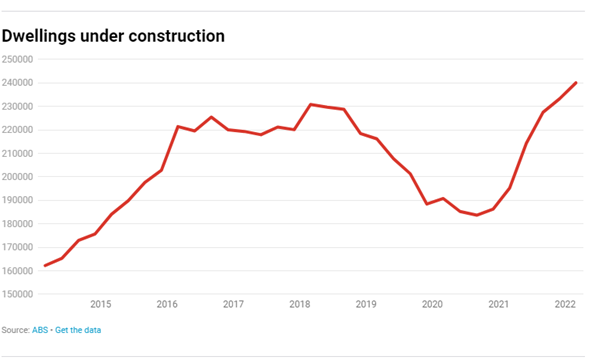

Thanks to the housing construction boom, partially fuelled by the HomeBuilder program, designed to boost the construction industry at the height of COVID lockdowns, project delays are now commonplace. The situation is exacerbated by a growing number of small private builders going out of business as the cost of raw materials squeezes profitability; in turn reducing the pool of builders available to meet the strong demand for home building and renovation services.

The chart below shows that dwellings under construction went from about 180,000 in 2020 to more than 240,000 today.

Given the myriad of challenges and uncertainty for homeowners, it can be difficult to move forward with new projects confidently. However, the fundamentals of good housing market knowledge, prudent decision-making, and win/win agreements with the right builder, can still make home building or renovations worthwhile in difficult times.

What matters is having a good understanding of what will add the most value to your style of home in your local market, and to understand your horizon for holding, selling, or renting your property in terms of realising capital growth or rental yields. Opportunities for people aged 60 and over to boost their super balance when downsizing may also be worth considering in terms of the right timing for lifestyle and property decisions in your overall financial plan.

As ever, your FMD adviser is here to support you in these complex times. They can help you model various financial scenarios based on your personal circumstances and consider some of the risks to be aware of in the face of some of these challenges. Your adviser can also introduce you to other specialists who can consider how important factors like those detailed above, may impact your situation if you’re considering sell, buying, developing or renovating a property.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.